A total of 50,000 visitors are expected at this year’s three day Smarter E event, up from the 40,000 registered in 2017, who are flocking to see the around 1,200 exhibitors, hailing from 60 countries – a marked increase from the 1,100 exhibitors from 51 countries recorded last year.

Hot topic

The hot topic on day one seems to be the power purchase agreement (PPA) market, particularly in Europe. In a session on Investing in Europe’s PV Future, hosted by Bloomberg New Energy Finance (BNEF), four panelists discussed just this, and how it is the key value driver to unsubsidized solar.

While the continent is still not offering PPAs longer than 10 – 15 years, yet, the long-term PPA market is growing, said Frederico Giannandrea, Partner, Head of Foresight Southern Europe, Foresight Group, Italy. In 2016, over a GW of PPAs were contracted for wind and solar, for instance.

The drivers of this change are the big corporations, like Google and McDonalds, in their bids to become carbon neutral by 2020. He added that Europe is unlikely to see longer term PPAs, like those in the U.S., which are typically 20-25 years, in the foreseeable future. “The market is not ready yet,” he said.

In his presentation, Tomás García, Head of Business Development EMEA, Canadian Solar, Italy, went on to say that a good PPA adds a lot of value to a solar asset, with good translating as long-term (“15 years is good”), with a credit worthy off-taker, a smart price structure (these are becoming more sophisticated, employing such mechanisms as profit sharing, as the market moves away from fixed/index prices), and bankable clauses.

He emphasized the need to be “extremely careful” with all the clauses in a PPA. Both buyer and seller are trying to push the risk to the other side and, as such, it is vital to look at all aspects of the agreement, including credit support, contracted volumes (pay as you produce vs. fixed volume), early termination penalties, and changes in market conditions and law.

Porfirio Squadrone, Business Development Manager, WElink Group, Italy, said investors need to ask ‘do I want a PPA with the government, where it is a take or leave contract, or one with a private off-taker, where the terms can be negotiated?'

A new asset class

Looking at the unsubsidized solar market, García stated that unsubsidized solar plants are a new asset class, where investors are looking at them as a new type of investment.

He added that market parity has been achieved in the Southern European countries of Spain, Portugal and Italy. The main drivers of this are: solar levelized cost of electricity (LCOE), and wholesale power prices.

He was careful to point out the difference between market parity (which refers to wholesale power prices), and grid parity (which refers to retail power prices).

Foresight’s Frederico Giannandrea spoke about grid parity, stating that the two main drivers are: continually decreasing costs (CAPEX has dropped 80% in the past eight years with module manufacturing), and long-term PPAs.

Popular content

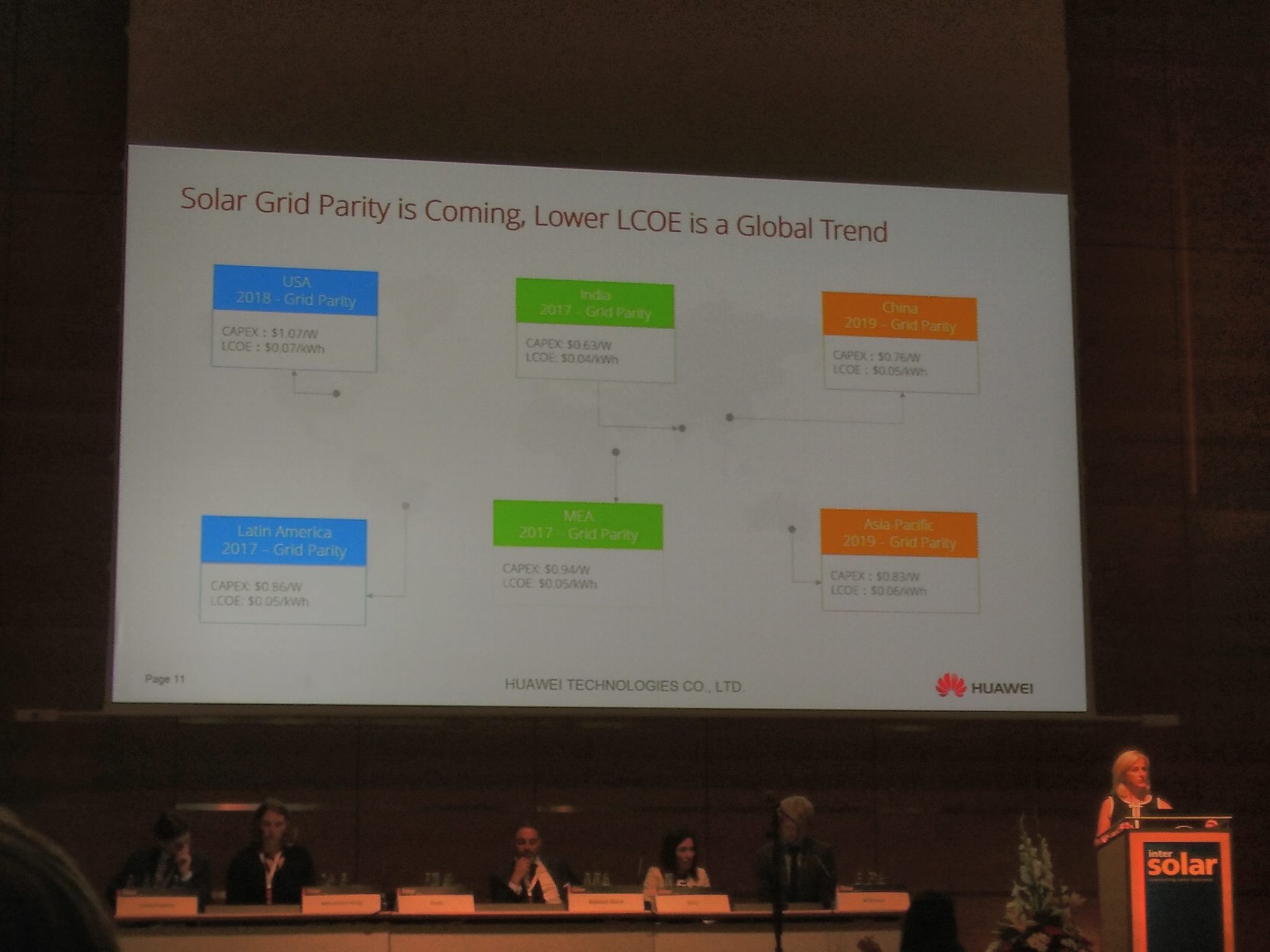

In a separate session, Comeback Time for Major Players – What Impact for Solar?, hosted by IHS Markit, Alison Finch, Chief Marketing Officer, Huawei Technologies Co. Ltd, United Kingdom, said that solar grid parity is unstoppable (see image).

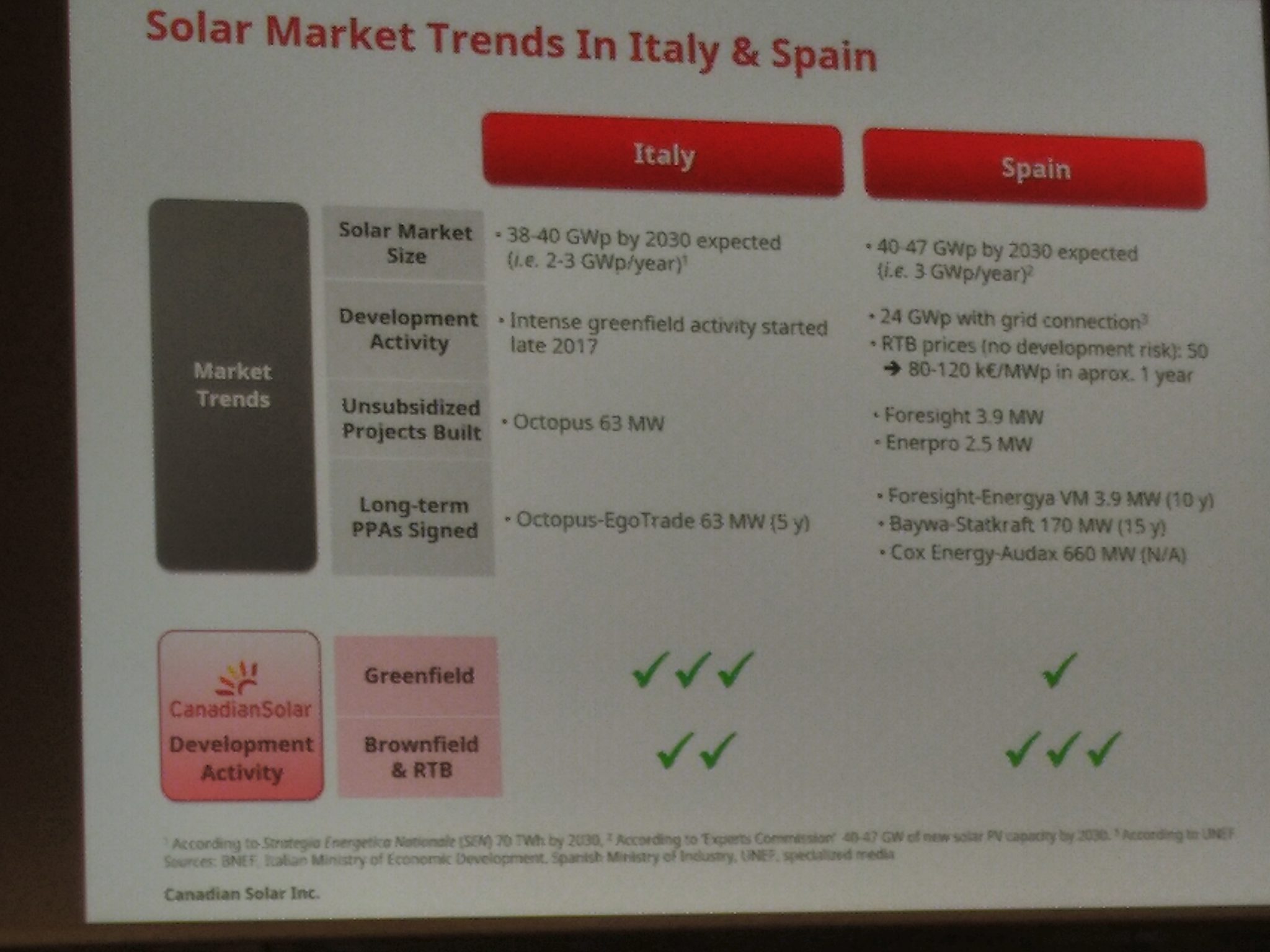

In terms of European markets, the BNEF panel agreed that Spain, Italy and Portugal are key markets for unsubsidized solar, and are attracting investors. Speaking of the trends being seen in Spain and Italy in particular, García said that both have ambitious national plans, announced by their respective governments, with 2-3 GW of new unsubsidized solar capacity expected to be added annually, or a total of 38-40 GW, in Italy; and 3 GW a year, or 40-47 GW by 2030, in Spain.

He went on to say that in Spain, Canadian Solar and “many” other players decided not to participate in the government’s tenders, due to badly designed rules and complicated procedures. Squadrone said that in Italy, people prefer private PPAS rather than auctions, as they don’t trust the government.

Q&A

In the ensuing Q&A session, in response to the question of what the main drivers are for the whole of Europe, and not just the Southern countries, the panel responded by saying the electrification of transport – another hot topic – batteries, and the wind down of conventional sources of power.

Another asked about the realistic roll out of the 24 GW of solar projects in Spain's pipeline. García explained that when a greenfield project is being developed in Spain, developers must secure an interconnection point, which costs around €10,000 per MW. The 24 GW have already paid this. However, he does not believe all will see the light of day. What is likely, as aforementioned, is that the market will see between 2 and 3 GW of new solar PV capacity, annually, over the next 10 years.

Indian announcements

In other news, the Indo-German Energy Dialogue on Solar PV Market Development in India, Shri Anand Kumar, Secretary, Ministry of New and Renewable Energy (MNRE), Government of India spoke on India’s increased renewable energy targets. In addition to raising the 2022 solar target to 225 GW, India is aiming to install 500 GW of renewables by 2030, the majority of which will comprise solar.

He added a main priority for the country is to become a manufacturing hub, to support its plans.

Read more about this, and how kerfless wafer technology is set to disrupt the industry, tomorrow.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.