From pv magazine, November edition

Data centers may operate in the shadows, but everyone in the digitalized world makes use of them on a daily basis. Google estimates that a typical search consumes the same amount of energy required to illuminate a 60 watt light bulb for 17 seconds – around 0.0003 kWh – and is responsible for emitting roughly 0.2 grams of CO2.

According to Michael Weinhold, CTO, Siemens Energy Division, who spoke at the High Level Industry Forum organized by SolarPower Europe, and held during this year’s The smarter E Europe in Munich, data centers currently account for around 2% of electricity demand worldwide, while the Yale School of Forestry & Environmental Studies further calculates that they emit almost as much CO2 as the airline industry.

A turning tide

In 2017, Alphabet Inc., parent company of Google, became the first company to match the energy its data centers and offices consume with renewables. To date, it has signed over $3 billion worth of corporate power purchase agreements (PPAs) totaling 3 GW of solar and wind, globally. And it is not alone: The majority of tech giants, including Amazon, Facebook, and Apple, have become the primary adopters of such agreements, thus helping to shape a truly profitable, dynamic renewable energy industry.

Indeed, according to figures supplied by Bloomberg New Energy Finance (BNEF), with a total of 1.8 GW worth of deals, these tech giants have been the largest off-takers to sign corporate renewable energy PPAs so far this year. “A large proportion of these deals will be destined to power data centers,” says BNEF editor, Bryony Collins, adding, “Facebook was the leading corporate globally signing these deals – with agreements for 1,117 MW of wind and solar power – while Microsoft and Google also ranked highly.”

While PPAs are proving to be one of the most popular avenues for such companies to go down, many data center operators procure their renewable energy through green certificates. Due to their low costs, however – in Europe a certificate costs less than €0.01/kW – they have little actual effect on the deployment of new green energy capacity and thus, amount to mere greenwashing.

Berlin-based Claus Wattendrup, Head of the Solar and Batteries Business Unit at Swedish utility Vattenfall, tells pv magazine that data centers, recognizing the grey area around green certificate schemes, are beginning to shift towards demanding less virtual delivery. As evidence, he points to the long-term supply and service agreement that Vattenfall signed with Facebook this May, under which the utility will supply wind integration and balancing services to data centers in Odense, Denmark and Luleå, Sweden, from three newly-built wind farms totaling 294 MW, which are located in Norway. Facebook also signed a PPA with the farm owner to purchase 100% of the generated energy.

Renewable potential

It is often impractical to physically co-locate renewable generation facilities with data centers, given that the ‘average’ data center has an average peak load of 10 MW, a 70% load factor, and consumes 61.32 million kWh/year, says Chris Thompson, Vice President, Secure Power at Schneider Electric. In contrast, 1 MW AC of PV provides around 1.25 to 1.5 million kWh/year. “Hence all net-metered out, we’d need 40 MW or more than 160 acres of space to supply energy to the ‘average’ electro-intensive data center,” he says.

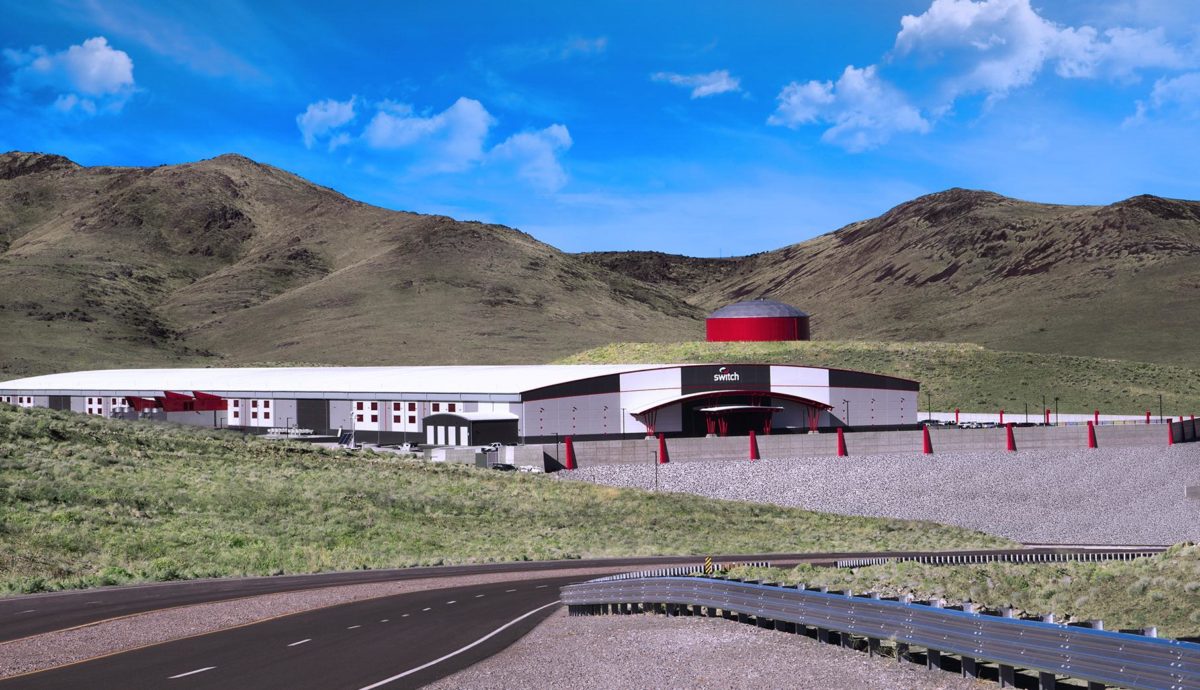

Despite this, some of the larger operators are building their own assets. An example of this is U.S.-based Switch, which announced this February that it will partner with Capital Dynamics to build the United States’ largest single solar project – Gigawatt 1 – in Nevada. While the primary power purchasers will be Switch and several of its clients, the project will also serve other private and public-sector customers, both inside and outside of the state.

Others are coming up with more unique ways to cater to this demand. Take U.S.-based Schneider Electric, for instance. Philip Barton, Sr. Director N.A. Microgrid Competency Center tells pv magazine that since data centers as standalone buildings are very energy dense, it is hard to get more than 10 to 25% of the peak load covered by solar. However, it is increasingly being used to serve data center loads and reduce fuel consumption when “islanded,” i.e. separated from the utility, in a microgrid, for reasons like hurricanes, wildfires, or cyber-attacks.

“The greater campus, base, facility, or cluster of buildings may have many acres available, not just rooftops covering white space. So the trend is definitely towards that of close-coupled resources, instead of just a virtual PPA served by renewables,” he explains.

Popular content

Schneider Electric has over 10 microgrids under construction in the U.S., and nearly every site has a data center, emergency operations center, and other critical loads, he adds.

The crux

While renewables can prove key to meeting energy demand, storage is also starting to offer interesting investment models for data centers, particularly when combined to create multi-use business cases. And this is the crux of the issue.

Germany-based ScutiX, co-led by German renewable energy company, Wirsol, says it will develop and construct solar and wind farms incorporating storage to serve its on-site data centers, where the crypto community and the IT sector can run on 100% green energy.

Each ScutiX farm is set to contain 10,000 computing units and generate 20 MW of clean energy. Andreas Wirth, one of the startup’s founders, explains that consumption will be around 70%, meaning roughly 30% of the generated energy will be supplied to the local grid. He adds that the first farms are planned in Australia, Canada, North America, and Spain. Here, Wirsol’s parent, Wircon GmbH has a pipeline of projects, some of which have already been built in Australia, which meet the requirements for the ScutiX farms, he says.

Wirsol also supplies the electricity for one of Google’s biggest data centers in Europe. Currently, it is dependent on the grid, however, by providing a self-scaling infrastructural solution for the generation of green power with ScutiX, the producer and the consumer will be brought together. “…We are not going to use the grid anymore,” Wirth explains. “For the night hours there will be options like wind, or storage, but also an intelligent electricity sourcing management system with the electricity providers in the located countries.”

Even without renewable energy, batteries can provide a supplemental income source for data centers. “Lithium-ion batteries can be installed behind the meter at data centers to provide backup power in case of a grid defect, and also to provide demand response services to the grid during peak periods of power demand,” says BNEF’s Collins. She adds that they are better suited to providing services like frequency response, where around 30 seconds to one minute of power is provided to the grid to smooth out intermittent faults in frequency. Large data center operators are currently said to be installing batteries between 5 and 7 MW, on average, says Collins, citing ABB.

Uninterruptible power supply (UPS) as a reserve is also emerging as an interesting business case. In the fourth quarter of 2017, U.S.-based Eaton Technologies launched such a product across Europe, the Middle East, and Africa. “The pilot with Svenska Kraftnät [in Sweden] has been successfully completed and has validated that stored energy in data centers…is suitable to support the Nordic power grid,” says Mike Byrnes, Director – Cloud & Data Center Sales & Services, Eaton EMEA.

Battery backup

Currently, lead-acid batteries are the technology of choice for emergency power batteries, because they improve power quality and provide instantaneous back-up. However, the future is changing. BNEF said lithium-ion batteries are an attractive alternative, and will see market share increase from 1% to 35% between 2016 and 2025.

Explaining the reason for this, BNEF’s Bryony Collins says Li-ion has a faster response time and higher energy density, which means it can store more power in a smaller volume. “This frees up space in data centers and increases design flexibility so that they are well suited to providing energy storage on distributed server racks,” she says.

While lead-acid and Li-ion technologies are the forerunners for data center storage applications, Vattenfall is also looking into redox flow batteries, although it is still early days. “The big advantage is that you can store much more energy at a cheaper price,” Wattendrup says. Overall, though more needs to be done to understand how it performs over the long term, before this technology can be rolled out on a large scale.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.