Top News

Renewables hit record levels in Australia as electricity demand rises

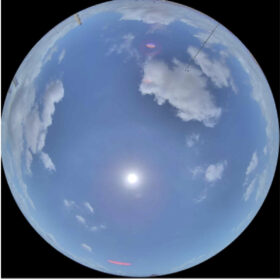

Solar forecasting based on all sky imaging, long short-term memory

Winter air pollution weighing on solar generation in India

pv magazine Webinar

pv magazine Webinar

MEDIA KIT 2024

Sign up for our free pv magazine newsletters

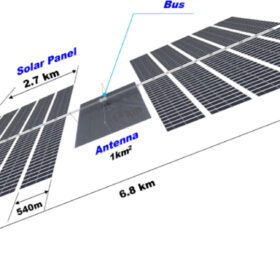

South Korea plans 120 GW space solar project

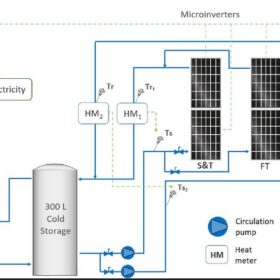

Coupling heat pumps with roll-bonded photovoltac-thermal collectors

High interest rates challenge global shift to renewables

Sinovoltaics maps out Southeast Asian PV manufacturing sites

German startup planning vertical floating PV plant

Press Releases

Sineng Unveils Extensive Portfolio of PV+ESS Solutions at WFES, Empowering MENA’s Green Transition

DAS Solar has advanced to ‘BBB’ in PV ModuleTech bankability ratings

Deye Releases New Single-Phase LV ESS: A Lightweight, Versatile, Stylish Power Solution

Hanersun Renewed Strategic Partnership with Munich Re

Opinion & Analysis

Featured

Solar module prices hovering at all-time lows

Dust and cloud impact solar across Arabian Peninsula

In a new weekly update for pv magazine, Solcast, a DNV company, reports that dust storms and slear skies led to contrasting March Solar Performance in West Asia. The Arabian Peninsula experienced humid winds and dust storms that reduced solar irradiance to 90% of typical levels for the month.

‘Paternity leave policies are strongly correlated with the female share of board seats’

In another article of a series on gender equality, Women in Solar Europe (WiSEu) gives voice Mariyana Yaneva, Vice Chair at the Association for production, storage and trading with electricity (APSTE). She explains that policies allowing childcare needs to be met but not placing the burden of care explicitly on women, increase the chances that women can build the business acumen and professional contacts necessary to qualify for a corporate board.

Global polysilicon prices decline slightly

In a new weekly update for pv magazine, OPIS, a Dow Jones company, offers bite-sized analysis on solar PV module supply and price trends.

Making the case for concentrated solar power

Dismissed by many in the solar industry as an overly-complex, outdated technology, concentrated solar power (CSP) is set for a comeback thanks to a scaled-down, modular approach.

A new twist on thermal storage

Power Panel offers a PV and thermal storage solution that combines simple, safe and easy to manage hot water with advanced thermoplastic technology and architecture.

Markets & Policy

Featured

Enphase Energy, Octopus Energy announce UK partnership

Vsun starts production at wafer facility in Vietnam

Japan-based solar manufacturer Vsun’s new facility produces n-type silicon wafers and is expected to be ready for full production by the end of the month.

EDF launches UK heat-pump tracker tariff

EDF says its heat-pump tracker tariff is the United Kingdom’s first, as it will never charge its customers more than the price cap, guaranteeing savings of at least GBP 164 ($202) per year. It says it is also offering a GBP 750 discount on new heat pump installations.

Large-scale solar, battery storage hybrid starts operations in South Africa

Norwegian PV developer Scatec ASA has switched on a hybrid solar and battery storage facility in the Northern Cape province of South Africa.

Premier Energies aims to raise over $180 million in IPO

Premier Energies has filed draft papers with the Securities and Exchange Board of India (SEBI) for an initial public offering (IPO). The company says it will partly use the proceeds to fund 4 GW of tunnel oxide passivated contact (TOPCon) solar cell and module production.

Oman’s solar transition roadmap

SolarPower Europe says in a new report on solar development in Oman that the nation will need to install a minimum of 13 GW of solar by 2030 to meet its ambitious net-zero targets.

Installations

Featured

Photovoltaic water pumping based on open-ended winding induction

Australia targets 6 GW of new renewables in ‘largest ever’ tender

Australia’s “largest-ever” tender for renewable energy will open in May, with the federal government targeting 6 GW of new solar and wind projects.

Agrivoltaics for fir trees

German researchers are studying using an overhead solar PV system, designed to be removable and reusable, as a sunshade for young fir trees. The pilot, located at a quartz sand excavation site, will be monitored to compare growth and water consumption with an adjacent unshaded tree plot.

Neighbors like solar, to a point

Research indicates that most neighbors of solar power facilities in the United States maintain positive attitudes toward these plants until they exceed 100 MW in capacity, or approximately 400 acres.

Johnson Controls releases new residential heat pump series

The new heat pumps use R-454B as a refrigerant and are specifically designed to be matched with Johnson Controls’ residential gas furnaces. Their size ranges from 1.5 tons to 5 tons and their coefficient of performance (COP) spans between 3.24 and 3.40, according to the manufacturer.

The Hydrogen Stream: Linde plans 5 MW electrolyzer in Brazil

Linde says its White Martins unit will build a second electrolyzer to produce green hydrogen in Brazil, while Sunfire has launched a front-end engineering and design study (FEED) for a new 500 MW hydrogen project.

Technology

Featured

Researchers design tin-germanium-based perovskite solar cell with potential efficiency of 31.49%

Attica-Crete leg of Mediterranean super grid due mid 2025

Greece has grand plans for an interconnector network that runs from the Middle East through to the heart of Europe. pv magazine examines the latest developments on the road to a Mediterranean super grid and what it might mean for the regions involved.

Global PV capacity hit 1.6 TW in 2023, says IEA-PVPS

The International Energy Agency (IEA) Photovoltaic Power Systems Programme (PVPS) has published a wide-reaching snapshot of the global PV market, covering installations, manufacturing, policy trends, and grid integration.

German startup offers modular PV system for parking lots

UV Energy has developed a PV system that can be used in parking lots and on other surfaces. It claims that the arrays can be deployed within time frames of three to six weeks.

ZSW, First Solar partner to collaborate on thin-film PV

Zentrum für Sonnenenergie- und Wasserstoff-Forschung Baden-Württemberg (ZSW) and First Solar have agreed to work together to develop thin-film PV technologies on a gigawatt scale.

Soltec launches dual-row, single-axis tracker

Spain’s Soltec has developed a new dual-row, single-axis tracker with a tracking range of up to 60 degrees, offering compatibility with 60-cell, 72-cell and 78-cell modules.

Manufacturing

Featured

PV industry demand for silver could rise by 20% this year

China PV Industry Brief: Beijian Energy to build HJT cell, module factory

Beijian Energy says it will build a new factory to make heterojunction (HJT) solar cells and panels. The facility in Liaoning province will produce 4 GW of cells and 3 GW of PV modules.

New model to optimize PV module encapsulation

An Austrian team develped a model to optimize lamination parameters and to flag critical, insufficiently crosslinked and inconsistent encapsulant laminations. It could be particularly suitable for the production of double-glass solar panels.

French PV module maker Systovi goes into liquidation

Systovi has gone into liquidation, as the commercial court in Nantes, France, has issued an order to do so, citing the solar panel manufacturer’s failure to find new investors, despite its 80 MW of panel manufacturing capacity.

Researchers design 31%-efficient perovskite solar cell based on calcium nitrogen iodide

An international team has demonstrated a perovskite solar cell relying on inorganic calcium nitrogen iodide (Ca3NI3) perovskite and has found this absorber material offers advantages such as tunable bandgap and resistance to heat. The device achieved a fill factor of 81.68%.

Ensemble techniques for solar energy forecasts

A Chinese research group has sought to understand the relative performance of two weather prediction techniques based on ensemble modeling for solar energy forecasts. The scientists applied the two methods in combination with three classical post-processing methods.

Energy Storage

Featured

Europe’s largest battery storage project secures approval

Netherlands allocates €100 million for battery storage subsidies

The Dutch government has earmarked €100 million ($106.7 million) of subsidies for the deployment of battery storage alongside PV projects. The funds are part of a €416 million subsidy program announced last year to alleviate grid congestion.

Europe’s negative price trend could continue until summer

AleaSoft and SolarPower Europe inform pv magazine that negative energy prices in Europe are related to the pandemic, low demand, insufficient storage solutions, and inadequate energy planning. They say this situation will likely continue into the summer.

ArcActive targets Australia with ‘re-engineered’ lead-acid battery tech

ArcActive, a New Zealand-based battery tech specialist, plans to set up a factory in Australia within 18 months. It says the facility will be able to produce 30,000 lead acid-based residential energy storage systems per year.

JLR, Allye Energy partner on 270 kWh portable battery energy storage system

Jaguar Land Rover (JLR) and Allye Energy have agreed to collaborate on a 270 kWh portable battery energy storage system (BESS) built with second-life Range Rover batteries. The system, which is set to become the first commercially available BESS with JLR battery packs, can fully charge up to nine Range Rover PHEV vehicles at once.

Nhoa Energy commissions battery storage project in Taiwan

Nhoa Energy, an Italian developer, has commissioned a battery energy storage project for Taiwan Cement Group in Yilan county, Taiwan, with a capacity exceeding 120 MWh.