Top News

Attica-Crete leg of Mediterranean super grid due mid 2025

PV industry demand for silver could rise by 20% this year

The Hydrogen Stream: Linde plans 5 MW electrolyzer in Brazil

pv magazine Webinar

pv magazine Webinar

MEDIA KIT 2024

Sign up for our free pv magazine newsletters

Europe’s renewable PPA prices fell 5% in Q1

China PV Industry Brief: Beijian Energy to build HJT cell, module factory

Europe’s largest battery storage project secures approval

Global PV capacity hit 1.6 TW in 2023, says IEA-PVPS

German startup offers modular PV system for parking lots

Press Releases

Trina Storage and Pacific Green sign Letter of Intent of 1500 MWh energy storage system at WFES

Astronergy Thailand Manufacturing Base perfects its industry chain with wafer lines

ATW Breakthroughs at SOLAREX ISTANBUL 2024 and the 12th Energy Storage International Conference and Expo

JinkoSolar’s Tiger Neo to Power Africa’s First Commercial Green Iron Plant in Namibia

Opinion & Analysis

Featured

Dust and cloud impact solar across Arabian Peninsula

‘Paternity leave policies are strongly correlated with the female share of board seats’

In another article of a series on gender equality, Women in Solar Europe (WiSEu) gives voice Mariyana Yaneva, Vice Chair at the Association for production, storage and trading with electricity (APSTE). She explains that policies allowing childcare needs to be met but not placing the burden of care explicitly on women, increase the chances that women can build the business acumen and professional contacts necessary to qualify for a corporate board.

Global polysilicon prices decline slightly

In a new weekly update for pv magazine, OPIS, a Dow Jones company, offers bite-sized analysis on solar PV module supply and price trends.

Making the case for concentrated solar power

Dismissed by many in the solar industry as an overly-complex, outdated technology, concentrated solar power (CSP) is set for a comeback thanks to a scaled-down, modular approach.

A new twist on thermal storage

Power Panel offers a PV and thermal storage solution that combines simple, safe and easy to manage hot water with advanced thermoplastic technology and architecture.

What does solar need to keep investment flowing?

In its latest monthly column for pv magazine, SolarPower Europe describes which policy tools are expected to help Europe move at a faster pace in solar and renewable energy deployment. The European trade body discusses the upcoming support schemes, the transformation of the PPA market and the rise of green finance.

Markets & Policy

Featured

Acen pushes ahead with 9.6 GWh pumped hydro project in Australia

US roadmap streamlines solar project interconnections

A new US Department of Energy (DoE) roadmap outlines 35 ways to allow solar developers to expedite the interconnection of utility-scale renewables and storage projects. The roadmap, developed through a DoE stakeholder process known as i2X, proposes actions to implement these solutions.

ReNew, Jera collaborating on green ammonia project in India

ReNew Energy Global and Japan’s Jera have teamed up to develop a green ammonia project in the Indian state of Odisha. It will have an annual production capacity of around 100,000 tons by 2030, with Jera serving as the offtaker.

Mercom, WoodMac note challenging PV investment climate in Q1

Mercom Capital Group says that total corporate solar funding, global venture capital funding, public market financing, and PV mergers and acquisitions all fell year on year in the first quarter of 2024. The sector is still grappling with high interest rates, which Wood Mackenzie says is disproportionately affecting renewables projects.

Netherlands allocates €100 million for battery storage subsidies

The Dutch government has earmarked €100 million ($106.7 million) of subsidies for the deployment of battery storage alongside PV projects. The funds are part of a €416 million subsidy program announced last year to alleviate grid congestion.

Stellantis acquires 49.5% stake in Argentine solar company

Car manufacturer Stellantis has agreed to invest $100 million in a 49.5% stake in Argentina’s 360 Energy Solar. The two parties plan to develop new solar plants, install large-scale storage systems, and produce hydrogen energy.

Installations

Featured

Soltec launches dual-row, single-axis tracker

EcoFlow unveils air-to-water heat pump, PV-powered water heater

EcoFlow has launched a new air-to-water heat pump for residential applications. The new product, equipped with R290 refrigerant, is available in 9 kW and 20 kW versions. The US-headquartered manufacturer has also developed a new smart immersion heater, which uses surplus solar energy to heat up water. It is compatible with all available rooftop PV systems.

Swiss canton to cover road with 14 MW of solar

The Swiss canton of Fribourg says it plans to cover a roadway with 14 MW of solar panels. The authorities are now conducting an in-depth feasibility study, to be followed by a financial plan for the project.

Saudi Arabia could hit 130 GW of renewables by 2030, says GlobalData

GlobalData say it is “plausible” that Saudi Arabia could close in on its target of 130 GW of renewables by 2030 by strengthening policies, competitive auctions and other financial measures.

Avaada Energy wins 250 MW solar-wind hybrid tender with $0.042/kWh bid

Avaada Energy has won NTPC’s 250 MW solar-wind hybrid tender with a winning bid of $0.042/kWh. The project must be connected to India’s Inter State Transmission System (ISTS).

EWEC seeking proposals for 1.5 GW of solar in Abu Dhabi

Emirates Water and Electricity Co. (EWEC) is now accepting proposals for a 1.5 GW solar project in Abu Dhabi. The tender is open to the 19 bidders who passed the qualification process, following an expression of interest stage last year. The chosen developer or consortium will sign a long-term power purchase agreement (PPA) with the Abu Dhabi-based utility.

Technology

Featured

ZSW, First Solar partner to collaborate on thin-film PV

New model to optimize PV module encapsulation

An Austrian team develped a model to optimize lamination parameters and to flag critical, insufficiently crosslinked and inconsistent encapsulant laminations. It could be particularly suitable for the production of double-glass solar panels.

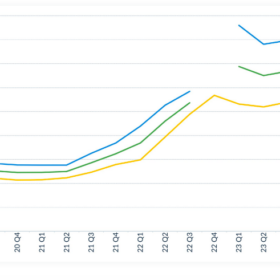

Europe’s negative price trend could continue until summer

AleaSoft and SolarPower Europe inform pv magazine that negative energy prices in Europe are related to the pandemic, low demand, insufficient storage solutions, and inadequate energy planning. They say this situation will likely continue into the summer.

ArcActive targets Australia with ‘re-engineered’ lead-acid battery tech

ArcActive, a New Zealand-based battery tech specialist, plans to set up a factory in Australia within 18 months. It says the facility will be able to produce 30,000 lead acid-based residential energy storage systems per year.

Researchers design 31%-efficient perovskite solar cell based on calcium nitrogen iodide

An international team has demonstrated a perovskite solar cell relying on inorganic calcium nitrogen iodide (Ca3NI3) perovskite and has found this absorber material offers advantages such as tunable bandgap and resistance to heat. The device achieved a fill factor of 81.68%.

Ensemble techniques for solar energy forecasts

A Chinese research group has sought to understand the relative performance of two weather prediction techniques based on ensemble modeling for solar energy forecasts. The scientists applied the two methods in combination with three classical post-processing methods.

Manufacturing

Featured

French PV module maker Systovi goes into liquidation

Mooring system design for offshore floating photovoltaics

Researchers in China have compared the performance of catenary and taut mooring systems for offshore floating PV systems. They found that the taut system offers a higher degree of reliability in shallow water environments with severe tidal variations.

Agrivoltaics for berries

Scientists in the Netherlands conducted meta-analysis on the growth of strawberries, blueberries, blackberries and blackcurrants under different levels of shade generated by elevated agrivoltaic systems. They found that, although classified as shade-benefitting in previous literature, not all berries are equally profiting from the presence of the photovoltaic panels.

Bifacial panels, representing 98% of U.S. solar imports, may soon be subject to tariffs

The Biden Administration is expected to revoke tariff exemptions on bifacial solar modules following a petition led by Qcells, a company with a multi-billion-dollar investment in U.S. manufacturing.

Sunmaxx PVT opens 50 MW PV-thermal module factory in Germany

Sunmaxx PVT, a photovoltaic-thermal (PVT) solar module specialist, has built an automated 50 MW module factory near Dresden, Germany.

ABB Motion launches new solar drive for water pumping

ABB Motion has unveiled a new solar drive for water pumping, featuring integrated maximum power point tracking (MPPT) logic to maximize operations, with an input voltage ranging from 225 V to 800 V.

Energy Storage

Featured

JLR, Allye Energy partner on 270 kWh portable battery energy storage system

Nhoa Energy commissions battery storage project in Taiwan

Nhoa Energy, an Italian developer, has commissioned a battery energy storage project for Taiwan Cement Group in Yilan county, Taiwan, with a capacity exceeding 120 MWh.

Vast Solar to build 30 MW/288 MWh CSP plant in Australia

Renewables developer Vast Solar has signed a key engineering contract as it pushes toward construction of a 30 MW/288 MWh thermal concentrated solar power (CSP) plant with more than eight hours of energy storage capacity near Port Augusta, South Australia.

System design for PV-driven hybrid EV charging stations

Researchers in India have simulated a 4 kW solar power-based hybrid electric vehicle (EV) charging station using a three-stage charging strategy and found that the station is capable of charging 10–12 EVs with 48 V 30 Ah lithium-ion batteries.

The Hydrogen Stream: Vale opens hydrogen metallurgy lab in China

Vale and Central South University have launched a joint laboratory for low-carbon and hydrogen metallurgy in Changsha, in China’s Hunan province, while Nippon Steel has secured approval to acquire U.S. Steel.

Rechargeable magnesium batteries for grid-scale storage

Researchers in Japan have developed a novel cathode material for rechargeable magnesium batteries (RMBs) in the form of rocksalt oxide. This new material reportedly enables efficient charging and discharging even at low temperatures.