Top News

French PV module maker Systovi goes into liquidation

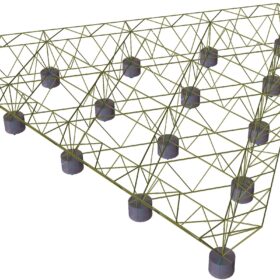

Mooring system design for offshore floating photovoltaics

Agrivoltaics for berries

pv magazine Webinar

pv magazine Webinar

MEDIA KIT 2024

Sign up for our free pv magazine newsletters

Bifacial panels, representing 98% of U.S. solar imports, may soon be subject to tariffs

Eskom launches tender to build 75 MW solar project at coal plant

JLR, Allye Energy partner on 270 kWh portable battery energy storage system

Nhoa Energy commissions battery storage project in Taiwan

European Space Agency mulling feasibility of space-based solar power

Press Releases

Astronergy Thailand Manufacturing Base perfects its industry chain with wafer lines

ATW Breakthroughs at SOLAREX ISTANBUL 2024 and the 12th Energy Storage International Conference and Expo

JinkoSolar’s Tiger Neo to Power Africa’s First Commercial Green Iron Plant in Namibia

Solar Charter unites EU governments and solar sector in commitment to reshore solar manufacturing in Europe

Opinion & Analysis

Featured

Making the case for concentrated solar power

A new twist on thermal storage

Power Panel offers a PV and thermal storage solution that combines simple, safe and easy to manage hot water with advanced thermoplastic technology and architecture.

What does solar need to keep investment flowing?

In its latest monthly column for pv magazine, SolarPower Europe describes which policy tools are expected to help Europe move at a faster pace in solar and renewable energy deployment. The European trade body discusses the upcoming support schemes, the transformation of the PPA market and the rise of green finance.

Solar cell prices fall for 3rd consecutive week

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

‘I don’t think I had more difficulties establishing myself in senior roles than my male colleagues’

This week, Women in Solar Europe (WiSEu) gives voice to Maria Sabella, CEO and founder of Italy-based Enlight Energy Services. She told as, in some cases, at the beginning of her working relationships, she felt some prejudgment from male colleagues, but she also aknowledged, that the initial reaction disappeared after the focus on the details of the activity to be performed increased.

European Solar sees warm, cloudy end to winter, linked to record temperatures

In a new weekly update for pv magazine, Solcast, a DNV company, reports that in March most European solar operators and grids saw less solar irradiance and production than normal, due to enhanced westerly winds bringing moist air off a relatively warm Atlantic ocean. Large areas of the continent saw irradiance down 10% to 25% below normal for March.

Markets & Policy

Featured

AleaSoft notes slight recovery in European electricity prices

Sunmaxx PVT opens 50 MW PV-thermal module factory in Germany

Sunmaxx PVT, a photovoltaic-thermal (PVT) solar module specialist, has built an automated 50 MW module factory near Dresden, Germany.

Origami Solar readies production of steel solar module frames

The U.S. based developer of steel PV module frames said its products are an alternative to conventional aluminum frames. They passed several third party tests as the company readies production and evaluations by module manufacturers.

India releases draft guidelines for residential rooftop solar subsidies

India’s Ministry of New and Renewable Energy (MNRE) has released draft guidelines for the PM Surya Ghar: Muft Bijli Yojana scheme, which aims to install rooftop solar plants in 10 million households, with subsidy support from the central government.

Vast Solar to build 30 MW/288 MWh CSP plant in Australia

Renewables developer Vast Solar has signed a key engineering contract as it pushes toward construction of a 30 MW/288 MWh thermal concentrated solar power (CSP) plant with more than eight hours of energy storage capacity near Port Augusta, South Australia.

LevelTen Energy reports stable solar PPA prices for US market

LevelTen Energy says in a new report that solar power purchase agreement (PPA) prices have remained stable in the United States, indicating greater stability after a period of market volatility.

Installations

Featured

Hail damage and toxicity risks in solar plants

Sunman launches glass-free balcony solar modules

The Chinese manufacturer said its new frameless module can be installed on a balcony through nylon cable ties, without the need for any mounting structure. The new product features a power output of 200 W and a power conversion efficiency of 16.2%.

System design for PV-driven hybrid EV charging stations

Researchers in India have simulated a 4 kW solar power-based hybrid electric vehicle (EV) charging station using a three-stage charging strategy and found that the station is capable of charging 10–12 EVs with 48 V 30 Ah lithium-ion batteries.

The Hydrogen Stream: Vale opens hydrogen metallurgy lab in China

Vale and Central South University have launched a joint laboratory for low-carbon and hydrogen metallurgy in Changsha, in China’s Hunan province, while Nippon Steel has secured approval to acquire U.S. Steel.

Croatia launches auctions for 607 MW of solar, wind, hydro

The Croatian Energy Market Operator (HROTE) has announced a much-anticipated, €257.2 million ($273.5 million) round of renewable energy auctions. It has allocated the biggest quota of 450 MW for solar projects and has set a deadline to award the subsidies by year’s end.

Spanish installer tests vertical rooftop PV array based on conventional panels

Sud Renovables has installed a pilot vertical rooftop PV system on one of its facilities in Barcelona, Spain. The array features two 500 W bifacial modules from US-based SunPower and two microinverters from Enphase Energy.

Technology

Featured

ABB Motion launches new solar drive for water pumping

New vapor deposition tech could accelerate commercialization of perovskite solar cells

A U.S.-based team developed a vapor deposition technique to fabricate outperforming all-inorganic perovskite thin films in under 5 minutes in a continuous process. The adoption of the proposed approach may also result in higher perovskite solar cell power conversion efficiencies.

Four-terminal tandem organic solar cell achieves 16.94% efficiency

Researchers in Spain claim to have recorded the highest power conversion efficiency result for a four-terminal tandem organic cell to date. The device is based on an ultrathin transparent silver electrode.

Reducing PV module temperature with radiative cooling based on polymeric coatings

A Saudi research group has assessed how polymeric coatings, such as polyethylene terephthalate (PET) and polydimethylsiloxane (PDMS), could be used for radiative cooling in photovoltaic panels and has found that both materials could reduce the operating PV module temperature by between 1.15 C and 1.35 C.

European study shows continent exports solar waste

Europe’s solar boom is hiding its waste through exports, according to a new study. Instead of recycling, as expected under European regulations, vast amounts of solar panel waste are exported, undermining sustainability goals. The researchers suggest a digitized value chain as a potential fix to work toward a circular economy.

Dracula Technologies, STMicroelectronics unveil photovoltaic illuminometer

France’s indoor organic PV specialist Dracula Technologies and Swiss-headquartered semiconductor manufacturer STMicroelectronics demonstrated a battery-free illuminometer at the Embedded World trade fair in Germany last week.

Manufacturing

Featured

EC announces European Solar Charter to support PV manufacturing

‘Polysilicon price will stay above $5.50/kg for at least a year,’ says analyst

Andries Wantenaar, solar analyst at Rethink Technology Research, tells pv magazine that high overcapacity levels in the polysilicon industry are exerting enormous pressure on prices for the entire supply chain. He says China hit 2.4 million tons of polysilicon production capacity at the end of 2023, and notes that the nation will end 2024 with 4 million tons of capacity if all announced production plans are realized.

Turkish solar module manufacturer launches production in Texas

Elin Energy says it has an agreement with key US distributors and will begin with 1 GW of annual PV module production, with plans to increase to 2 GW within 18 months.

Adjusting oxygen distribution in Czochralski silicon crystal growth

Researchers in Taiwan have discovered that in polysilicon production the crucible angular speed affects the oxygen concentration near the crucible wall, which in turn affects the wafers’ mechanical and electrical properties. They simulated a Czochralski process for an ingot with a diameter of 200 mm diameter and a length of 700 mm.

Solar module cooling tech based on waste neem oil

An international research team has placed a neem oil tank on the back of solar modules for cooling purposes. The proposed solution reportedly improves PV panel performance by up to 17.8%.

EU Ecodesign and Energy labels for solar risks fall short of objectives, says coalition

Representatives from the European Solar Manufacturing Council, Ultra Low Carbon Solar Alliance, PVthin, and the Environmental Coalition on Standards have proposed changes to the carbon footprint accountability methodology, the use of green certificates, and the planned design of the Energy Label for PV products.

Energy Storage

Rechargeable magnesium batteries for grid-scale storage

Key takeaways from Advanced Battery Power + V2G conference

Battery research is advancing to address issues in the lithium-ion development process and concerns about safety and aging. Vehicle-to-everything (V2X) tech, meanwhile, is in the starting blocks, but interoperability is the key hurdle to achieving mass market penetration.

Photovoltaics for cold storage

Researchers in China have developed a photovoltaic cold storage system that is reportedly able to improve refrigeration capacity and ice storage rate. The system is said to ensure a stable cooling system operation for the refrigeration needs of agricultural products.

Alpha Innotec launches new residential heat pumps

The German manufacturer said the new air-to-water systems are part of its Hybrox series. Their coefficient of performance is between 4.3 and 5.3 and their size ranges from 11 kW to 16 kW.

Engie connects solar mini-grid in Benin

The mini-grid, expected to connect over 1,500 residents to electricity, is part of the company’s wider plans to install over 20 mini-grids in Benin, which will serve more than 30,000 people across 20 rural localities collectively, through a total 1.2 MW capacity.

Egyptian solar set to expand beyond the massive 1.8 GW Benban PV project

In this edition of the Weekend Read, we turn to Egypt. The gigawatt-scale Benban project showcases the North African country’s solar potential, and premium prices for gas exports make the case for a more diverse energy mix. A nation with grand renewables targets – but slow installation rates – may finally be weaning itself off fossil fuel resources.