Top News

DualSun launches foldable plug-and-play solar kits

Australia announces community battery rollout

GameChange Solar, JZNEE to build 3 GW tracker factory in Saudi Arabia

pv magazine Webinar

pv magazine Webinar

MEDIA KIT 2024

Sign up for our free pv magazine newsletters

Azerbaijan announces first solar auction

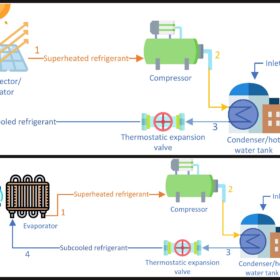

Solar-assisted heat pumps vs. air-source heat pumps

NREL updates interactive chart of solar cell efficiency

French module makers request permits to build GW-scale panel factories

Spain launches 1.3 GW synchronous renewables, storage tender

Press Releases

Philadelphia Solar launched a new battery production line

Sineng Unveils Extensive Portfolio of PV+ESS Solutions at WFES, Empowering MENA’s Green Transition

DAS Solar has advanced to ‘BBB’ in PV ModuleTech bankability ratings

Deye Releases New Single-Phase LV ESS: A Lightweight, Versatile, Stylish Power Solution

Opinion & Analysis

Featured

The fastest energy change in history still underway

At least 29 countries installed more than 1 GW of PV in 2023

IEA PVPS has published its new “Snapshot of Global PV Markets 2024” report, highlighting key insights and trends. Despite record installations, concerns over profitability and manufacturing dynamics persist, underscoring the need for strategic interventions and policy support to navigate towards a resilient and sustainable PV ecosystem.

When nano- meets climate technology

The use of metal-organic frameworks (MOFs) to create nanoscale crystal structures to attract hydrogen molecules could drastically improve the energy efficiency of storing and transporting the energy carrier.

Solar module prices hovering at all-time lows

As solar module prices continue to fall, pvXchange.com founder Martin Schachinger explains how price pressure could increase in the weeks and months to come.

Dust and cloud impact solar across Arabian Peninsula

In a new weekly update for pv magazine, Solcast, a DNV company, reports that dust storms and slear skies led to contrasting March Solar Performance in West Asia. The Arabian Peninsula experienced humid winds and dust storms that reduced solar irradiance to 90% of typical levels for the month.

‘Paternity leave policies are strongly correlated with the female share of board seats’

In another article of a series on gender equality, Women in Solar Europe (WiSEu) gives voice Mariyana Yaneva, Vice Chair at the Association for production, storage and trading with electricity (APSTE). She explains that policies allowing childcare needs to be met but not placing the burden of care explicitly on women, increase the chances that women can build the business acumen and professional contacts necessary to qualify for a corporate board.

Markets & Policy

Featured

Anker Solis launches residential batteries

IRENA’s 14th assembly underscores role of geopolitics, urgent need for action

The 14th assembly of the International Renewable Energy Agency (IRENA) last week in Abu Dhabi underscored the centrality of geopolitics and security in the current global energy landscape. The gathering also called for greater action to achieve the COP28 target of tripling renewables deployment by 2030.

The Hydrogen Stream: Denmark may produce green hydrogen from wind

Denmark will procure at least 6 GW of offshore wind power capacity to potentially produce hydrogen, while Orlen says it will use a European Commission grant to build 16 hydrogen refueling stations in Poland.

Chinese PV Industry Brief: China’s cumulative PV capacity tops 660 GW

China’s National Energy Administration (NEA) says the nation installed more than 47 GW of solar in the first three months of this year.

European Parliament approves law to ban products made with forced labor

The provisions cover all products and do not target specific companies or industries. They will be published in the Official Journal of the European Union tomorrow. EU member countries will have three years to enforce them.

France announces new FIT rates for PV systems up to 500 kW

France’s new feed-in tariffs (FITs) for the period from May to July 2024 range from €0.1735 ($0.1850)/kWh for installations below 3 kW to €0.1141/kWh for arrays ranging in size from 100 kW to 500 kW.

Installations

Featured

Kaco launches new inverters for complex roof architectures

Renewables hit record levels in Australia as electricity demand rises

A new report by the Australian Energy Market Operator (AEMO) shows the nation’s clean energy transition is gathering pace with renewables, including large-scale and rooftop solar.

Winter air pollution weighing on solar generation in India

Solargis says that Indian solar operators have experienced below-average PV panel performance due to air pollution in each of the past five winters. Northern India experienced the worst air quality in decades this January, with data showing a 30% to 50% dip in solar irradiance due to high aerosol levels.

South Korea plans 120 GW space solar project

Two Korean research institutes are designing the 2.2 km × 2.7 km Korean Space Solar Power Satellite project with the aim of providing approximately 1 TWh of electricity to the Earth per year. The proposed system should use 4,000 sub-solar arrays of 10 m × 270 m, made out of thin film roll-out, with a system power efficiency of 13.5%.

Coupling heat pumps with roll-bonded photovoltac-thermal collectors

Researchers in Sweden have analyzed how roll-bonded PVT collectors can act as secondary heat sources in ground-source heat pumps and have found they provide a better performance than conventional PVT panels. Their techno-economic analysis also showed roll-bonded PVT systems can be up to 9% more expensive than conventional installations based on sheet and tube absorbers.

High interest rates challenge global shift to renewables

A new report from Wood Mackenzie examines how the global shift to higher interest rates to combat inflation is squeezing the energy transition.

Technology

Trina Solar claims 740 W output for TOPCon PV module

Solar forecasting based on all sky imaging, long short-term memory

A Dutch research team have developed a solar radiation forecasting model that uses the long short-term memory (LSTM) technique. The proposed methodology reportedly achieves better results than other forecasting approaches.

Sinovoltaics maps out Southeast Asian PV manufacturing sites

The latest supply chain report from the Hong Kong-based technical compliance and quality assurance company covers the Southeast Asia region, providing information about 50 manufacturing sites.

German startup planning vertical floating PV plant

Germany-based Sinn Power plans to build a 1.8 MW floating PV system with vertically deployed solar modules. Construction is expected to start this summer.

Photovoltaic water pumping based on open-ended winding induction

Indian scientists have designed a water-pump drive system that is powered exclusively by photovoltaics. The proposed system configuration reportedly ensures effective use of both the solar modules and the motor.

Researchers design tin-germanium-based perovskite solar cell with potential efficiency of 31.49%

Researchers in Malaysia have simulated a mixed cation perovskite solar cell integrating tin and germanium in the absorber. By modulating the perovksite layer thickness, they were able to achieve an efficiency ranging from 24.25 % to 31.49 %

Manufacturing

Featured

Low solar module prices affecting secondhand market

PV Cycle Belgium claims 404 tons of recycled solar panels in Q1

PV Cycle Belgium says it collected and processed 404 tons of solar panels for recycling during the first quarter of this year. It notes that the number of solar panels it has collected over the last five years has more than quadrupled.

Maxeon sues REC, Hanwha Qcells for alleged TOPCon patent infringement

Maxeon has filed two different lawsuits in the United States against Hanwha Qcells and REC over claims that the two manufacturers used an unspecified tunnel oxide passivated contact (TOPCon) solar cell technology.

Enphase Energy, Octopus Energy announce UK partnership

Enphase Energy says that Octopus Energy’s retail customers will be able to integrate solar and battery systems into their energy plans in the UK market, with the introduction of Enphase IQ8 microinverters and the IQ battery 5P platform.

Vsun starts production at wafer facility in Vietnam

Japan-based solar manufacturer Vsun’s new facility produces n-type silicon wafers and is expected to be ready for full production by the end of the month.

Premier Energies aims to raise over $180 million in IPO

Premier Energies has filed draft papers with the Securities and Exchange Board of India (SEBI) for an initial public offering (IPO). The company says it will partly use the proceeds to fund 4 GW of tunnel oxide passivated contact (TOPCon) solar cell and module production.

Energy Storage

Featured

Large-scale solar, battery storage hybrid starts operations in South Africa

Johnson Controls releases new residential heat pump series

The new heat pumps use R-454B as a refrigerant and are specifically designed to be matched with Johnson Controls’ residential gas furnaces. Their size ranges from 1.5 tons to 5 tons and their coefficient of performance (COP) spans between 3.24 and 3.40, according to the manufacturer.

The Hydrogen Stream: Linde plans 5 MW electrolyzer in Brazil

Linde says its White Martins unit will build a second electrolyzer to produce green hydrogen in Brazil, while Sunfire has launched a front-end engineering and design study (FEED) for a new 500 MW hydrogen project.

Europe’s largest battery storage project secures approval

Netherlands-based developer Giga Storage has obtained the irrevocable permit for the construction of a 600 MW/2,400 MWh battery energy storage system (BESS) project in Belgium.

Netherlands allocates €100 million for battery storage subsidies

The Dutch government has earmarked €100 million ($106.7 million) of subsidies for the deployment of battery storage alongside PV projects. The funds are part of a €416 million subsidy program announced last year to alleviate grid congestion.

Europe’s negative price trend could continue until summer

AleaSoft and SolarPower Europe inform pv magazine that negative energy prices in Europe are related to the pandemic, low demand, insufficient storage solutions, and inadequate energy planning. They say this situation will likely continue into the summer.