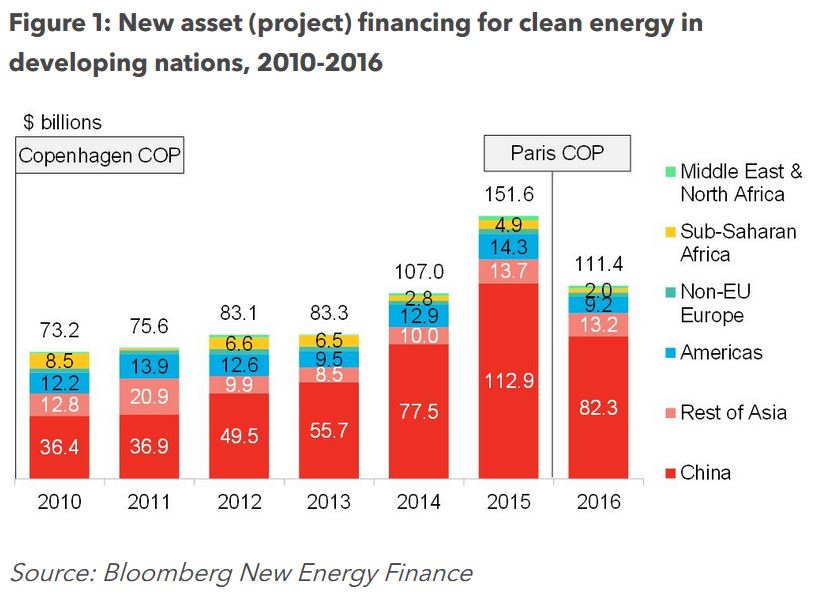

New research conducted by Climatescope on behalf of Bloomberg New Energy Finance (BNEF) has found that total new clean energy investment among non-OECD countries was just $111.4 billion in 2016 – some $40.2 billion less than the $151.6 billion invested in 2015.

This decline was driven predominantly by China, which accounted for three-quarters of the reduction in investment, but all other non-OECD countries spent 25% less on clean energy last year compared to 2015. However, BNEF was keen to stress that investment shortfalls were recorded on both sides of the rich-poor divide, with the developed world failing on its 2009 Copenhagen pledge to make $100 billion a year available to help non-OECD countries address the impacts of climate change.

The Climatescope data shows that funds specifically deployed from the world’s richest OECD nations to non-OECD countries to support clean energy development was just $10 billion in 2016 – far below the $100 billion pledge and also down on 2015’s figure of $13.5 billion.

“The figures highlight the gap between talk and action when it comes to addressing climate and supporting clean energy,” said BNEF analyst Ethan Zindler. Allied to tumbling investments in non-OECD clean energy, CO2 emissions in these nations are continuing to rise, reaching 22 million tonnes in 2016. In contrast, emissions in the world’s richest economies such as the U.S., Germany, Japan and the U.K. are falling: BNEF’s data shows that wealthy nations pumped out less than 14 million tonnes of CO2 in 2016.

Collectively, global carbon emissions increased by less than 1% in 2016 – largely thanks to concerted global efforts to install solar and wind power. BNEF estimates that $8.7 trillion will be invested in clean energy through 2040, although this figure would still be $5.4 trillion short of meeting the goals set under the Paris Agreement.

Popular content

However, such calculations fail to properly grasp the impact of tumbling solar and wind costs on these investment totals. Even though non-OECD countries spent $40 billion less on clean energy in 2016, installation of solar power increased thanks to the cost of PV components falling drastically.

A recent report by the International Energy Agency (IEA) found that solar PV capacity grew 50% globally in 2016 to make it the world’s fastest-growing energy source. At the same time, PV has become as cheap or cheaper than fossil fuels in many countries, and will likely become the lowest-cost source of power generation globally within five years. Given this cost-reduction trend, it is somewhat inevitable that overall investment in the sector will fall.

That being said, many non-OECD countries have a distinct lack of policy direction where clean energy investment is concerned, BNEF said. Of 71 nations researched in detail, 76% have established domestic CO2 containment goals, and just two-thirds have introduced FITs or auctions to support clean energy projects. Furthermore, a mere 18% have set binding greenhouse gas emissions reduction policies.

BNEF states that the absence of such policies serves to deter private investors in developing nations.

“Wealthier countries have been slower to ramp investment than might have been expected, given the promises made eight years ago at Copenhagen,” said Zindler. “But poorer nations have in many cases not built the policy frameworks needed to build investor confidence to attract clean energy investment.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.