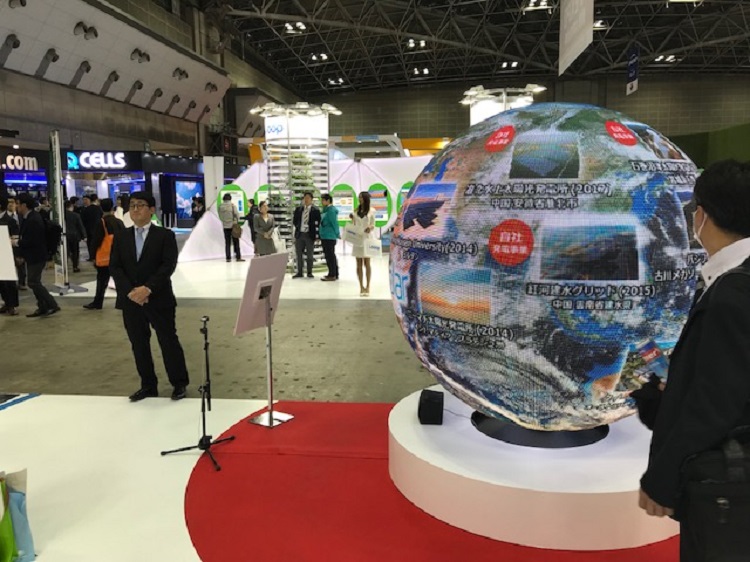

The three-day PV Expo show in Tokyo, Japan, drew to a close today after a relatively busy gathering of leading solar and storage firms drawn from around the globe.

Days one and two were certainly quieter than in recent years, but the final day seemed to deliver a spring into the steps of the visitors equal to the warm and welcoming weather outside.

Conversations that pv magazine had with module suppliers, cell makers, inverter companies and storage firms suggest that Japan is gearing up for the transition of its energy market as it liberalizes and adapts to a solar landscape that will be less bullish than in recent years.

While few industry veterans were optimistic that annual installation growth figures will return any time soon, there was confidence that 2018 could deliver above 6 GW of new capacity. Andreas Liebheit of Heraeus Photovoltaics even believes that 7 GW could be installed this year, as developers act on their generous FIT approvals and eat into Japan’s large-scale pipeline of projects approved, but yet to be developed.

The residential and C&I markets are poised to offer the most dynamic movement for growth, albeit growth largely driven by domestic players who still enjoy strong brand advantage in Japan. Panasonic’s booth, made up to look like an open-plan living room in places, was very busy, drawing a great deal of attention among Japanese visitors for its full home energy management systems, which comprise HIT modules of varying shapes and sizes, modular storage capabilities and smart home software.

IHS Markit’s Julian Jansen told pv magazine, however, that when it comes to storage at the C&I and utility scale, Japanese players appear a little behind the curve, in terms of understanding what the market needs, with Korean firms in particular poised to strike – their grasp of the importance of digital solutions, virtual power plant capabilities and software optimization outshining that of the Japanese firms.

Popular content

Innovation in the cell and module space appeared less pronounced than in previous years; a fact Liebheit put down to 2017’s uniquely rapid pace of development across the value chain – 2018 is shaping up to be somewhat of a breather year for new technologies, he said, and a welcome one at that, as firms digest and strategize the innovations introduced last year.

This meant that modules on the show floor emphasized features already well known to the industry, such as half-cut cells, black silicon, a mono and multi-PERC products.

One area where innovation did appear rather penetrative was in bifacial technology, with DuPont showcasing for the first time their new clear Tedlar backsheet film for bifacial cells. According to the company, modules made with this transparent backsheet are 30% lighter than glass-glass modules. The clear backsheets can help boost bifacial cell output in much the same way as glass-glass modules, but without the additional cost and weight associated with double-glass.

China's Sungrow, meanwhile, displayed its floating solar PV capabilities, which include the production of the full floating devices, mounting devices, and inverter solutions for floating solar plants. The Chinese company is targeting a 15% global share of the floating solar market this year.

pv magazine will publish a full report with our five key takeaways from the show next week.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.