From: pv-magazine USA

Big players are making moves because they see a growing market. Companies, portfolios and pipelines are being acquired and and partnerships are forming – while talent is being scouted. And as the bankers gain comfort, the capital flows to manufacturing expansions and to project construction. And it’s just getting started.

Consolidated Edison (Con Edison) announced today that its subsidiary has completed its previously announced purchase of a Sempra Energy subsidiary that owns 980 MWac of operating solar projects and certain development rights for additional solar electric production and energy storage projects. The acquisition brings the Con Edison Clean Energy Businesses portfolio of renewable assets to 2.6 GWac in 17 states, with 2.2 GW of that being solar power assets.

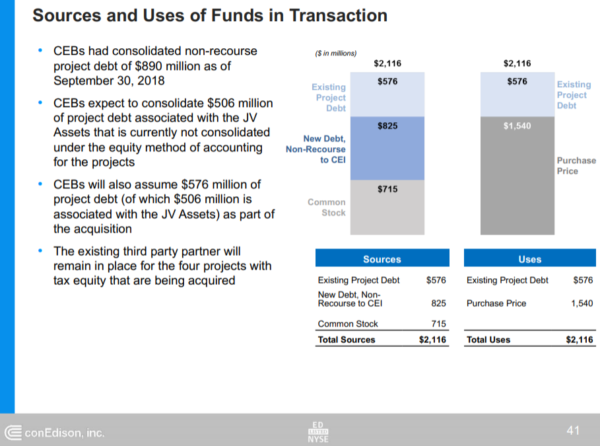

The transaction will book a cost of $2.1 billion, including the assumption of $576 million in existing project debt, plus a purchase price of $1.54 billion.

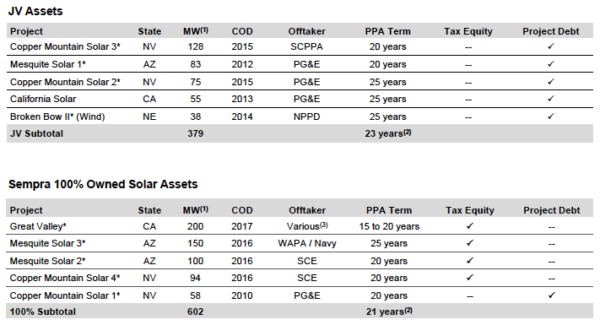

The transaction (below image) included: Mesquite Solar 2 and 3 in Arizona; Copper Mountain Solar 1 and 4 in Nevada, Great Valley Solar in California, and solar and battery storage development projects. Additionally, Con Edison also acquired Sempra Energy’s interest in the jointly owned facilities including: Mesquite Solar 1, Copper Mountain Solar 2 and 3, the Alpaugh, Corcoran and White River solar facilities in California and the Broken Bow II wind facility in Nebraska.

Popular content

For Sempra Energy, this represented an exit from the renewables business as the company dealt with activist investors who forced a strategic review earlier in 2018.

Con Edison is continuing is acquisitions as well. pv magazine as been told that developers and asset owners are being contacted by Con Edison team members.

The most recent list available of North American solar portfolios put out Solarplaza, listed Sempra at #6 and Con Edison at #11. Combined, their operating assets would be number one on this list at just over 2.5 GWdc worth of projects.

| Rank | Name | Role | Capacity 2018 (MW) | City | State | Country |

|---|---|---|---|---|---|---|

| 1 | Duke Energy | Utility | 2,500.00 | Charlotte | North Carolina | US |

| 2 | NextEra Energy Resources | IPP | 2,140.50 | Juno Beach | Florida | US |

| 3 | Cypress Creek Renewables | IPP | 2,041.50 | Durham | North Carolina | US |

| 4 | EDF Renewable Energy | IPP | 1,673.53 | San Diego | California | US |

| 5 | Dominion Energy | Utility | 1,588.00 | Richmond | Virginia | US |

| 6 | Sempra Renewables Services | IPP | 1,522.00 | San Diego | California | US |

| 7 | Capital Dynamics | Investor | 1,500.00 | New York | New York | US |

| 8 | Southern Power | IPP | 1,230.00 | Atlanta | Georgia | US |

| 9 | sPower | IPP | 1,092.80 | Salt Lake City | Utah | US |

| 10 | Clearway Energy Inc | IPP | 1,072.00 | New Jersey | New Jersey | US |

| 11 | Con Edison Development | IPP | 1,042.50 | Valhalla | New York | US |

| 12 | Sunrun | IPP | 1,000.00 | San Francisco | California | US |

| 13 | Vivint Solar | IPP | 1,000.00 | Lehi | Utah | US |

| 14 | Georgia Power | Utility | 970.00 | Atlanta | Georgia | US |

| 15 | TerraForm Power | YieldCo | 968.00 | Juno Beach | Florida | US |

| 16 | Florida Power & Light Company | Utility | 930.00 | Juno Beach | Florida | US |

| 17 | Strata Solar | IPP | 800.00 | Chapel Hill | North Carolina | US |

| 18 | Austin Energy | Utility | 780.00 | Austin | Texas | US |

| 19 | Appalachian Power (AEP) | Utility | 680.00 | Columbus | Ohio | US |

| 20 | Invenergy LLC | IPP | 673.60 | Chicago | Illinois | US |

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.