From pv magazine 06/2021

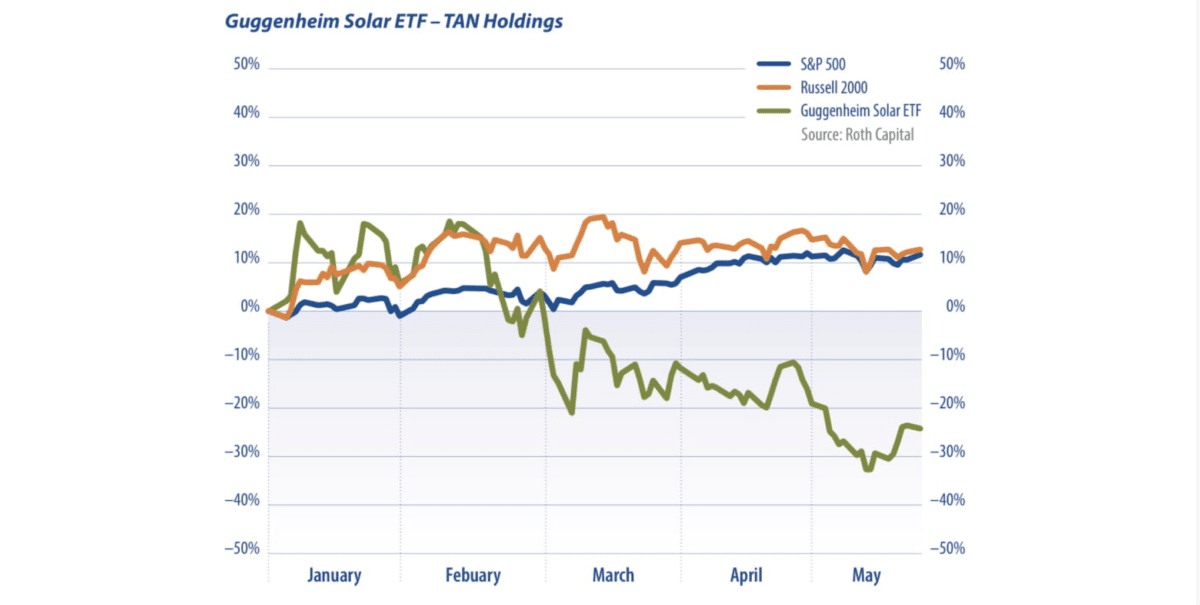

Up to May 25, the Invesco Solar ETF – an exchange-traded fund that tracks the MAC Global Solar Energy Index – underperformed relative to the S&P 500 and Dow Jones Industrial. The Invesco Solar ETF (TAN) decreased 6.4%, while the S&P 500 and DJIA increased 0.4% and 1.5%, respectively.

Up to May 25, the Invesco Solar ETF – an exchange-traded fund that tracks the MAC Global Solar Energy Index – underperformed relative to the S&P 500 and Dow Jones Industrial. The Invesco Solar ETF (TAN) decreased 6.4%, while the S&P 500 and DJIA increased 0.4% and 1.5%, respectively.

The five solar stocks in the U.S. market that predominantly recorded losses include Applied Materials (1.4%), Enphase Energy (1.2%), SolarEdge Technologies (-3.3%), Atlantica Sustainable Infrastructure (4.1%), and Generac Holdings (-4.1%). The most pressing challenge for the solar PV industry is without a doubt the cost increases throughout the supply chain, but none are highlighted more than the increase in commodities costs, in particular steel and freight costs.

U.S. steel prices are expected to remain high through the first two quarters of 2022. U.S. manufacturers do not appear in a rush to increase production. Factors that contribute to the price increases include the consolidation of U.S. steel mills and tariffs on steel imports. Steel imports have driven the rise in U.S. steel mill utilization (now reported at 85%), and with a decline in suppliers due to consolidation, producers are able to maintain their “stranglehold” on supply and sustain high prices until the first half of 2022. Overall, price increases and a higher cost of capital have added $0.05/W of incremental costs.

Popular content

Input costs

Solar tracker manufacturers such as Array (ARRY) and FTC Solar (FTCI) witnessed major hits to their stock prices (down ~50% and ~40% on May 12, respectively) during earnings season in the week of May 10. Again, this was directly attributed to cost inflation. For reference, U.S. utility-scale PV module pricing six months ago for the third quarter of 2020 was $0.25/W, compared to $0.28/W today. With mid-teen IRRs for utility-scale projects, these companies do not have much room to absorb this rapidly increasing cost inflation.

By Jesse Pichel

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.