The rising number of unsubsidized large scale solar power plants in Poland has recently shown the increasing attractiveness of the Polish PPA market and the potential of the Eastern European country to see its energy prices and reliance on coal significantly reduced by resorting to photovoltaics.

Several projects are currently being developed and built outside the country's auction scheme for renewables over 1MW and the large capacities expected from these solar parks should be already operational in this and next year. These projects, however, are not the only signal that unsubsidized PV is gaining market share in Poland and an interesting trend has also been shown by the most recent auction held by the regulator, the Polish Energy Regulatory Office (ERO), in which not all contracted generation capacity has been allocated on the basis the electricity produced will be marketed under the auction's contracts for difference (CfD) mechanism.

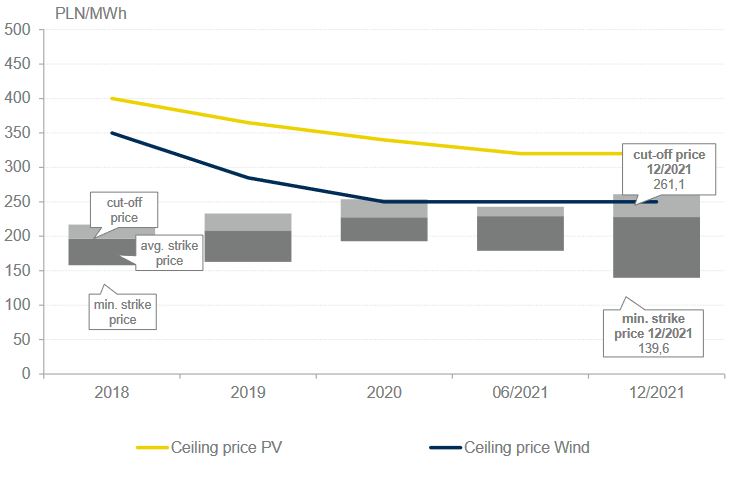

“Because expected mid-term PPA prices for pay-as-produced or pay-as-forecasted are higher compared to expected cut-off prices from the CfD auction, bidders withheld a large share of their total energy volume,” Tim Steinert, from German consultancy Enervis, told pv magazine.

He explained that the Polish CfD auction awards a total energy amount in megawatt-hours with an indexed bid price over 15 years' time, instead of awarding generation capacity as most other auction systems in Europe do, and that bidders are free to distribute their total submitted electricity volume among the 15 years, prior to entry into the support system after a generation license has been obtained. “On average, we estimate that only 40% of the total potential energy volume, based on winning capacity, will be marketed under the CfD scheme and, therefore, mostly shifted towards the last years of the support system,” he further explained. “Vice versa, 60% will either be sold to PPA off-takers or on the spot market, most of them with a tenure of 5-10 years.”

Steiner also revealed that the lowest bid submitted for the auction was PLN139.6o/MWh ($34.57) and that it was most likely set by a project with a long-term PPA. “Therefore, just a fraction of the total volume was supposedly submitted under the CfD, to secure a binding obligation to conclude an interconnection agreement,” Steinert emphasized. “Alternatively, this might have been a smaller project with EU grant investment support which has to be deducted from the bid price.”

Popular content

According to him, the current success of grid parity solar in Poland depends on several factors. “Mostly mid-term development of LCOE of PV, maturity of the project pipeline, and PPA price levels over the next years,” he also said. “One thing is quite clear: the Polish PPA market is on a steep rise and is more attractive compared to the CfD scheme in the current market situation.”

In the latest auction for renewable energy projects exceeding 1MW in size held by the ERO, solar accounted for around 570MW of the allocated capacity at an average price of PLN207.85/MWh.

Poland has, currently, an installed PV capacity of more than 6.3GW. The Polish PV market is expected to grow strongly during the current decade to reach 30GW of installed capacity by the end of 2030, according to the Polish research institute, the Instytut Energetyki Odnawialnej (IEO).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.