Since Belfort, the invasion of Ukraine and the succession of international sanctions that have descended upon Russia have only accentuated the need to work towards greater energy autonomy and sobriety. On Mar. 8, the European Commission unveiled its plan, labeled REPowerEU, to halt Russian oil and gas imports. One of the four main axes of this plan is based, once again, on the development of renewable energies.

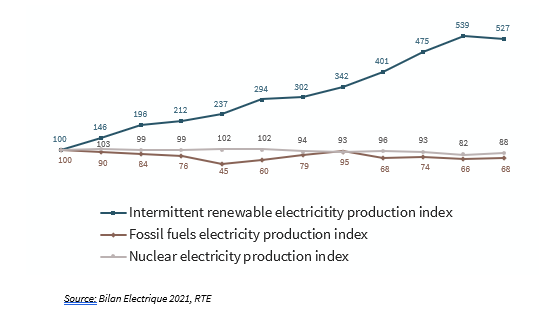

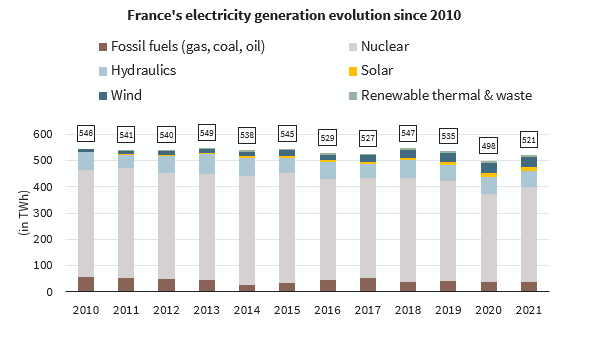

The inevitable penetration of intermittent renewable energies into the European electricity mix constitutes an ever-growing challenge to the stability of the grid. In Europe, the development of renewable energies is taking place much more rapidly than the growth of electricity consumption – in France, the latter has not increased since the years 2005-2010. The emergence of renewables penalizes twice over conventional controllable electricity sources (such as gas, oil, and coal, called as such due to their high reactivity – nuclear power is also controllable but over longer time periods due to strong inertia):

- The rise of intermittent capacity on the grid – with a marginal cost of electricity production equal to zero – has been so far compensated by a gradual shutdown of controllable power plants to allow the grid to absorb this new renewable electricity production.

- When the grid-connected intermittent capacity is underperforming, the controllable production plants must be available to act as a buffer alongside increased electricity imports; to allow for this, gas-fired power plants see their production capped in normal times to be able to take over from renewables by producing more on windless and sunless days.

The development of wind and solar on the grid was therefore primarily at the expense of well-established controllable energies. European grid operators, responsible for ensuring the supply-demand balance at all times throughout the year, are now juggling between (i) on the one hand, variable electricity consumption punctuated by peaks in electricity consumption during heat waves and extreme winter colds and (ii) on the other, increasingly intermittent means of electricity production, less and less predictable in electricity output.

In the long run, innovation will be needed to equip electricity grids with flexible resources to control and modulate this growing intermittent electricity production. Tasking controllable power plants to ensure grid stability, as is done today, may not seem like the best option: many complementary alternative solutions seem more suitable to perform grid flexibility services.

In the long run, innovation will be needed to equip electricity grids with flexible resources to control and modulate this growing intermittent electricity production. Tasking controllable power plants to ensure grid stability, as is done today, may not seem like the best option: many complementary alternative solutions seem more suitable to perform grid flexibility services.

Changes in electricity consumption behaviors with cut-offs, energy efficiency, and sobriety stand as the obvious primary solution; but technological innovation with electricity storage (lithium-ion batteries, hydrogen power-to-gas etc.) should be another. Every given storage technology has its own use case, mainly defined by its activation speed as well as its charging (or discharging) time.

Among all options, lithium-ion storage stands out as the most mature technology to meet the grid’s rapid short-lived imbalances. These assets can be activated in a few seconds by the grid operator but are limited by their charging time, most often of an hour or two (and up to four hours). They can therefore respond very quickly to these imbalances, both upwards and downwards in frequency, by temporarily storing or injecting electricity. However, the relatively short discharging time of lithium-ion batteries makes them unsuitable for responding to imbalances over long periods of time, such as seasonal imbalances, whereas other technologies such as Pumped Energy Transfer Stations (PETS) or hydrogen will be more suitable.

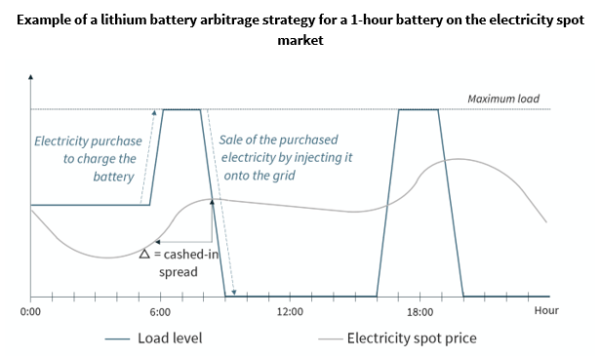

In France, the development of these new flexibility resources is supported by the opening of new markets to remunerate their services. The long-term intraday electricity price forecasts today make it unlikely that lithium-ion assets will solely be profitable on the basis of a buy-sell arbitrage strategy on the spot market. In such a strategy, the asset buys and stores electricity when the spot price is low – in the middle of the day when the sun is in full swing for instance – to sell and inject it later into the network when the spot price rises, as in the evening after the return from work.

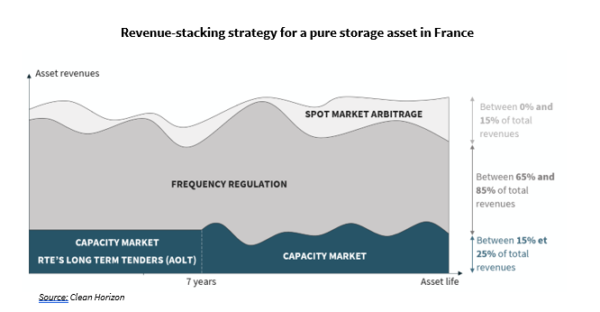

In France, two alternative markets allow for better profitability for storage assets: the capacity market and the frequency regulation market. At any point in time, a storage asset can either perform arbitrage on the spot market or operate on either one of these markets – whatever is more profitable for the battery.

Popular content

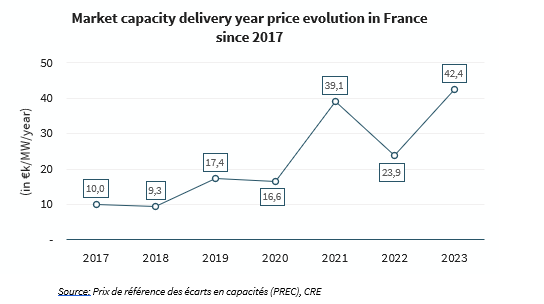

- Under the capacity market, the storage facility commits for a full year to exclusively follow the grid system’s operational instructions on peak consumption days. The storage asset finds itself thereby unable to perform arbitrage or frequency regulation during these days. The number of these so-called “PP2” days cannot exceed 25 per year, and they are announced the day before by the grid operator. The storage installation benefits from an annual remuneration in return defined the year before the commitment through auctions organized by EPEX SPOT.

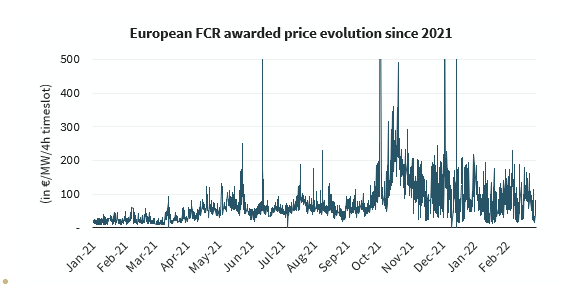

- The frequency regulation market consists of a one-off commitment to follow the grid system’s operational instructions for a specific time slot on any given day in the year (four-hour time slots for the Frequency Containment Reserve – FCR and one hour for the automatic Frequency Restoration Reserve – aFRR ). The associated remuneration is defined through an auction system on the Regelleistung platform. Multiples auctions take place every day for the next day’s time slots. Storage facilities that have committed to the capacity market are therefore able to bid outside PP2 days. Between January 2021 and February 2022, FCR prices were very variable, ranging from €0 to €1,600 per MW for four hours of availability.

Beyond these existing markets, the trend is towards the multiplication of remuneration sources for storage assets in France. The upcoming European opening of the secondary reserve/aFRR to this asset class (the PICASSO project), RTE’s experimental flexibility tenders under development as well as ENEDIS’s ongoing territorial tenders are good examples. Interestingly, the latter two aim at providing a local solution to decongest grid inflexibility nodes (although the applicability of ENEDIS’s tenders to lithium-ion storage assets remains uncertain at this stage).

These new markets remain very volatile and difficult to read for a long-term infrastructure asset class. Unlike renewable electricity projects that are remunerated via a power purchase agreement, often at a pre-agreed fixed price, storage assets in France are subject to significant market risks: the pricing of flexibility services systematically stems from a supply-demand balance rationale. Whether through operating on the spot markets or through participating in recurring tenders, the different sources of turnover of these assets are, in essence, volatile and difficult to predict in the long run.

This volatility greatly stifled the financialization of this asset class by the French energy transition long-term lenders, cooled down by these significant market risks. In 2019, RTE brought a first solution to the issue with its first long-term tenders (AOLT). These tenders offer predictability on the capacity market by guaranteeing a fixed price for seven years to the awarded projects. The introduction of these new tenders only partially met the lenders' need for predictability, despite being a step in the right direction. The capacity market (on which the AOLT provides seven-year visibility) rarely exceeds 25% of the total turnover base of lithium-ion storage assets.

Developers who want to quickly position themselves in the lithium-ion flexibility market are therefore forced to make strong choices:

- Some are convinced of the relevance of a large-scale stationary model. Large autonomous batteries are connected to the grid and only derive their profitability from the different flexibility markets described above. Most of the time, these assets are entirely funded with equity from their developers who bear the full risk. In the longer run, there is a chance these assets could benefit from debt refinancing.

- Others are betting on decentralized hybridization, locally coupling their renewable electricity generation plants with lithium-ion batteries. Such a setting allows electric plants to smooth the intermittency of their electricity production by relying on storage. This second option seems today more suitable to bank lenders who are already offering appropriate financing thanks to their familiarity with renewable power plants.

The need for flexibility on the grid constitutes a real problem today with multiple answers. Among them, lithium-ion batteries appear the best suited to ensure the structural stability of the grid for short-term imbalances. The take-off of the French lithium-ion sector, which has been anticipated for some years now, seems to be slowed down by the lack of visibility on the profitability of the various flexibility markets. With (i) the multiplication of the number of projects and actors involved and (ii) the maturation of the various flexibility markets, the lithium-ion sector should continue to develop and structure itself so as to offer a suitable framework for third-party financiers. Interests look aligned between all parties: developers and lenders would find a relay for growth, while the grid operator would reduce its balancing costs.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.