PV asset managers, O&M providers, and project owners have spoken: and their perspective demonstrates what can be expected in the adoption of robotic cleaning in the near future. The results also provide new insights into how insiders feel about current market offerings and shed light on what factors really matter in the adoption process of solar robotic cleaning.

Addressing utility scale

Industry insiders clearly understand that the cleaning of utility-scale solar sites is only sustainable with automation and that its application is not so much an “if” as a “when.” It seems that many of today’s large-scale solar sites are in some stage of adopting automation, whether that be full or partial.

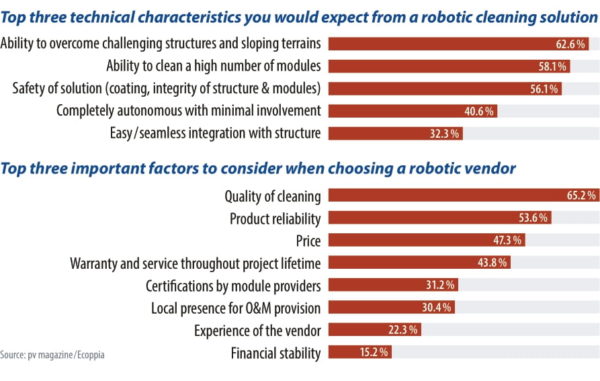

Additionally, one of the top considerations for choosing a robotic cleaning solution is its ability to clean thousands of modules efficiently. Some 25% of the survey’s participants named the ability to clean a large number of modules as one of the top three features they expect from an automated cleaning system. With solar site capacities reaching hundreds, and even thousands of megawatts, cleaning modules is no longer sustainable with manual labor, either physically or financially. Without automation, asset owners are literally – and figuratively – leaving their panels in the dust.

Sloping terrain

No two solar parks are the same and when projects are situated in remote and uneven desert terrain, site developers must customize structures to cater for unique installations. When choosing to optimize a site with robotic cleaning, it needs to be with a technology that does not compromise the structure’s integrity. One of the key factors site owners and managers are looking for is compatibility with a variety of module types and trackers while also overcoming sloping terrain and challenging land structures. The ability to overcome challenging structures and sloping terrain was the top technical requirement cited by survey participants, with more than 62% naming it as one of the top three concerns regarding robotic cleaning technology.

“Ecoppia has taken its decade of experience, and cleaning over 7 billion modules, to create a variety of robust robotic solutions to work for varying terrains and module layouts and we analyze tens of thousands of robots’ daily operations in differing environments and conditions,” says Jean Scemama, the CEO of Ecoppia. “This allows us to customize our new features and developments to customers’ various site needs. We’re proud to offer hybrid solutions for sites with a variety of row lengths, structures, and terrains – such as our latest project with Azure Power in India. Our teams keep developing new features to cater to O&M’s constantly changing needs and the growing complexity in site design.”

Safety and reliability

The survey results indicate that quality of cleaning is at the forefront of minds when it comes to robotics, with 65% of participants naming it as a top factor influencing which robotics to choose. Product reliability; price and warranty; and service were named among the top three technical characteristics that developers consider when choosing to automate cleaning, making up 54%, 47%, and 44% of responses, respectively. Given the long life cycle of solar projects, lasting up to 25 years, it is clear that long term safety is of the utmost importance.

With manual cleaning, a solar module can only be cleaned a handful of times a year and, subsequently, there are major risks such as damage to the PV panel’s anti-reflective coating caused by brush cleaning, which decreases power output. Using robotic cleaning diminishes the impact of unpredictable factors such as dust storms or heavy soiling, by cleaning site panels daily as opposed to the reduced cleaning frequency that manual processes permit.

Similarly, cleaning robots themselves must be highly reliable because the application of automated cleaning is intended to enhance productivity. More than 50% of survey respondents named safety as one of the top three technical characteristics they expected of a cleaning solution.

Safety priority

Safety also applies to the manufacturing of robotic cleaning systems themselves. Providers need to include thorough quality assurance and testing of temperature endurance, wind resistance, and UV resistance to check that quality is at all times embedded in the robotic manufacturing process. With the automated cleaning itself, there are safety considerations and the robots must not cause damage to modules, even when it is potentially unseen damage, such as to module coatings.

Considering a switch to robotics also involves a shift from looking at cleaning as an ad-hoc service, to engaging in a long term partnership with a provider which will not only be providing equipment but also maintenance services for the lifespan of a PV project. Indicative of this, is that 44% of respondents selected product warranties and service throughout a robotic cleaning system’s lifetime as a top-three factor when selecting a vendor.

However, the majority of the surveyed respondents that did not use robotics consider cleaning as a service, realizing it facilitates optimal production. Therefore, investing in automated cleaning is essentially adding another O&M asset to the site. Ensuring the quality of the solution requires more than trust and certification with reputable bodies goes a long way to verifying that the robotic solution under consideration has been fitted with quality as well as durable parts that are built for extreme weather conditions and longevity.

Popular content

LCOE over initial cost

The cost of robotic cleaning is a major concern. However, the importance of cost diminished among respondents who had experience with automation, and therefore have developed an appreciation of its value. Some 47% of survey participants who had not deployed robotic cleaning indicated that price is their top constraint. Additionally, those respondents also named price among their top factors when choosing a provider. Once solar site managers implement robotics, however, the increased value and reduced levelized cost of energy (LCOE) it brings to their daily operations is likely to supersede their concerns about cost.

The dynamic of value over cost, among those with an experience with robotic cleaning, was borne out in the survey results in other ways. For those who have already been using robotic cleaning solutions, cost was not a top concern. When asked for their top three influencing factors when choosing robotics, price was ranked sixth out of eight choices, ranking below the quality of cleaning, product reliability, warranty and service throughout a project’s lifespan, certifications by module providers, and a local team presence for O&M provision.

Concerns removed

It seems that for companies that are currently using manual cleaning solutions, any concerns about their current cleaning strategy mostly relate to the pricing of the services, making up 21% of their responses. Their other concerns largely considered the managerial overhead that robotic cleaning will require, and ensuring the cleaning quality is high. Those were named as the two other top disadvantages, making up 20% and 17% of the responses, respectively.

According to Scemama, the risk of damage posed by low-cost, low-quality robotic cleaning should also be considered. “There are solar projects where low-cost automated solutions were installed and had to be removed due to poor performance, high maintenance costs, or even damage they caused to the modules,” he said. “Our robots have been designed to provide continuous and reliable cleaning for 25 years, in addition to our warranty and service throughout a project’s lifespan.”

A mindset focused on price hinders the ability to see the lifetime savings robotic cleaning can offer and can even cause module damage or the disruption to O&M schedules due to failures.

Need for a trusted partner

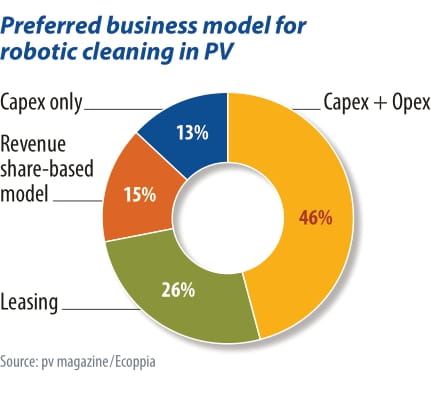

Capital expenditure (capex) might be one thing weighing on developers’ minds when it comes to adding robotics to a solar site but operating expenditure (opex) is an equally important factor, and the survey data indicated that this was understood by the industry. When asked which business model is preferred for robotic cleaning, nearly half opted for a combined capex-opex model, while more than 25% indicated that leasing was a desired model.

Having a trusted partner gives a full understanding of project expenditure and greater project efficiency. This is because O&M is no longer blinded by variable, ad-hoc maintenance costs.

But it is not just finding a trusted partner that can make robotics viable for projects – it also relies on the undertaking and enthusiasm of O&M and asset managers. Asset managers and O&M providers were seen as the key drivers of implementation, as indicated by 56% of the responses, while 46% of those surveyed who did not have automation, believed its implementation should be down to management.

It appears the real drivers of automation are the on-the-ground personnel and that they have the real power to drive robotic implementation.

The pv magazine/Ecoppia survey

- The survey comprised 23 questions exploring aspects of module cleaning for respondents who already deploy robotic cleaning and those that don’t

- The questions covered both technical and commercial aspects of robotic cleaning and PV project O&M

- The survey was conducted between May and July 2022 and was completed by hundreds of respondents from all over the world

- It was first launched during a pv magazine webinar in April 2022

The aim of this first-of-its kind survey was to better understand the expectations and needs of the solar market in relation to robotic cleaning, which itself represents a radical change in the way O&M is conducted at large scale solar sites.

At a glance

The robotics selected for a PV project matter and there is an understanding among the industry that safety, quality, and reliability are the most important factors. O&M teams are concerned with finding robotic cleaning systems that work for their unique structure and geography and they look for a partner that can adapt to their individual site needs.

Through the survey, one of the important takeaways was that cost is not the only factor in choosing a robotic cleaning partner. Expense is, however, an obstacle that needs overcoming, as it holds asset owners and managers back from reaping the benefits that robotic cleaning can deliver in ultimately reducing a site’s LCOE. Finally, the capex-only model hinders progress and limits the ability of asset managers to keep up with changing requirements in solar energy innovation, which is inevitable in projects that last up to 25 years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.