After years of record capital spending, wafer companies that had struggled with shortages of polysilicon are now facing a sudden drop in prices for the material. Businesses that hoarded polysilicon for one or two quarters are now opting to tap into their inventory, while polysilicon makers have at the same time rushed to ramp up capacity. This combination of factors contributed to the recent plummet of polysilicon prices.

Changes in supply and demand may be the primary drivers of these changes, but JinkoSolar says that’s not all that’s behind the current decreases in polysilicon pricing. Additional factors are coming into play here as a large chunk of the new polysilicon capacity built over the last two years has gone online simultaneously. On top of that, the rapid loosening of China’s anti-pandemic policies has further accelerated the release of supplies.

As wafer makers reduce their stockpiles of inventory, prices will balance out and remain at a reasonable level, perhaps even staying tight on the polysilicon side since the combined online polysilicon capacity to satisfy 400GW in 2023 still lags far behind the strong wafer manufacturing capacity of nearly 700 GW. That said, polysilicon manufacturers are not motivated to further depreciate costs. According to industry professionals and analysts, polysilicon makers will not brace for a prolonged downturn and will instead rebound and stabilize at somewhere around 100-130RMB/kg (13.74-17.86 euros/kg) over the long-term, because they still have power over pricing compared to the much larger wafer and cell production capacities. Over the last few weeks, signs have been accruing that the polysilicon price downturn that's been going on since August 2022 has slowed down.

On the other hand, the downward trend in polysilicon prices may not have been fully reflected in the panels, especially given the sharp upward trend in costs of other critical materials, particularly increases for the quartz sand used in the crucible, POE and EVA encapsulant films, and other components. For example, the price of a quartz crucible is about four times the price from twelve months ago. Analysts predict the cost of quartz sand – particularly the price for high-purity sand – will continue to skyrocket due to the even greater gap between supply and demand.

The POE/EVA encapsulant film is another key material that will remain in tighter supply, or will even run short this year, due to the longer time necessary for capacity expansion, as well as its higher manufacturing difficulty. With the strong demand spurred by polysilicon price stabilization, 2023 will see a peak in POE/EVA pricing due to the enlarged gap between demand and supply. There is currently no sign of easing, as this shortage is being experienced everywhere. The inevitable rippling effect across the supply chain means end customers will ultimately experience less of a price drop.

More from our partners

Downstream demand is traditionally soft in the first quarter of the year, given heavy inventory. The depreciation in polysilicon might not be enough to offset the rising cost of the rest of the materials, while shipping costs remain high, according to one panel manufacturer. In addition, panel makers will opt to avoid dropping their prices; instead, they will speed up adoption of n-type technology.

The p-type panel, which has been losing ground to the n-type since last year, looks particularly vulnerable under this scenario. The drop in polysilicon costs would hammer demand even in market areas that have typically remained solid, such as in price-sensitive segments. DG rooftop market customers will continue to stay away from PERC-centric products, due to the technology’s prolonged depreciation risk and the weakness in energy yield that the market continues to see.

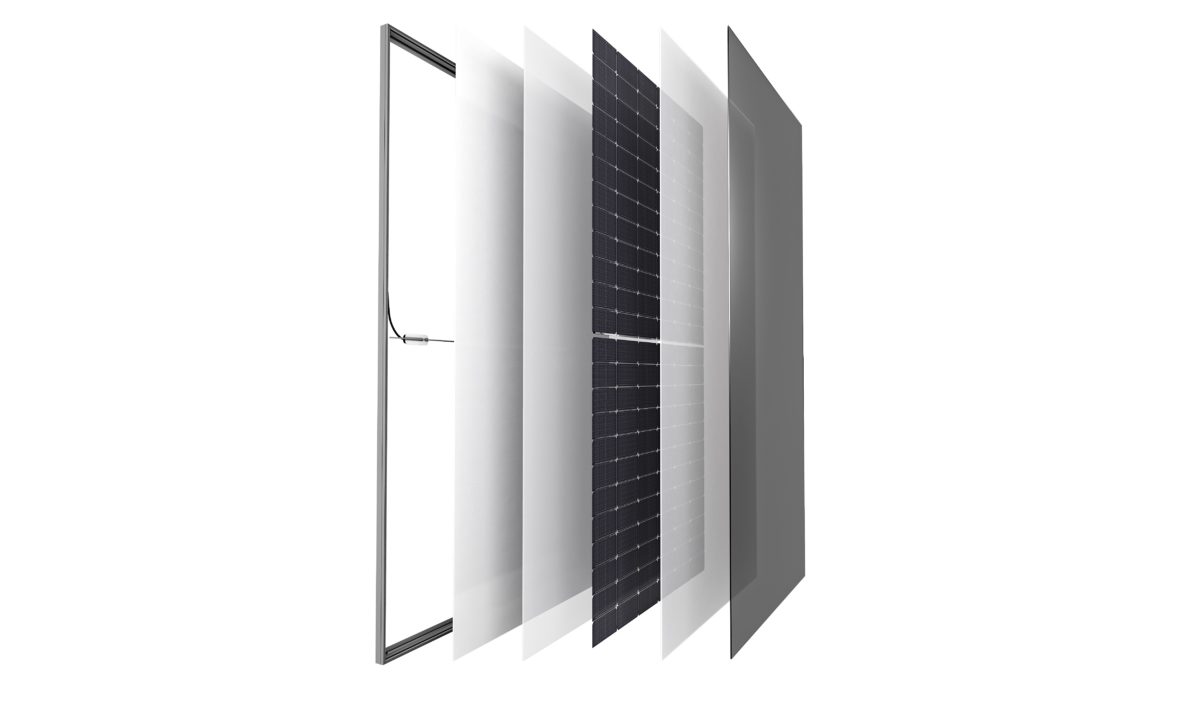

Price vulnerability fears, among other factors, are making cutting-edge n-type panels the new norm across the solar industry. According to JinkoSolar, more and more end customers, developers, and investors will take advantage of the price affordability to transition toward n-type products, which offer better value for the money and are more resistant to depreciation.

Many in the solar manufacturing industry have been building up supplies for a demand that is turning out not to be as real as they thought it was. This may be the current reality for material makers and specialized manufacturers, but it’s also the eternal challenge for the whole industry. Only a large vertically integrated and highly resilient operation will be able to survive these ups and downs.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.