3: PV’s day of judgement

China continued to take center stage in Q3 2018; however the focus shifted from its now notorious policy change. In both positive and negative news, Europe announced the end of the MIP, at almost the same time as the United States slapped tariffs on Chinese imports of inverters, AC modules and non-lithium batteries. Yin yang. Ping pong.

Unlocking Scandi-candy for PV projects in developing countries

A new report suggests that better guarantee mechanisms and securities could unlock more investments from Scandinavia for renewable energy projects in developing countries. Overall, however, it finds that Norway, Sweden and Denmark have comprehensive mechanisms in place for bringing together industry and public support schemes.

Now or never for the EU

The European solar industry is on its knees, but the EU appears willing to set a course for reconstruction. With SolarPower Europe and the European Solar Manufacturing Council, there are now two associations that are actively advancing a course for strong solar industrial policy among the EU bureaucrats in Brussels. The goals, however, are somewhat different.

2: And let the solar games commence

While China’s PV policy announcement dominated the headlines in Q2 2018, there were a lot of other significant happenings in the world of solar, not least the EU’s 32% renewable energy targets, rumors of U.S. tariffs on inverters, PV records in Germany, and unexpected new partnerships. Read on to discover the highlights from April to June.

1: What a difference a year (in PV) makes

Dire warnings about the state of our planet characterized 2018, with a plethora of reports released calling for climate action. The solar PV, and storage, industries have a leading role to play in the required energy transition: this bold quest was taken on by many over the last year, with technological progress and expansion seen upstream and downstream, and in policy, globally. Like last year, China took all by surprise, this time, however, in the form of its abrupt 31/5 policy change, the effects of which are still being felt in almost every corner of every market. And of course, Tesla grabbed the headlines – also for rather more unsavory reasons than in 2017. In this first out of a total of four posts pv magazine reflects on Q1.

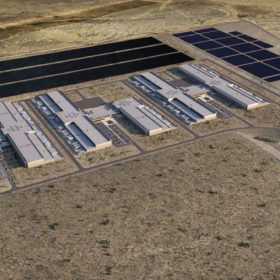

United States: 2.8 GW of corporate solar deals in 2018

According to a new report from Rocky Mountain Institute, corporations have signed contracts for 2.8 GW of solar in the United States this year, a gigawatt more than the deals signed in all previous years combined.

The outlook is sunny for solar in 2019, according to Credit Suisse

Although the investment bank says large manufacturers will suffer from continuing panel price falls, developers will be able to take advantage and experts predict a resurgence in the global market next year.

US corporate solar procurement knocks it out of the park in 2018

According to Rocky Mountain Institute corporations have signed contracts for 2.8 GW of solar in the United States this year, a gigawatt more than the deals signed in all previous years combined.

Greece awards 62 MW of small-scale PV, cancels tender for larger projects in the same day

Greece ran two separate tenders for PV on December 10. However, the Greek energy regulator has decided not to award the winners of the tender for large-scale farms, due to lack of adequate competition. The tender for the large projects will be repeated next year.

UK export payments won’t end – but they will get much smaller

The government has finally announced the results of its consultation on ending FIT export payments. With the vast majority of respondents against the proposal… it has responded by going ahead anyway.