European energy market prices went down in first week of June

In the first week of June, prices of most European electricity markets fell and some negative prices were registered, thanks to the decrease in demand and prices of gas and CO2, and to the increase of renewable energy production in some cases. However, prices rose in the Nord Pool and MIBEL markets, with the latter being the highest weekly price, something that did not happen since the first week of November. A record photovoltaic energy production was registered in Germany on June 3.

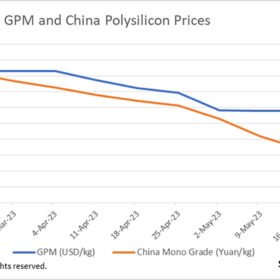

Polysilicon prices plunge worldwide on bearish market sentiment

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

New York and Ontario steal California’s sunshine, as high pressure systems affect May irradiance

In a new weekly update for pv magazine, Solcast, a DNV company, presents the solar irradiance data it collected for North America in May. New York registered a new record on May 18th, when solar power met 20% of the state power demand, while Los Angeles and San Diego rooftops actually received less irradiance during May than New York’s or Boston’s.

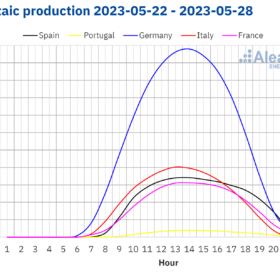

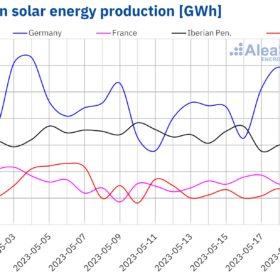

Photovoltaic energy continues to set new records in European electricity markets

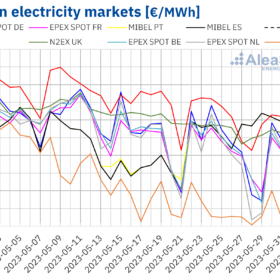

Gas and CO2 prices continued their downward trend in the fourth week of May, which led to a general downward trend in prices in European electricity markets and several negative hourly prices were registered, which reached -€400/MWh in Netherlands. The notable exception of the Iberian market, which saw a rise in prices, came from the fall in renewable energy production. During the week, records of solar photovoltaic energy production were reached in Germany, France, and Italy.

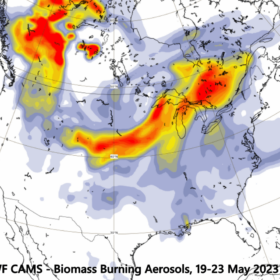

Smoke from early fire season impacts irradiance across North America

In a new weekly update for pv magazine, Solcast, a DNV company, presents the solar irradiance data it collected for North America since early May. The province of Alberta saw close to 100 wildfires raging from the beginning of the month and solar asset operators throughout the impacted regions can expect reduced efficiency from both the irradiance impacts and increased panel soiling.

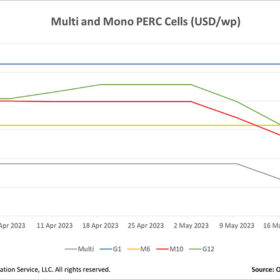

Cell prices slip, weighed down by sustained falling upstream prices

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

New episodes of negative or zero prices in European electricity markets

In the third week of May, negative or zero hourly prices were registered in most of the European electricity markets, especially during the weekend. In the Nord Pool market, the value of -€5.67/MWh registered during an hour on Sunday May 21, is the lowest one in history. For the week as a whole, prices decreased in every market, due to the decrease in demand and gas prices, and also to a higher solar and wind energy production than that of the previous week in several markets.

Biofuels vs. solar electricity for urban mobility

Solar electricity will have to compete with biofuels in the urban mobility landscape. Biofuels, however, have a very low energy productivity per hectare, as well as high requirements for fertilizers, pesticides, and water.

Solar dawn

Frank Haugwitz arrived in China in June 2002 as technical adviser to the solar-focused Sino-German Renewable Energies in Rural Areas Program. He has directly observed the nation’s rise to solar superpower status.

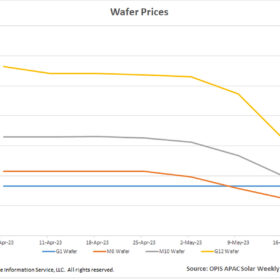

Falling wafer prices continue to make headway for downstream prices

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.