So much cash, so little land

German institutional solar investors manage portfolios amounting to tens of millions of euros. Investor groups have high standards and need one thing above all else: big projects in which to invest. These are scarce in Germany and competition from other funds is fierce, so investors have developed three strategies to identify projects.

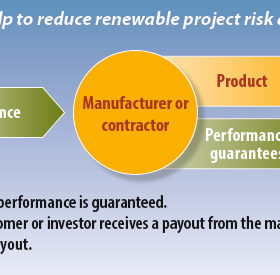

Reducing financial risks

Derisking solar investments and providing confidence in the long-term reliability of PV project components can help accelerate global renewable energy investment. The established track record of PV warranty insurance provides an example of how innovative insurance products can help provide investor confidence and perform this vital role, argues Prentiss Darden, who heads up business development operations in North America for Munich Re Green Tech Solutions.

Opportunity in crisis

The developed world is facing scenarios of zero economic growth or even recessions, as inflation, energy costs, interest-rate rises, and tougher lending criteria makes life tough for business. But money is flowing into the energy transition by scaling and commercializing existing technologies, reports pv magazine’s Tristan Rayner.

Huge room for European PV production

A highly competitive new era of solar installations has arrived. Europe has an important role to play in producing these technologies, argues Javier Sanz, thematic leader of renewable energy for EIT InnoEnergy. And the organization is putting its money where its mouth is.

Final thought: Consumer-led solar boom

By Gerard Reid, co-founder and partner, Alexa Capital.