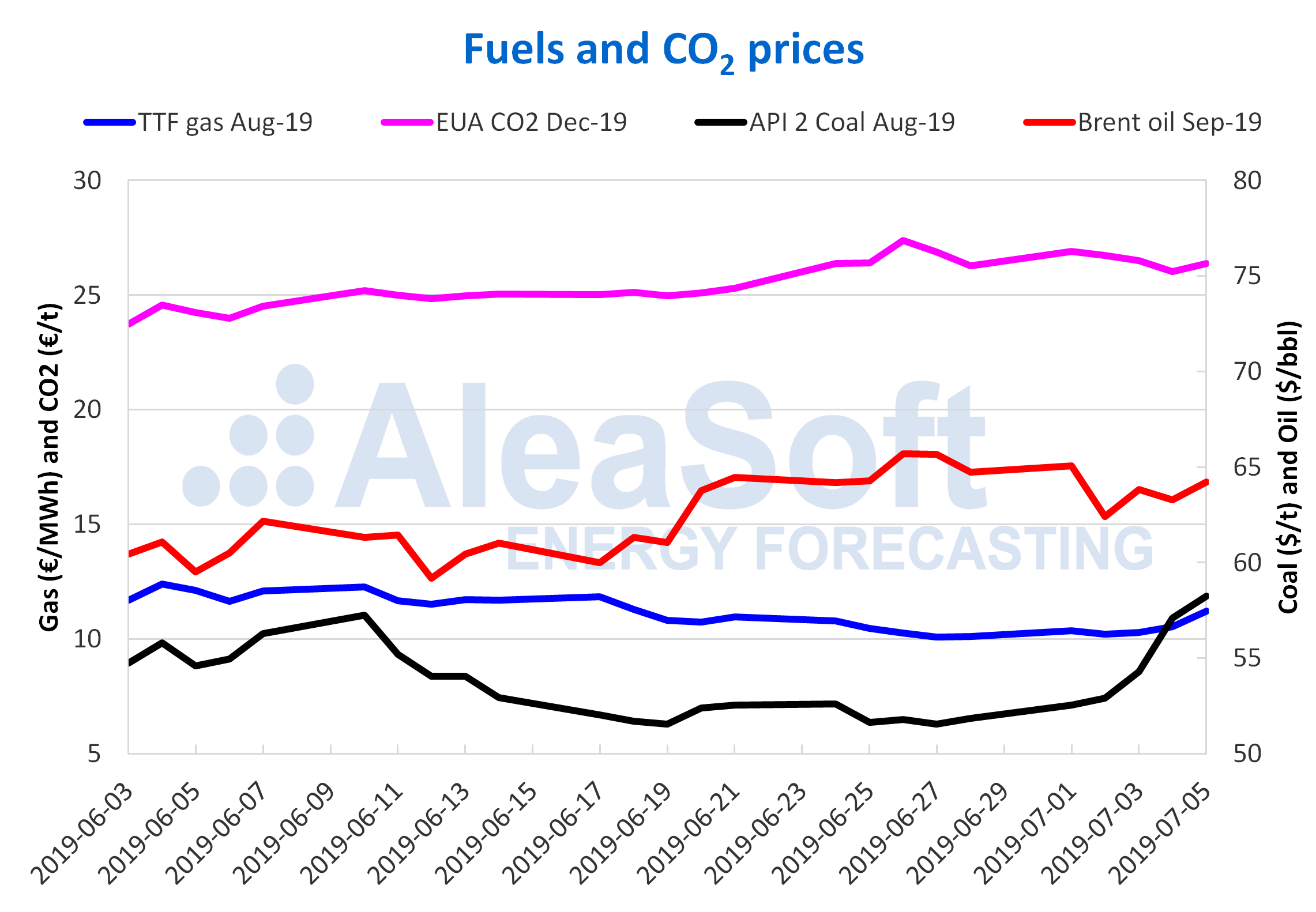

Brent, fuels and CO2

The Brent oil futures prices for September on the ICE market settled at $64.23/bbl on Friday after recovering from the fall seen last Tuesday of 4.1% on the previous day. On Tuesday last week the settlement price was $62.40/bbl, the lowest of the week. An increase in the United States’ oil production and the risk of the global economy weakening due to the trade war between the U.S. and China offset production cuts by OPEC+ nations at the same time as geopolitical tensions grew between the States and Iran.

TTF gas futures on the ICE market for August recovered at the end of the week, settling on Friday at $11.22/MWh after falling almost every day since June 18, with an increase of 11% with respect to the historical minimum price for the last two years, reached on Thursday, June 27.

The prices of API 2 coal futures on the ICE market for August recovered in parallel with the gas market – after being traded downwards since the third quarter of last year and reaching two-year lows at the end of June – to settle on Friday at $58.25/t.

The futures of CO2 emission rights on the EEX market for the reference contract of December 2019 remained stable, moving between €26 and €27/t. On Friday they settled at €26.37.

Sources: Prepared by AleaSoft using data from ICE and EEX.

European electricity markets

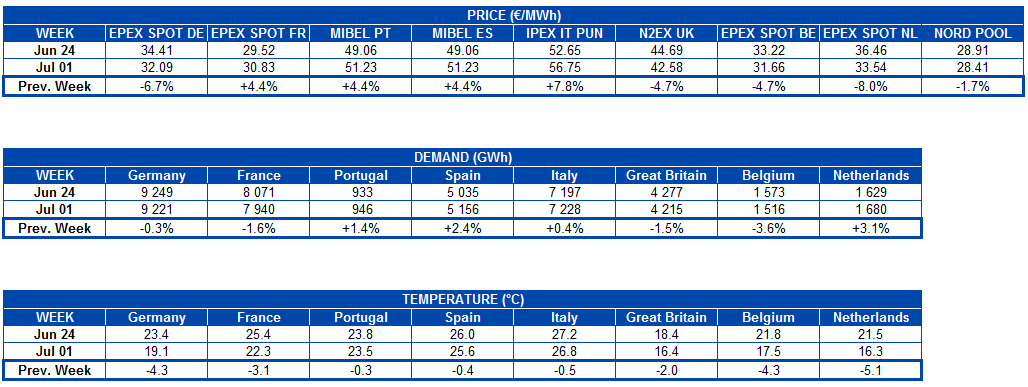

The average price of the analyzed European electricity markets had disparate behaviour compared to the last week of June. In markets in the center and south of Europe prices rose. On the MIBEL of Spain and Portugal and the EPEX SPOT of France, the growth was 4.4%, and in Italy’s IPEX market 7.8%. However, prices fell on the N2EX market of Great Britain, the Nord Pool market of the Nordic countries and EPEX SPOT of Germany, Belgium and the Netherlands, the latter seeing the greatest decrease, of 8%.

The EPEX SPOT and the Nord Pool markets, normally in the group with the lowest prices, moved between €27 and €35/MWh, with the Nordic market lowest for most of the week. The N2EX, MIBEL and IPEX markets – normally in the group with the highest prices – moved at different levels. For most of the week, the N2EX market was above €44/MWh, the MIBEL market was between €50 and €55 and the IPEX market was between €56 and €64/MWh as the market with the highest average price in Europe, although at the weekend prices fell to €59.99 on Saturday and €43.10/MWh on Sunday, favouring the MIBEL to position itself as the market with the highest price in Europe on those two days.

Electricity futures

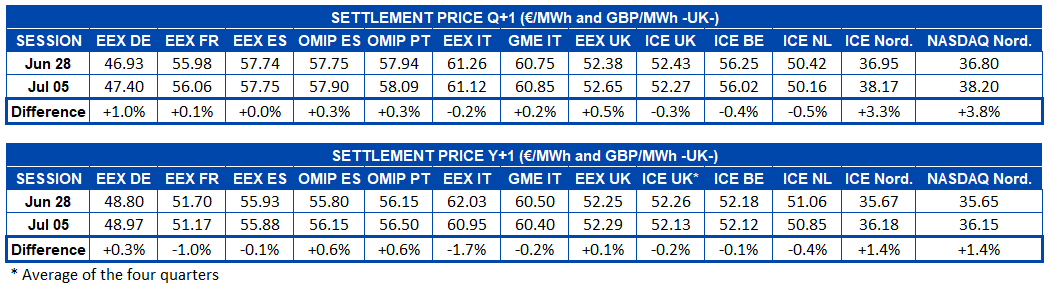

The prices of European electricity futures for the fourth quarter settled into increases in most markets. The markets of the Nordic countries on the ICE and NASDAQ saw considerable increases of 3.3% and 3.8%, respectively. The futures of Germany in the EEX market rose 1% and those of Italy on the EEX market plus those of the U.K., Netherlands and Belgium on the ICE market, settled with a discrete fall of between 0.2% and 0.5%. The rest of the markets registered a slight upward variation.

In the case of the European electricity futures for 2020, the behavior of the settlement prices on Friday was heterogeneous. An increase of 1.4% on the markets of the Nordic countries on the ICE and NASDAQ stood out, as well as falls in the futures of France and Italy on the EEX market of 1% and 1.7%, respectively. The rest of the markets settled from -0.4% to 0.6%.

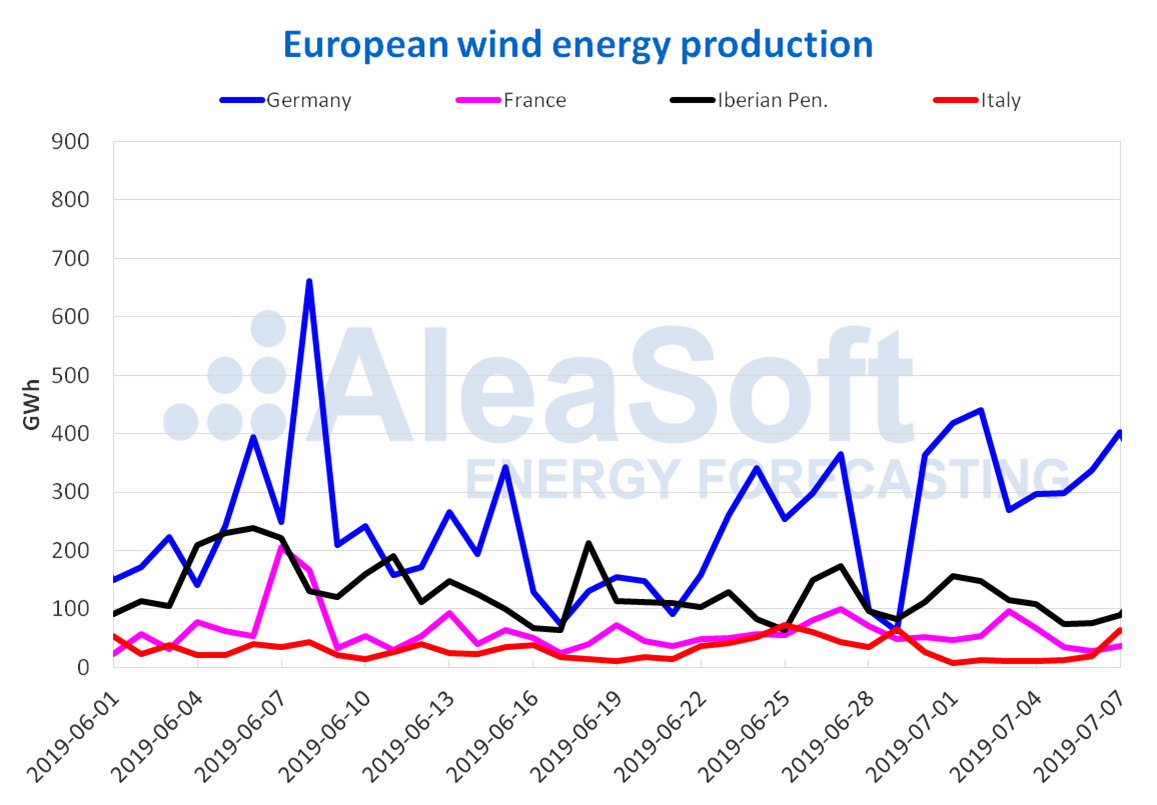

Wind and solar energy production

Wind energy production had different behavior across Europe. In France it fell 22%, in Spain 1.4% and in Italy 60%. However, there was growth in Germany and Portugal, of 38% and 19%, respectively. AleaSoft expects for this week, France and Portugal will maintain the same trend while in Germany, Spain and Italy the variations will take the opposite course to that observed last week – in Germany production will fall and in Spain and Italy it will rise.

Sources: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.

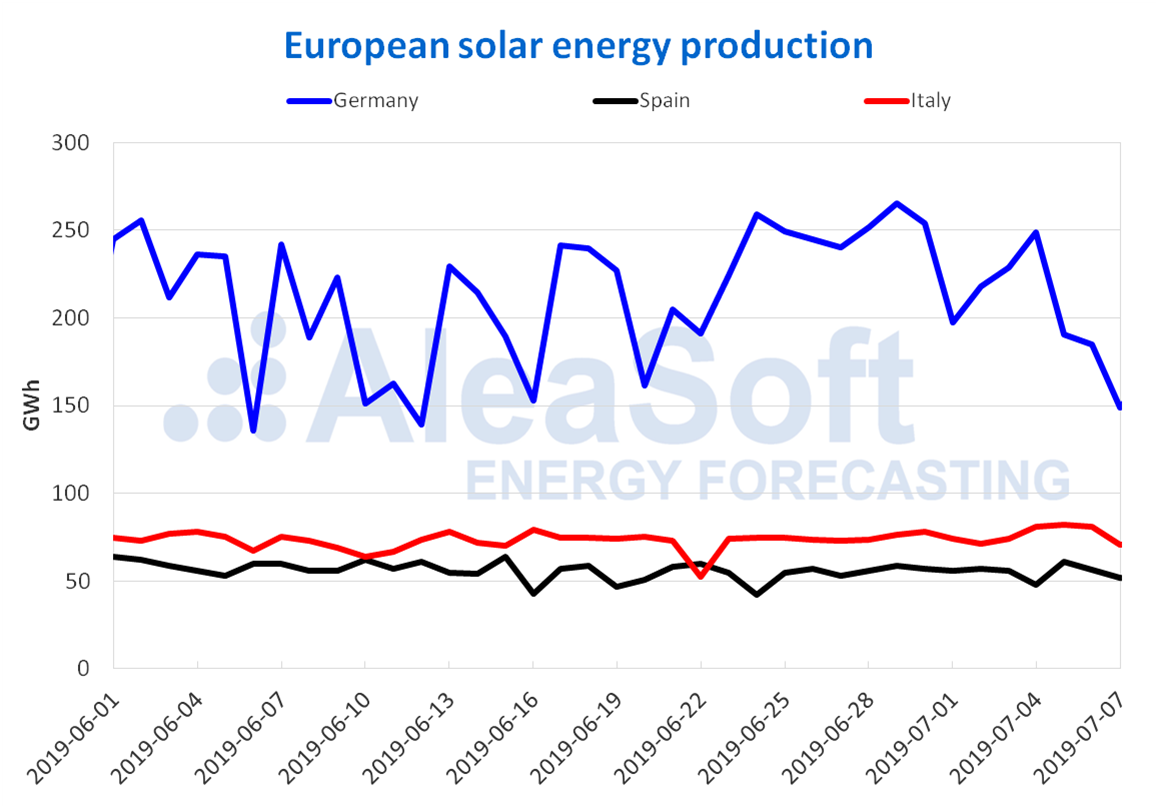

Solar energy production – PV and solar thermal – fell in Germany by 20% but increased in proportions close to 2% in pain and Italy. This week generation is expected to fall in those countries.

Sources: Prepared by AleaSoft using data from ENTSO-E, RTE, REN, REE and TERNA.