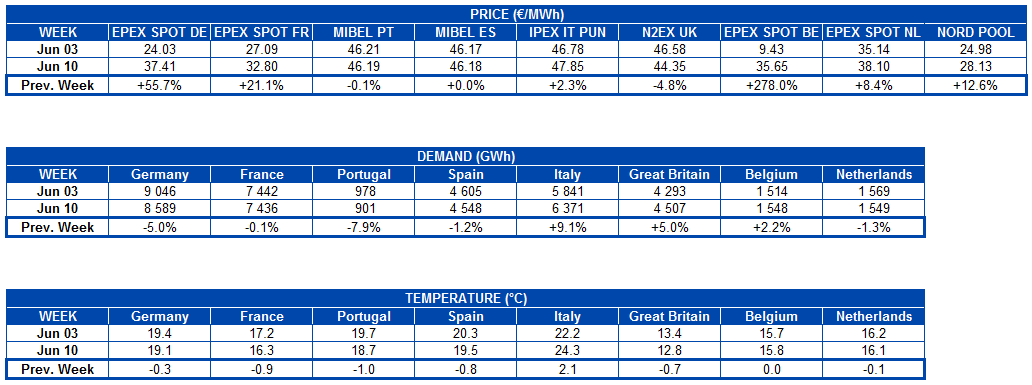

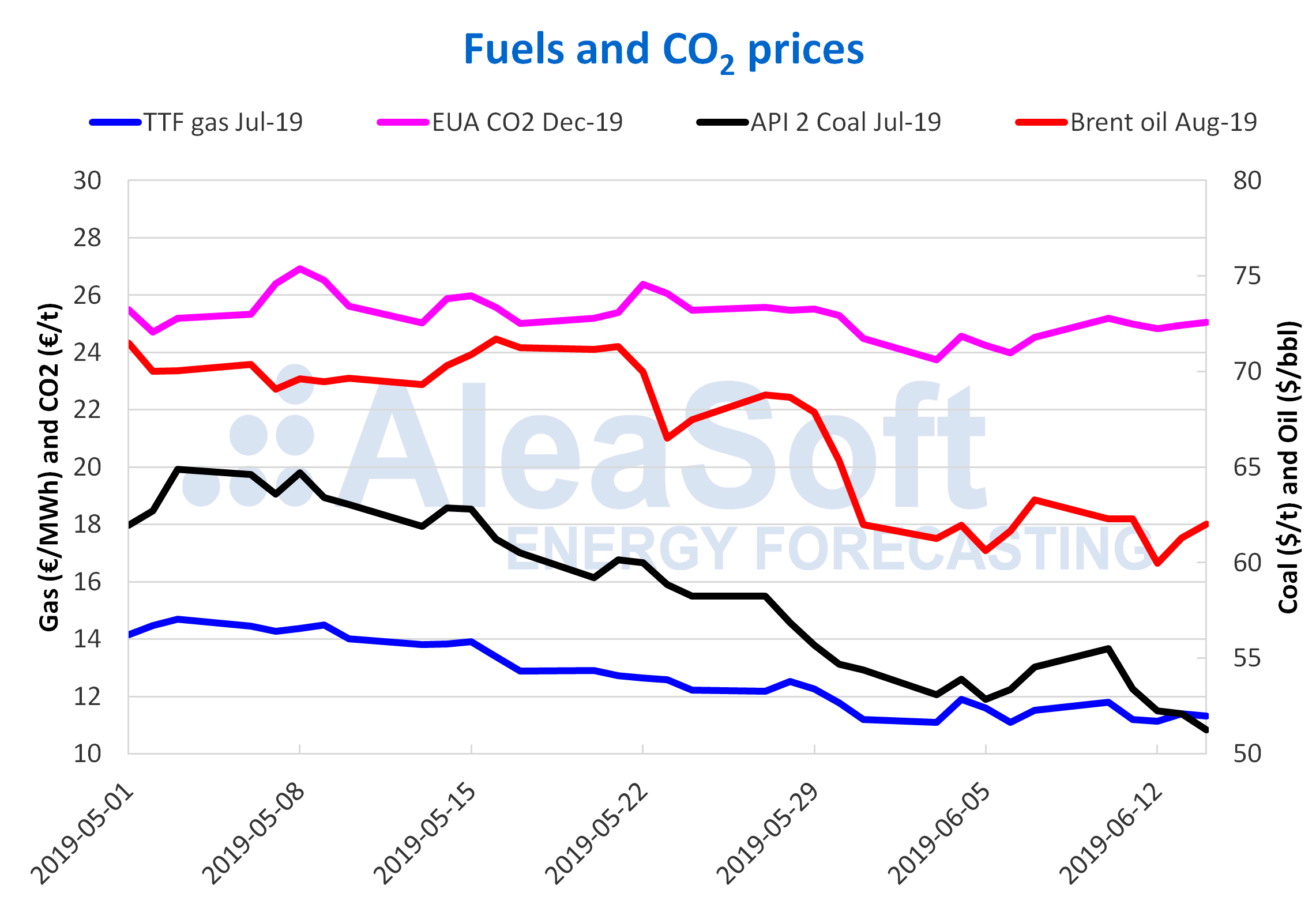

Brent, fuels and CO2

The prices of Brent oil futures for August on the ICE market maintained the downward trend observed since the end of May and, by the middle of last week, were further affected by news of the suspected attack against two tankers in the Gulf of Oman near the Strait of Hormuz. On Friday, prices settled at $62.01/bbl, after falling last Wednesday to $59.97 – an increase of 3.4%. The market has been heavily influenced by U.S. sanctions on Iran and Venezuela along with cuts in OPEC production, which put pressure on supply side prices. Concerns related to demand and global economic growth as a result of trade tensions between the United States and China, as well as the increase in crude reserves in the U.S. are pushing prices down.

TTF gas futures on the ICE market for July continued their own downward trend and settled on Friday at €11.32/MWh.

The prices of API 2 coal futures on the ICE market for July increased to $55.50/t at the start of last week but continued a downward trend and settled on Friday at $51.25, their lowest value for two years. The market has been influenced by more competitive gas prices and an excess of global supply.

The prices of CO2 emission rights futures in the EEX market for the reference contract of December were traded in June between €24.50/t and 25.50. On Friday they settled at €25.05/t after being stable all week at around €25.

Sources: Prepared by AleaSoft with data from ICE and EEX.

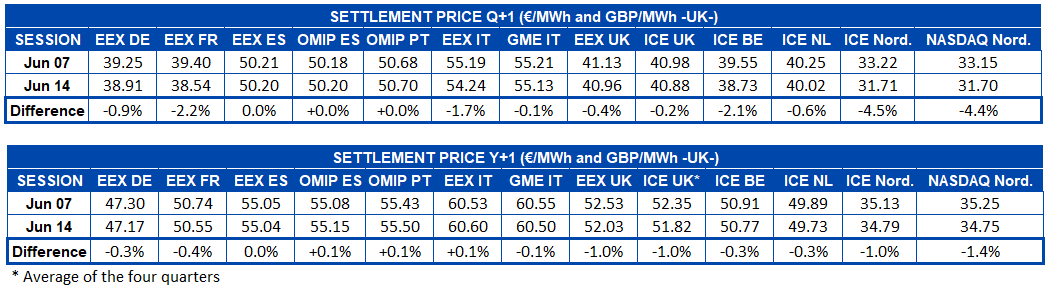

European electricity markets

Last week, the average price of most European electricity markets increased compared to the previous week. The biggest increase was in the EPEX SPOT market of Belgium, with 278%, due to the fact the average price of the market on Saturday, June 8, was €-133.56/MWh. It is worth remembering, on June 7 when prices for June 8 were traded, a technical problem occurred that caused some European electricity markets to uncouple and local auctions resorted to the matching process. The only markets where prices fell last week were the MIBEL of Portugal, with a decrease of 0.1% and the N2EX market of Great Britain, which fell 4.8%, although in the latter case it also has a strong influence on the average price of June 8, of €75.39/MWh, the highest in Europe that day. If the prices of June 8 are not taken into account, last week the prices of all European markets rose on a weekly comparison, with the German EPEX SPOT the highest increase – 9.9%. According to analysis by AleaSoft, the decrease in renewable energy production, specifically solar and wind energy, was the main cause of the increase in prices.

European markets remain divided into two groups, according to price. In the group with the highest prices – last week between €45 and €50/MWh – were Italy’s IPEX, which had the highest price for most of the week; the MIBEL of Spain and Portugal, which had the highest price in the last three days, from Saturday to Monday; and the British N2EX. In the other group, ranging from €30 to €40/MWh, were the EPEX SPOT markets of Germany, France, Belgium and the Netherlands, and the Nord Pool Nordic market, which had the lowest price in Europe for most of the week.

Electricity futures

The prices of European electricity futures for the third quarter settled on Friday with a fall compared to the session the previous Friday in most markets. However, the EEX market of Spain and the OMIP of Spain and Portugal were practically unchanged. The markets of the Nordic countries in ICE and NASDAQ stood out with a decrease close to 4.5%. The EEX markets of France and Italy as well as the ICE market of Belgium settled about 2% lower than in the previous week. For the rest of the markets, the drop was 0.1-0.9%.

In the case of European electricity futures for 2020, those of the UK stood out in the ICE and EEX markets and those of the Nordic countries in the ICE and NASDAQ markets fell close to 1%. The rest of the markets decreased 0.1-0.4%, except for the OMIP of Spain and Portugal and the EEX market of Italy, which settled at a price 0.1% higher than in the previous week.

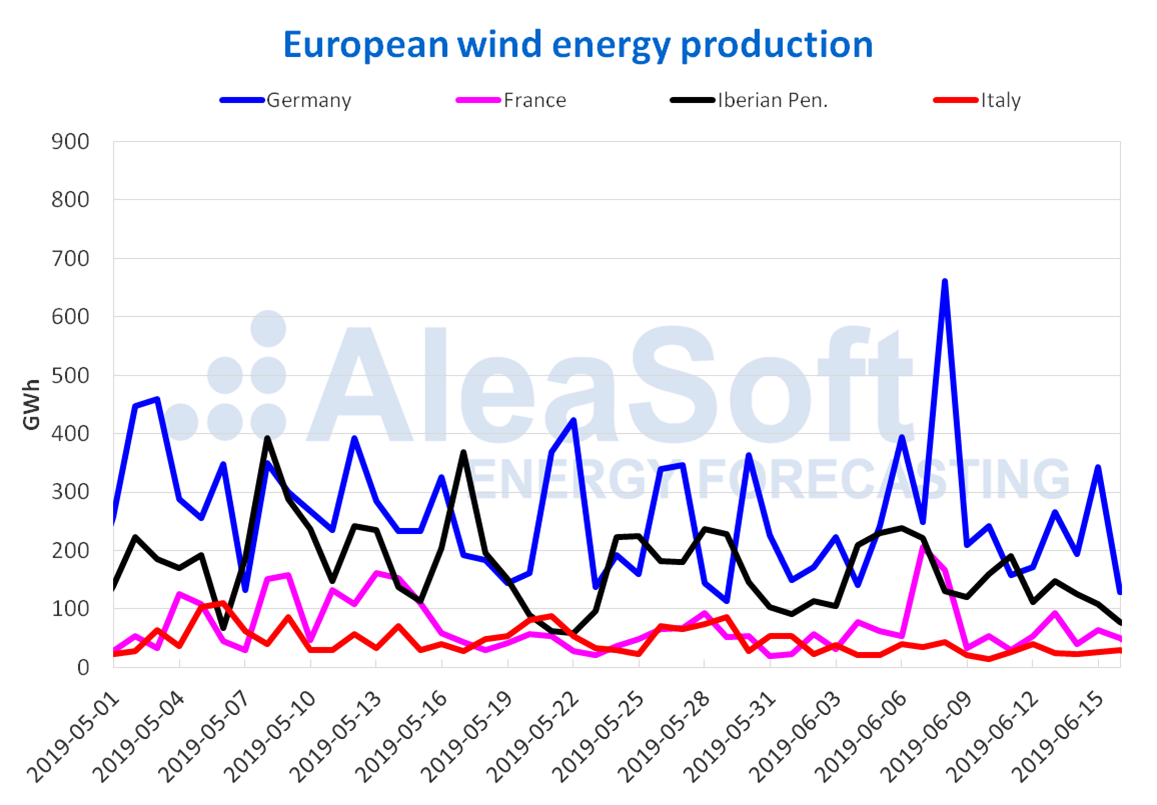

Wind and solar energy production

Wind energy production had a general decline in Europe last week. In Germany it was 29% down, in France 39%, in Spain 28%, in Portugal 23% and in Italy 18%. This week it was expected production would continue to decline.

Sources: Prepared by AleaSoft using data from ENTSOE, RTE, REN, REE and TERNA.

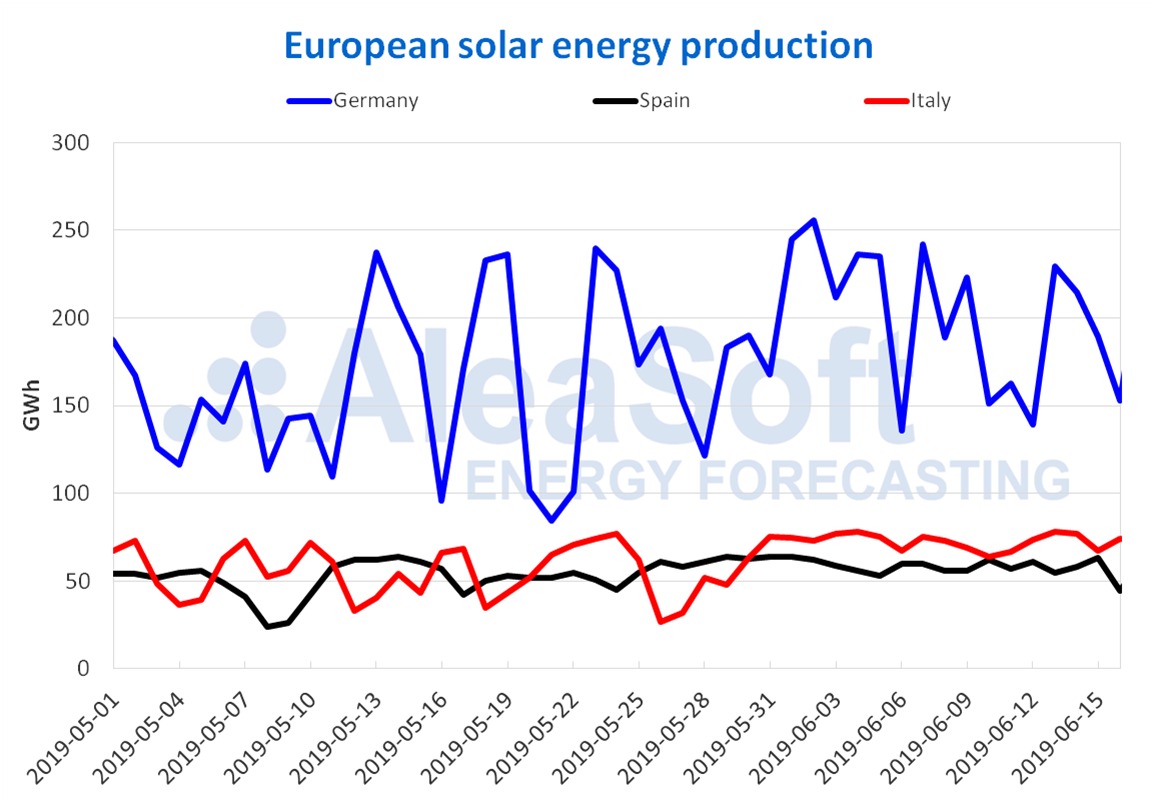

During the past week, solar energy production – PV and solar thermal – suffered a 16% fall in Germany and 3% in Italy while in Spain it recovered 0.3%. At AleaSoft it is expected solar energy production will increase mainly in Germany this week, and to a lesser extent in Spain and Italy.

Sources: Prepared by AleaSoft using data from ENTSOE, REE and TERNA.