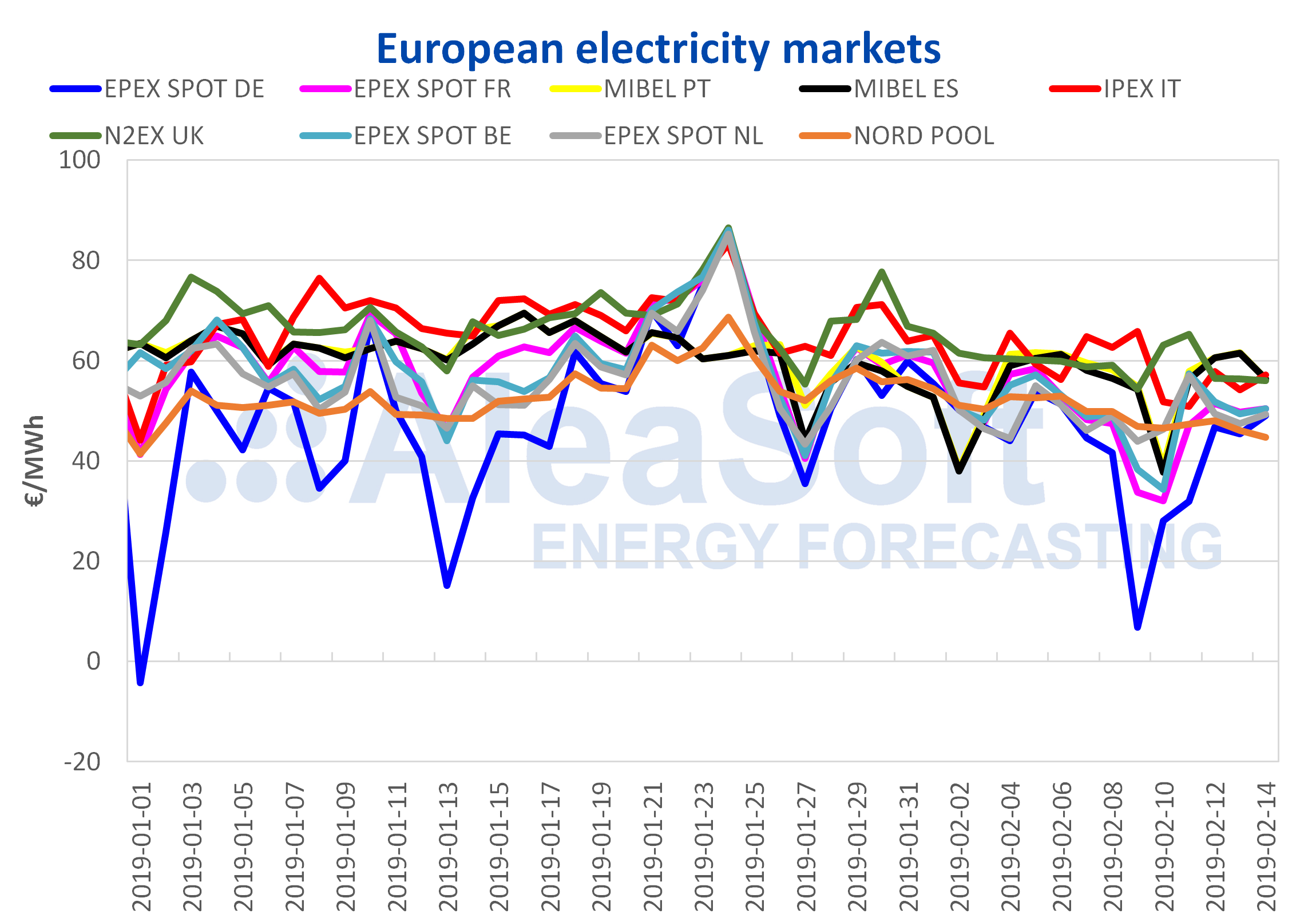

European electricity markets

The average price of the MIBEL Spanish electricity market since the beginning of last week, from February 11-14, was €58.68/MWh, 1.7% lower than the first four days of the previous week, from February 4-7. In the case of MIBEL Portugal, the average price from February 11-14 was €59.13/MWh, 3% lower than the average of the corresponding days of the previous week. Although the price fell, the MIBEL market in Spain and Portugal was the most expensive of the European markets on average for the first four days of last week, and also reached the highest price on February 12 and 13.

Sources: Prepared by AleaSoft with data from OMIE, EPEX SPOT, N2EX, IPEX and Nord Pool.

According to AleaSoft’s analysis, the current scenario with lower electricity demand due to higher temperatures than usual for this time of year, with no nuclear stops, hydroelectric production of around 100 GWh per day and the fuels price following a downward trend, helped electricity market prices to fall. However, last week renewable energy production in Spain – mainly wind energy production –was lower than in the previous week, unlike in other countries such as Germany, where wind and solar energy production were higher last week, at 43.7% and 7.5% more than the previous week, respectively, which led the MIBEL market to have the highest price in Europe.

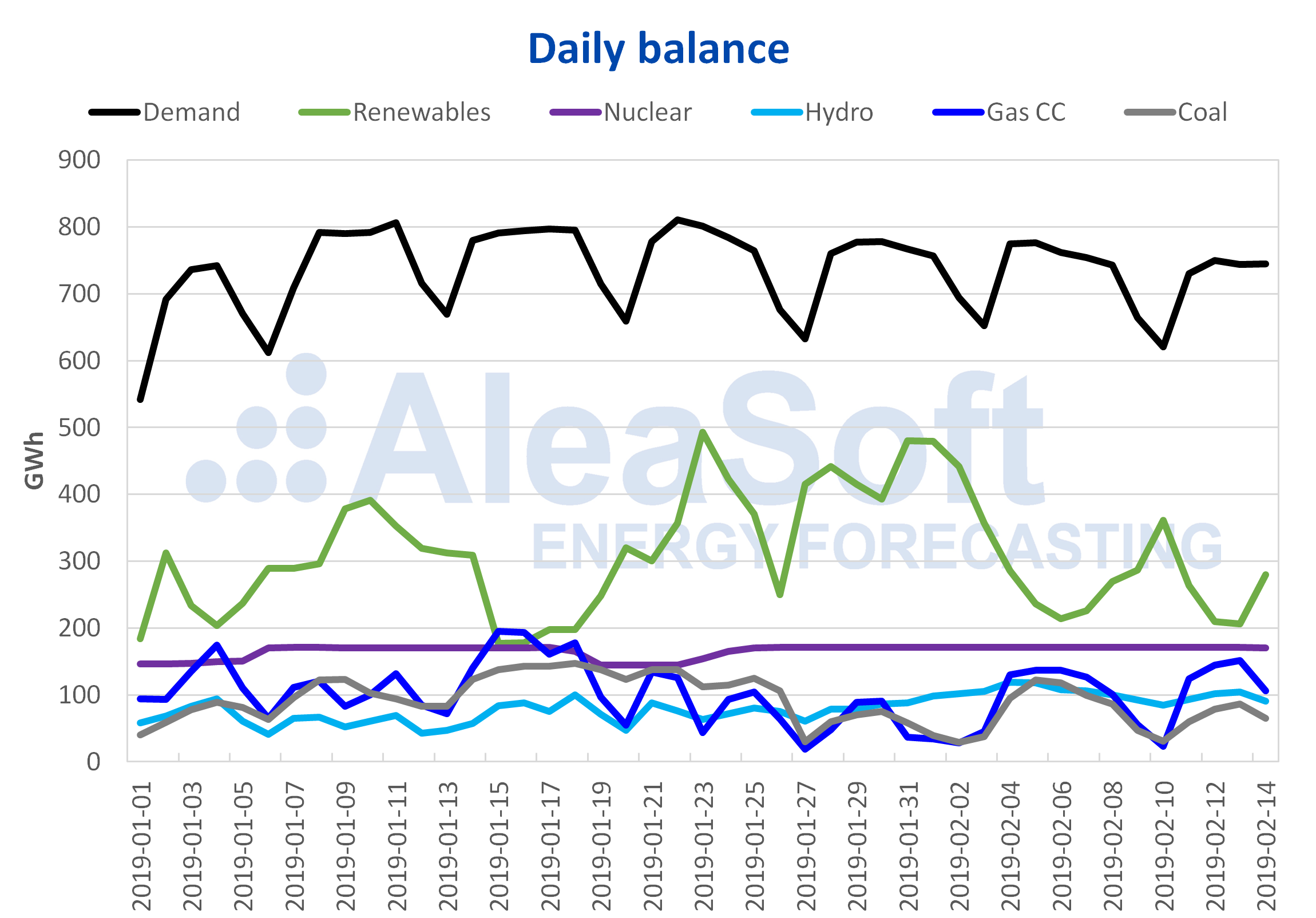

Sources: Prepared by AleaSoft with data from REE.

Up to Thursday, in the upper part of Europe’s electricity prices, above €55/MWh and following the MIBEL market, were the N2EX market of Great Britain and the Italian IPEX market. The German EPEX SPOT market was again, on the four days from February 11 to 14, the one with the lowest average price in Europe, with €43.29/MWh, followed by the Nord Pool market of the Nordic countries, with €46.54/MWh.

Electricity futures

In the European electricity futures markets, the trend is bearish, in line with the bearish climate the fuels prices maintained. The week of February 11 saw the futures price of Spain and Portugal in the OMIP market for March 2019 sit around €50 and €51/MWh, between €1 and €1.5/MWh lower than the previous week. At the beginning of September 2018, the price of these products was higher than €63/MWh. On the other hand, in the EEX market, the Spanish futures for March 2019 settled on Wednesday at €51.08/MWh, €1.31/MWh lower than in the February 6 session. The futures of France and Germany for March in the EEX market were traded last week between €3 and €4/MWh lower than in the previous week. The settlement price of Wednesday’s session was €44.80/MWh for France and €41.88/MWh for Germany.

Brent, fuels and CO2

Brent oil futures in the ICE market for April, which had been traded during the first two days of last week between $61 (€54)and $62/bbl, settled at $63.61/bbl on Wednesday’s session, a value not reached since the end of November. Signs of tighter supply due to production cuts by OPEC countries and their allies – including Russia – sanctions on Iran and the political crisis in Venezuela were being considered as the causes of the increase on Wednesday. In Thursday’s session, the price reached values above $64/bbl.

The price of TTF gas futures continued the bearish trend since early September. Last week the futures for March in the ICE market were traded below €18/MWh on Tuesday, at €17.79/MWh. On Wednesday’s session, they settled at €18.02/MWh.

The price of the API 2 coal futures in the ICE market for March was around $71.50/t on the first days of last week, following the downward path it had been experiencing, although in Wednesday’s session it closed at $73.30/t.

The price of CO2 emissions rights futures for the reference month December 2019 in the EEX market, started the week above €22/t and fell below €21/t, closing Wednesday’s session at €20.95/t, after the United Kingdom stated that it would not issue or auction EUA permits soon.

Mainland Spain, wind and PV energy

Last week, temperatures were slightly higher and above the usual values for the time of year, which led to lower electricity demand. According to AleaSoft, at the end of last week, electricity demand would have dropped 1.8% compared to the previous week.

Wind energy production last week was lower than in the previous week. By the end of last week, AleaSoft estimated wind energy production would be 16.3% lower than the previous week. This week, wind energy production is expected to increase by 39%.

As for solar energy production, which includes PV and solar thermal, it is estimated that by the end of last week it would have increased 2.3% compared to the previous week, according to AleaSoft forecasts. This week, solar energy production is expected to fall 5.6%.

According to the latest hydrological bulletin published by the Ministry for the Ecological Transition, hydroelectric reserves continued to increase up to last week, to 10,927 GWh, representing 46.9% of total capacity. Since the end of January, there have already been three consecutive weeks of increased reserves, after they fell for four consecutive weeks since the end of December.

Source: AleaSoft Energy Forecasting