Storage Highlights Countdown #9; Keeping score of battery performance with DNV GL

The Energy Storage Europe conference is nearing and pv magazine is featuring the top ten developments in the field as our Energy Storage Highlights, selected by an independent jury of experts. Having kicked off with a hydrogen fuel cell based approach to self-sufficient living in Switzerland, we continue our ranking with DNV GL’s bid to map the vast battery storage landscape, helping buyers make decisions.

Shell moves to acquire German storage business Sonnen

In May, oil giant Shell invested in German manufacturer Sonnen. Now the 112-year-old company wants to fully acquire the business, subject to Germany’s monopoly authorities. Sonnen said it hopes the deal will accelerate its growth by expanding its market reach and capacity.

EnBW and Energiekontor ink PPA for subsidy-free PV plant in Germany

The companies have entered a 15-year agreement for the plant, probably the first PPA for a project that size in Germany. Last week, EnBW said it was considering constructing a subsidy-free solar park in Brandenburg.

Amprion and OGE announce 100 MW power-to-gas project in Germany

The €150 million project is entering the approval phase. Using the new facility, expected by 2023, the two companies will test how electricity from renewable energy can be converted into green hydrogen and green methane via electrolysis.

Investor search for Solarworld failed, module factory to be auctioned-off

The manufacturer’s insolvency administrator has declared the investor search over. By March at the latest, all production equipment at the German module factory in Freiberg, as well as the buildings themselves, should come under the hammer.

Unsubsidized 175 MW solar project under development in Germany

EnBW is planning a big solar park in Weesow-Willmersdorf, in the northeastern region of Brandenburg. If built, the project would become Germany’s largest solar plant. The company says it has a pipeline of unsubsidized projects with a combined capacity of 800 MW.

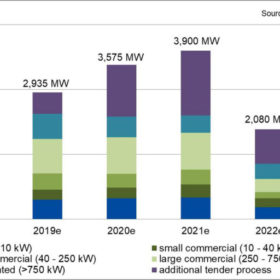

Germany to install more than 10 GW of PV before 2022 contraction

Extraordinary PV tenders by the federal government will provide for more growth. Market research company EuPD Research expects newly installed capacity of 4 GW in 2021. After that, however, the market could see a sharp reduction, after the 52 GW cap for solar subsidies is reached.

Helmholtz Center achieves 21.6% for perovskite CIGS tandem solar cell

The German researchers were able to improve the efficiency through a simplified production process.

E.on’s acquisition of Innogy would create customer energy data monopoly, claims rival utility

The planned acquisition of RWE subsidiary Innogy’s sales and network business, would make E.on the largest electricity supplier to two-thirds of Germany with a 70% market share in its distribution network. That is the finding of analysis conducted by consulting firm LBD on behalf of rival power firm Lichtblick.

Germany installed almost 3 GW of solar in 2018

PV demand grew 68% year-on-year from the level seen in 2017 as Germany’s cumulative installed solar generation capacity reached 45.92 GW.