2019: A year for critical adjustments

Since the PV module market has already witnessed intense industrial concentration over the past few years, the top 10 manufacturers didn’t change significantly as 2018 unfolded, writes PV InfoLink Chief Analyst Corrine Lin. On the cell side, the decline of Taiwanese cell makers has Chinese cell makers filling the top three spots this year.

2: And let the solar games commence

While China’s PV policy announcement dominated the headlines in Q2 2018, there were a lot of other significant happenings in the world of solar, not least the EU’s 32% renewable energy targets, rumors of U.S. tariffs on inverters, PV records in Germany, and unexpected new partnerships. Read on to discover the highlights from April to June.

1: What a difference a year (in PV) makes

Dire warnings about the state of our planet characterized 2018, with a plethora of reports released calling for climate action. The solar PV, and storage, industries have a leading role to play in the required energy transition: this bold quest was taken on by many over the last year, with technological progress and expansion seen upstream and downstream, and in policy, globally. Like last year, China took all by surprise, this time, however, in the form of its abrupt 31/5 policy change, the effects of which are still being felt in almost every corner of every market. And of course, Tesla grabbed the headlines – also for rather more unsavory reasons than in 2017. In this first out of a total of four posts pv magazine reflects on Q1.

Positive signals from China boost 2019 forecasts

On November 2, China’s National Energy Administration held a symposium to evaluate the results of the 13th Five-Year Plan for solar PV development at its halfway point, discussing the adjustment of PV and thermal generation targets in the plan. As a result of this, there is renewed positivity regarding China’s domestic solar demand in 2019-2020.

REC Silicon posts loss for second quarter running amid poly market slump

The Norwegian polysilicon producer posted an EBITDA loss of $6.1 million for the third quarter of 2018, as it continues to struggle with low demand and prices. Revenue for the company’s solar materials segment fell almost 70% on the previous quarter.

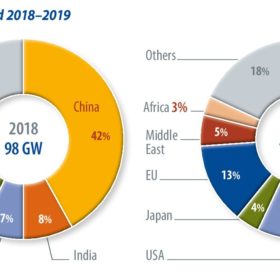

Frost & Sullivan forecasts strong 2018 for solar, despite China’s policy setback

A new report published by business consultants Frost & Sullivan expects around 90 GW of new solar installations by the end of 2018, in line with the predictions of other leading analysts. It further notes that PV remains the world leader in renewable energy capacity, and that markets are moving away from feed-in tariffs to make increasing use of auction models and private PPAs.

PERC market to reach 158 GW by 2022

Taiwan-based analyst firm, WisolPro says the global capacity for PERC cells is rapidly increasing, with the technology likely to replace polycrystalline cells. HJT, thin film, and n-type PERT technologies are also on the rise.

Is China about to add 10 GW of unsubsidized solar?

Rumor has it industry lobbying has persuaded the government to agree to 300-500 MW of distributed PV in each of the populous nation’s 34 local government areas, with a reduction in “non-technical costs” making up for a lack of guaranteed payment.

SMA closes first half of 2018 with higher earnings and revenue

The company reports having shipped 4.3 GW of PV inverter capacity, which marks a significant year-on-year increase. While revenues increased slightly, net income improved by a higher margin.

Daqo New Energy lowers Q2 forecast

Chinese polysilicon giant Daqo New Energy has revised down its guidance for both polysilicon and wafer sales in the second quarter of 2018. The company states, however, that it remains confident in long-term prospects for the solar industry; and is proceeding as planned with capacity expansions.