Global energy storage market to surge to 15 GW by 2024

As the sector continues to grow rapidly, delays in manufacturing scale-ups, difficulties sourcing raw materials and a separate path taken by the electric vehicle sector could all chuck ‘sand in the gears’, according to analyst Wood Mackenzie.

The weekend read: The land of the low tender

Some of the world’s most cost-competitive solar arrays have been built among the rolling dunes of the vast Arabian Desert. While some government policies appear to be targeted at breaking records, nobody expects the oil-rich Gulf region to bring about truly sharp changes in pricing for solar PV plants.

Indian PV to take off after gloomy 2019

India’s annual solar installations are set to exceed 10 GW in 2020, following a year marked by political uncertainty, module price increases associated with safeguard duties, and a lower number of awarded tenders. The outlook for battery energy storage installations for solar projects is particularly bleak, however, as such combinations in India can cost three to five times more than standalone renewable projects.

Solar electricity can retail for $0.027-0.036/KWh as renewables close in on global grid parity

The latest figures released by BloombergNEF show new solar and onshore wind power plants have reached parity with average wholesale prices in California, China and parts of Europe. The technologies are winning the race to be the cheapest sources of new generation for two-thirds of the world’s population.

Highview Power to build UK’s first large scale ‘cryogenic’ energy storage facility

The long-duration energy storage provider plans to eventually build a portfolio of 50 MW/250 MWh liquid air systems throughout the United Kingdom.

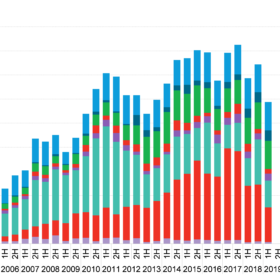

Green bonds lead sustainable funding past $1tn mark

In the past 12 years, green bonds have raised nearly $800 billion for investment in clean energy and other sustainability projects and companies are now pegging bond interest payments to their environmental performance.

Fitch predicts a decade of corporate renewable power procurement growth in the US

Growth in U.S. solar and wind generation capacity will average 7.9% and 3.9%, respectively, between 2022 and 2028 according to Fitch Solutions, who projects almost 120 GW of solar power to be deployed in that period. Corporate clean energy buyers are to be a large part of the trend, and to accelerate deployments during the period.

Global renewables investment fell in the first half of this year

While Spain, Sweden, Ukraine and Brazil attracted more funds than last year, China’s transition to an auction-based procurement system and slow performance overall in Europe saw worldwide backing decrease. BloombergNEF does expect investments to ramp up in the second half, however.

Shell and Total join fossil fuel companies bidding for a piece of Europe’s PV renaissance

With Europe set to return to solar power levels last seen during the PV boom seven years ago, a wave of mergers and acquisitions is taking place as the oil and gas majors splash the cash to buy the expertise needed to participate in PV’s new dawn.

BNEF: Cheap finance is key to PV deployment in the developing world

While solar is lauded as a cheap energy resource in OECD countries, the cost of financing PV projects in developing nations has impeded progress. Development banks and the Clean Technology Fund they finance have played a key role in providing access to cheap financing for clean energy projects in many markets.