1: What a difference a year (in PV) makes

Dire warnings about the state of our planet characterized 2018, with a plethora of reports released calling for climate action. The solar PV, and storage, industries have a leading role to play in the required energy transition: this bold quest was taken on by many over the last year, with technological progress and expansion seen upstream and downstream, and in policy, globally. Like last year, China took all by surprise, this time, however, in the form of its abrupt 31/5 policy change, the effects of which are still being felt in almost every corner of every market. And of course, Tesla grabbed the headlines – also for rather more unsavory reasons than in 2017. In this first out of a total of four posts pv magazine reflects on Q1.

Poor polysilicon performance affects Wacker’s Q3

Despite its chemical business performing strongly, Wacker Chemie AG’s Q3 2018 financials took a tumble, with polysilicon sales and EBITDA sharply declining. The blame has been laid on China’s PV policy change in May.

Interview: GoodWe talks IPOs, policy changes and tripling production capacity

In an interview with pv magazine, vice president of GoodWe, Ron Shen, talks about the company’s plans for Germany, Spain, Africa and India, in addition to its goal to triple production capacity to 15 GW in China. He also discusses the effect of China’s 31/5 policy change, and plans for an initial public offering (IPO).

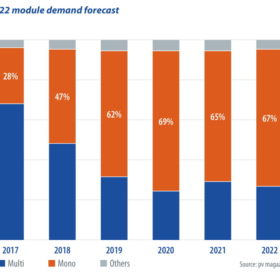

Low demand driving consolidation

With the release of second quarter financial results, the rankings of global module shipments in the first half of the year can be confirmed. JinkoSolar shipped 4.8 GW to take first place in this period.

Solargiga expects $15 million loss on back of China’s PV policy changes

Solargiga Energy Holdings Limited has issued a profit warning, stating it expects to record a loss of around US$15.2 million for the period ending June 30, 2018.

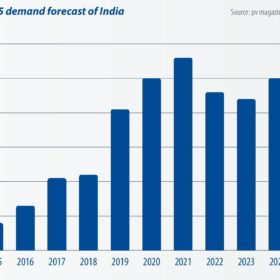

India’s trade war will have global repercussions

India is currently the second largest market in the world for PV module demand. With China’s domestic demand frozen since the 31/5 notification, the country’s total module demand in 2018 will likely only achieve 32-34 GW. This will allow India, which may surpass 10 GW in annual demand, to reach 13% of global PV demand this year. As a result, the future of India’s trade war has become an influential factor in the global PV industry.