Corporate PPAs hit record high in 2023, says BloombergNEF

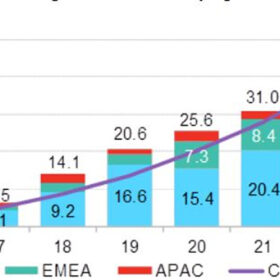

BloombergNEF says in a new report that corporations publicly announced 46 GW of solar and wind power purchase agreements (PPAs) in 2023, up 12% year on year. It says the increase was driven by a surge of activity in Europe.

The weekend read: Central Asian solar on the rise

Utility-scale solar is stirring in the region, with support from development banks. Following a series of competitive auctions, PV projects have been commissioned and are under development in Uzbekistan and Kazakhstan. In the latter nation, corporate interest in distributed, small-scale renewables is growing but for further market uptake, additional incentives should be introduced, practitioners say.

Telecoms business signs Bulgaria’s ‘first sleeved solar power deal’

The clean power to be generated by Sofia-based developer Renalfa will be matched to the consumption profile of customer A1 Bulgaria by a subsidiary, utility business unit of the renewables company.

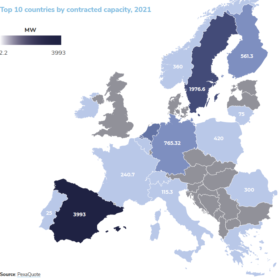

Spain largest PPA market in Europe last year with almost 4 GW of deals

According to Swiss consultancy Pexapark, around 11 GW of power purchase agreements were closed in Europe last year. For 2022, the analyst expects shorter deals and the presence of more new entrants.

Romania authorizes bilateral PPAs, raises size limit for solar under net metering to 400kW

With Emergency Ordinance no. 143/2021, the Romanian government has restored legal certainty for bilateral power purchase agreements and has created more favorable conditions for solar power generators under net metering regime.

Re-Source 2021: Q&A with Iron Mountain’s Chris Pennington

US data management company Iron Mountain has a growing portfolio of onsite and PPA renewables, and it’s one of the first major corporate firms to track its renewables by the hour as part of an innovative PPA that may serve as a forerunner for widespread 24/7 matching.

Re-Source 2021 Recap

Re-Source 2021 took place in Amsterdam at the end of last week, and pv magazine was there to cover the event where the suppliers and sellers of renewable power purchase agreements (PPAs) meet the (largely corporate) buyers, though encouraging PPA uptake among small and medium-sized enterprises (SMEs) was among the major talking points, including ‘additionality’, de-risking renewable PPAs and 24/7 matching.

Top 10 US corporate renewable energy buyers of 2020

A new report from REBA highlights the leading players and found that utility scale solar power was the most sought-after renewable resource among the country’s major companies.

Covid-19 weekly briefing: Merchant solar developers could seek shelter in return to subsidies and PPAs are being revisited, but at least the Irish are coping with lockdown measures

The unfolding effects of the Covid-19 crisis, and fears of a possible second wave, have split analysts trying to guess how the unsubsidized renewables market will emerge as slumping demand continued to distort power markets. pv magazine rounds up the week’s coronavirus developments.

Spain is Europe’s cheapest market for corporate solar PPAs

The country’s solar sector offers the lowest average prices for corporate power purchase agreements on the continent, according to BloombergNEF.