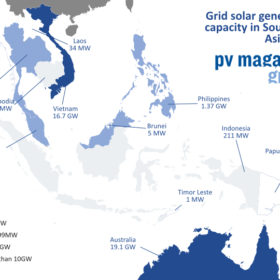

Weekend read: Southeast Asian interconnection

While near neighbors, the electricity generation of the countries of Southeast Asia couldn’t be further apart. Indonesia burns locally mined coal; Malaysia has reserves of oil and gas; and populous Singapore, Vietnam, and the Philippines depend on fossil fuel imports. They could all benefit from increased solar electricity but higher grid capacities and interconnection are key for an opportunity to unlock the power of the sun.

The mobility rEVolution: New tech cuts risk of electrocution from EVs

UK researchers have found a way to reduce the risk of electrocution with electric vehicles, while US utility Duke Energy said it is exploring how the Ford F-150 Lightning can serve as a grid resource. Chinese carmaker Geely posted disappointing first-half results, while IHS Markit said it expects strong uptake of battery electric vehicles in Europe through to 2030.

Huge opportunity for module-level power electronics

A new report form analysts at IHS Markit notes that the market for module-level power electronics (MLPE) grew by 33% between 2019 and 2021, with around one-third of new residential solar installations now taking advantage of MLPE’s promise of improved safety, energy yield and fault detection. And with smaller, distributed generation systems expected to represent 43% of global PV installations between now and 2025, the opportunity for MLPE will only get larger.

IHS Markit: Battery prices won’t fall until 2024

The London-based analyst has published a series of clean tech predictions for the year which also highlighted the rising proportion of sub-5MW solar projects in the global market, and cheaper clean energy financing costs even as panel prices continue to rise.

US big solar to fire tracker market to 2025

Data company IHS Markit expects almost nine out of ten big solar projects in the Americas over the next three years to be tracker mounted. More than a terrawatt of new solar will be added from this year to the end of 2025, the analyst predicted.

The weekend read: Where’s the opportunity for solar with EVs?

Electric vehicles, both fully electric and plug-in hybrid EVs, look set to become dominant in new car sales within years in many parts of the world, but overall changes to car fleets face significant inertia. What impact will this have on the future grid, and where’s the opportunity for solar? Tristan Rayner gets behind the wheel.

Brazil heads for a solar installation rush

Brazil’s deployment of distributed generation PV (below 5 MWp) has exploded from a total capacity of 500 MW in 2018 to 7 GW by September of this year. The trigger for this increase, alongside rocketing electricity prices, was the 2019 proposal of law 5829, writes IHS Markit analyst Angel Antonio Cancino. The proposal is expected to pass into law at the end of this year and will gradually introduce grid-access charges for residential and commercial system owners.

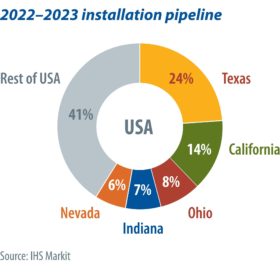

US solar market in flux

Next year will set new records for the U.S. solar market, with 30.4 GW of installations expected. The utility-scale PV pipeline in 2022 is nearly 50% greater than 2021 and 2023, due to the combined effects of pandemic-related supply chain impacts, the solar Investment Tax Credit schedule, and other module procurement challenges. Over the next two years, solar installations will be concentrated in Texas, California, Ohio, Indiana, and Nevada, with large portions of the pipeline being developed by a few key players in each state. IHS Markit’s Eric Wright takes a closer look.

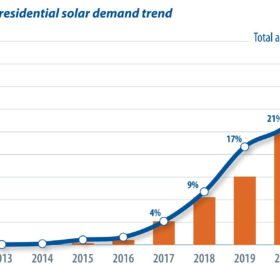

The evolution of residential PV in China

China is the largest residential PV market in the world, and this trend is only expected to strengthen in the next few years. By July 2021, China’s cumulative installed residential PV capacity had reached more than 30 GW, with a total of 1.864 million residential units hosting solar PV systems. IHS Markit’s Holly Hu looks behind these impressive numbers.

Global tracker shipments reached 45 GW in 2020

The global single-axis tracker market increased shipment volume by 40% year on year to reach 45 GW in 2020. This was despite significant pandemic-related supply chain turbulence that resulted in longer lead times for the delivery of components, the idling of steelmaking capacity in some key markets, container shipping dislocation, and widespread restrictions, particularly at ports. Most notably, this caused the cost of some commodities, such as steel, to more than double between 2020 and 2021. Jason Sheridan, a senior research analyst for IHS Markit, runs through some of the key developments in the tracker market.