Mercom, WoodMac note challenging PV investment climate in Q1

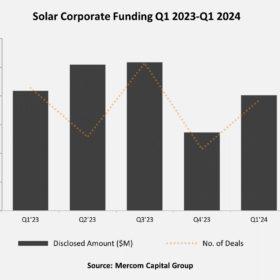

Mercom Capital Group says that total corporate solar funding, global venture capital funding, public market financing, and PV mergers and acquisitions all fell year on year in the first quarter of 2024. The sector is still grappling with high interest rates, which Wood Mackenzie says is disproportionately affecting renewables projects.

Venture capital support for solar blossomed during the first half

The $800 million of private backing secured by Californian residential solar finance business GoodLeap helped the sector achieve VC and private equity funding of $1.6 billion in the first six months of the year, up from just $210 million a year earlier.

The billion-dollar battery boom

Corporations are buying up batteries and investing in their companies like it’s going out of style.

Solar funding moves from companies to projects

Mercom Capital’s latest report shows sustained low levels of funding for solar companies, but strong investment in solar projects and many acquisitions.

Battery storage companies attracting increasing investment

While total corporate funding was down in H1 2018, compared to a year earlier, due to lower investment in the Smart Gird and Efficiency categories, battery storage companies recorded an increase of 12%.

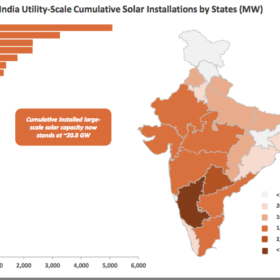

India records best ever quarter, but safeguard duties holding solar industry back – Mercom

According to Mercom India, the Indian solar PV industry has recorded its strongest quarter since the launch of the National Solar Mission. In addition to declining module prices, both rooftop and utility-scale installations saw strong growth. Clarity is needed, however, on the ongoing safeguard duty saga, to drive the industry forward.

India records best ever quarter, but safeguard duties holding solar industry back – Mercom

According to Mercom India, the Indian solar PV industry has recorded its strongest quarter since the launch of the National Solar Mission. In addition to declining module prices, both rooftop and utility-scale installations saw strong growth. Clarity is needed, however, on the ongoing safeguard duty saga, to drive the industry forward.

Battery storage funding booms in Q1 (w/ chart)

The latest report by Mercom Capital finds VC investment in battery storage companies rising five-fold year-over-year to $299 million in 12 deals.

Global solar power funding slows during Q1, 7.7 GW of assets change hands

Mercom’s Q1 2018 report shows only US$2 billion raised during the quarter, a 2/3 fall from the previous quarter and a decline on a year-over-year basis.

Solar corporate funding rebounds in 2017 (w/ charts)

Venture capital, debt, securitization and project finance were all winners in 2017, as were solar stocks. However Mercom Capital warns that the pending Section 201 ruling could cause significant damage to the sector in 2018.