PV module price index: New dimensions, new problems

The speed at which manufacturers are introducing changes from one product generation to the next is accelerating – currently, formats are scarcely available for more than a few months before another revised product is launched. But occasionally new module dimensions also bring new problems, be it in handling, plant design, or logistics. Ever-shorter product cycles and hastily launched record-breaking modules with capacities of 500 W, 600 W, or even 700 W are not always welcomed with open arms – especially by those who have to work with them, writes Martin Schachinger of pvXchange.com.

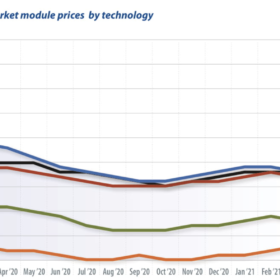

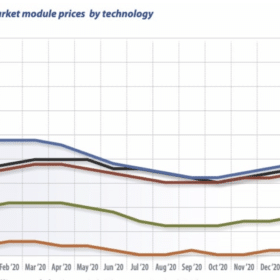

EU spot market module prices: A wrench in the works

Looking back at the past year, the renewables sector has seen two extremes. In Germany, disparities were triggered in part by the recently passed amendment to the Renewable Energy Sources Act (EEG). For solar PV in particular, the pendulum will swing in favor of installers of small systems in the near term, writes Martin Schachinger of pvXchange. For installations up to 30 kWp, the new law has cleared market barriers.

Solar system prices to rise – then fall – in 2021, with another record year anticipated

IHS Markit is predicting the world will add 30% more solar capacity this year.

Jenny Chase predicts up to 194 GW of solar this year

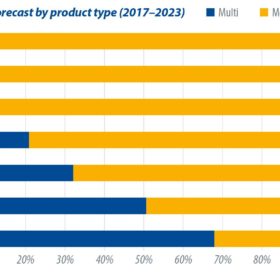

Falling module prices will help PV post another record year after an estimated 132 GW was installed worldwide in 2020, according to an energy transition investment trends report published by Bloomberg New Energy Finance.

New PV installations to reach 158 GW next year, says IHS Markit

Market observer IHS Markit has shared its forecast installation figures for 2021, where they expect a ‘wild ride’ for the PV industry to install 158 GW of new generation capacity. This figure amounts to 34% growth on 2020 installations, driven by completion of delayed projects from this year, as well as a generally increased appetite for PV and renewables around the world.

Module prices continue to slide

After China’s National Day holiday, demand started picking up at a slow pace, but the anticipated installation rush did not occur as expected, due to land and financing issues, as well as the return of winter. These factors will also delay the timing of more than 6 GW of capacity to the first half of next year. PV InfoLink has thus downwardly revised its estimates for installed capacity in the fourth quarter to 11.3 GW in China and 30 GW globally, bringing this year’s global demand forecast to below 120 GW.

MIP impact: EU module prices to decline by 30%, 2019 PV demand up 40%

According to IHS Markit, on the back of the decision to end the MIP in Europe, solar module prices will decline by up to 30%, while total project system costs will be “immediately” driven down. Overall, it forecasts PV demand to grow 40% in 2019.

Solar cell prices decline in reaction to safeguard duties, impending MIP decision

“Significant” price movements in solar PV cells has been observed this week, in reaction to India’s safeguard duties, and the impending MIP decision, says EnergyTrend. Module, wafer and polysilicon prices, however, remain stable. In contrast, prices for li-ion batteries are set to increase by as much as 15% in Q3.

Prices begin to stabilize, though falling revenues and job losses expected among Chinese manufacturers

According to reports from Energy Trend, a 30% decline in PV demand from China this year will likely spell trouble for some of the country’s major module manufacturers, with job losses and factory closures expected, despite China’s determination to open new international markets for its PV industry.

First Solar sees manufacturing hiccups, but bookings remain strong

The thin film PV maker reports difficulties in ramping its new Series 6 product, as well as pressure from module price collapses.