The weekend read: Buyer power in a tight PV module market

Material shortages, trade restrictions, and shipping bottlenecks create challenges for PV module buyers, but the good news is that there are steps to take to ensure quality supply in a timely fashion. PVEL CEO Jenya Meydbray takes us through best practice for module buyers in the current market climate.

GoodWe: Global solar installations could exceed 240GW in 2022

According to Shen Rong, Vice President of GoodWe, the global PV market could see new installations exceeding 240GW in 2022 on the back of easing supply chain issues. In an interview with pv magazine he lays out the current challenges and opportunities this year’s solar market is likely to see, as well as discussing the PV inverter manufacturers R&D and manufacturing plans.

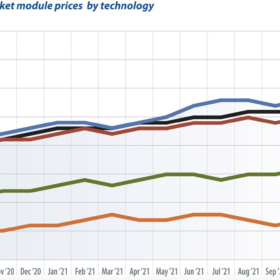

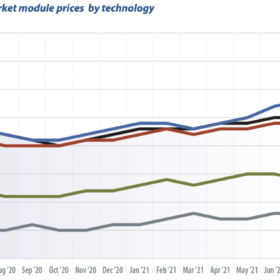

PV module price index: Prices set to rocket back to 2019 levels

First, the bad news: PV modules will be caught up in the global wave of inflation. After a very brief respite, prices are picking up again for almost all module technologies. But the changes recorded for early October are paltry compared to the price increases still to come, writes Martin Schachinger of pvXchange. As of the cutoff date for this market survey, some manufacturers had already announced even more significant upward corrections for future deliveries. The price adjustments shown in the October index are thus only a tentative start to rises of no less than 15-20% over the price levels that prevailed just a few weeks ago. However, this will probably be the last price correction we can expect at the manufacturer level until the end of the year.

PV modules expensive and scarce, no change in sight

Solar PV modules are currently trading at price levels last seen in 2018 and 2019, according to an account manager at PVO International. EPC companies in Europe, in particular, are suffering. A lack of large-scale integrated PV production on the continent is also playing a role.

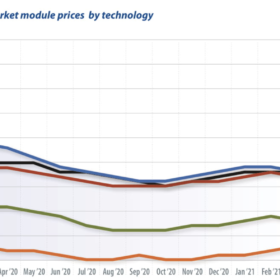

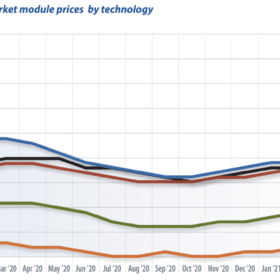

EU spot market module prices: Declines witnessed

The sky is the limit. Fortunately, this expression does not apply to current prices for PV panels, which have recently declined, following a continuous rise since the beginning of the year. Whether this situation holds, or whether prices drop further in the coming months is hard to say at the moment, writes Martin Schachinger of pvXchange. Polysilicon prices and thus wafer and cell prices could be in for a slight decline. However, a decisive movement in module prices in general is unlikely before the fourth quarter.

PV module price index: New dimensions, new problems

The speed at which manufacturers are introducing changes from one product generation to the next is accelerating – currently, formats are scarcely available for more than a few months before another revised product is launched. But occasionally new module dimensions also bring new problems, be it in handling, plant design, or logistics. Ever-shorter product cycles and hastily launched record-breaking modules with capacities of 500 W, 600 W, or even 700 W are not always welcomed with open arms – especially by those who have to work with them, writes Martin Schachinger of pvXchange.com.

Why human rights protection is pushing up PV module prices

The solar industry typically sees itself as being supportive of the environment, humanity, and human rights. Even large Chinese PV manufacturers publish statements to this effect, particularly if they are listed on Western stock exchanges. But what do human rights have to do with the solar industry? What connections exist, asks Martin Schachinger of pvXchange, and how are they important to the future success of the European PV market?

Solar modules prices rose by up to 15% in China, Jinko’s vice president says

According to JinkoSolar vice president Dany Qian, PV panel prices rose significantly since the second quarter of last year due to an increasing shortage of polysilicon, glass, silver, and module frames. She also stated that rushing demand cannot stop prices from rising for at least the next six months or longer, until sufficient capacity ramps up.