A simmering cauldron of renewables ‘revenue cannibalization’

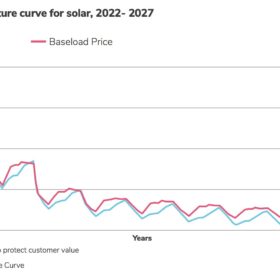

There is enormous demand for renewables to enter the grid, and for power purchase agreements to make use of them. However, as more renewables feed into the grid at intermittent periods, the risk of “revenue cannibalization” increases. Swiss consultancy Pexapark’s latest report looks at the “cannibalization effect” and how the solar PPA market can adapt.

Re-Source 2021 Recap

Re-Source 2021 took place in Amsterdam at the end of last week, and pv magazine was there to cover the event where the suppliers and sellers of renewable power purchase agreements (PPAs) meet the (largely corporate) buyers, though encouraging PPA uptake among small and medium-sized enterprises (SMEs) was among the major talking points, including ‘additionality’, de-risking renewable PPAs and 24/7 matching.

The future of solar PPAs in Turkey

Both the current status, and the future of, solar PPAs in the Turkish market as a key tool for increasing PV capacity has become a widely discussed topic. This is particularly due to the fact that after mid-2021, the future of YEKDEM (Turkey’s local FIT regime) is uncertain. The incentives could be lower than expected, or even unavailable for some technologies. This has raised the question of alternative financing mechanisms with respect to new investments.