Weekend Read: Gray skies over Californian solar

There may be a global solar boom but a drastic revision of California’s net metering program has ruptured the industry overnight and is affecting everyone from installers to financiers to makers of power electronics.

More than 3 GW of solar panels held by US customs under forced labor law

ROTH Capital Partners reports 3 GW have been seized under enforcement of the Uyghur Forced Labor Prevention Act.

Guggenheim Solar Index: Two sides to PV import tariffs

Solar stocks underperformed the broader markets in November, writes Jesse Pichel of ROTH Capital Partners. This is in large part thanks to uncertainty coming from the United States, where the Court of International Trade reinstated an exemption from import tariffs for bifacial modules – a decision that will likely see an appeal.

Guggenheim Solar Index: PV supply chain shake-up

Solar stocks have underperformed in the broader market in August, writes Jesse Pichel of ROTH Capital Partners. Project delays could be on the horizon as more module imports are held up at customs, and the supply chain will start to see impacts as suppliers look for options to source polysilicon outside of China.

Guggenheim Solar Index: Solar’s shipment struggle

The outlook for U.S. residential solar remains strong, according to Jesse Pichel of ROTH Capital Partners. The large-scale segment, however, is hampered by rising costs and the likelihood of sanctions on Xinjiang-made materials.

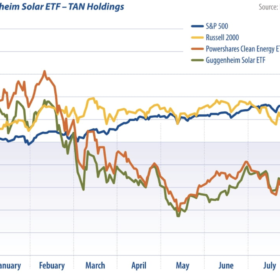

Guggenheim Solar Index: PV stocks slip on short supply

Supply shortages and price increases slowed solar stocks in April, writes Jesse Pichel of ROTH Capital Partners. In the United States, however, new policies promise to foster growth in the second half of the year.

Guggenheim Solar Index: PV industry facing headwinds

The solar industry faced headwinds in March, writes Jesse Pichel of Roth Capital Partners, thanks to rising interest rates and, in California, concerns over increasing grid access fees. Despite this, the recent earnings season reveals strong fundamentals and a healthy outlook for most players.

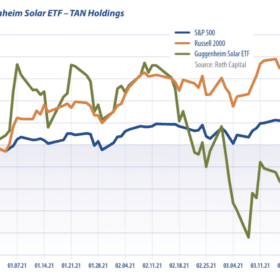

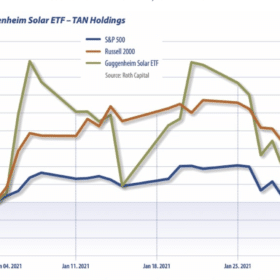

Guggenheim Solar Index: Strong beginnings

Solar stocks enjoyed a good start in 2021, writes Jesse Pichel of ROTH Capital Partners. In the United States, the Biden administration’s focus on climate change and the expectation of further incentives for renewables saw solar stocks rally in January. The global forecast is also positive, with China and others set for big installation numbers.

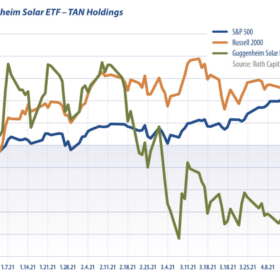

Guggenheim Solar Index: More to come in ‘21

With the wholesale transformation of the power industry from the inside out and other energy transition mega-trends, capital will continue to flow into renewables from ESG, energy funds, and retail, writes ROTH Capital Analyst Jesse Pichel. Look for a greater mix of unsubsidized economic solar projects to support improving revenue visibility, increasing earnings quality, and multiple expansions.

Explosions at GCL polysilicon fab have reportedly taken down 10% of global production capacity

California-based investment banking group Roth Capital Partners has reported four flash explosions on Sunday and a fifth yesterday “working their way through the GCL facility across multiple systems in a chain-reaction-like sequence.”