From pv magazine Germany

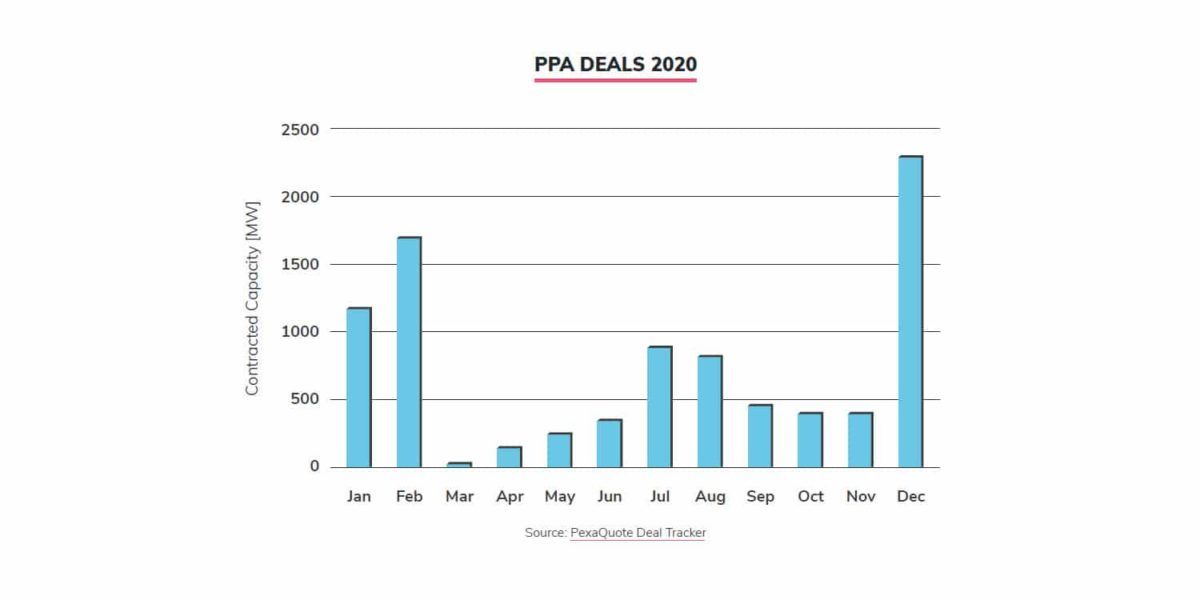

The coronavirus pandemic reached Europe in March 2020 and the market for unsubsidized photovoltaic and wind power plants was suddenly thwarted. After 23 power purchase agreements (PPAs) were signed between January and February, for a total of 2.8 GW, the market came to an almost complete standstill from March, according to the 2021 European PPA Market Outlook produced by Swiss consultancy Pexapark.

Between March and June, only 14 PPAs, for 644 MW of renewable energy projects were closed across Europe. In the second half of the year, however, the PPA market in Europe recovered and picked up significantly, reaching pre-Covid-19 levels at the end of December. Between July and the end of the year, in fact, 33 new corporate PPA deals were sealed for 3.1 GW of photovoltaic and wind power capacity. In December alone, PPAs for 1.1 GW were concluded.

Overall, PPAs for a total renewable energy capacity of 8.9 GW have been signed in Europe to date. However, the Swiss analysts estimate that the actual market volume is likely to be around 10 GW, as not all deals are known. Corporate PPAs account for around 54%, or 4.8 GW, of the total, which represents an increase of almost 70% compared to 2019. The analysts attribute this to the fact that more and more companies want to switch their supply to green electricity and prefer to resort to PPAs for this. Energy companies and traders remain the backbone of the PPA market. Photovoltaic is the leading renewable energy technology, with 4.1 GW of PPAs closed for this technology last year. In regional terms, Spain stands out, with PPAs for a total of 3.4 GW.

Popular content

The analysis of the prices for the PPAs in Europe is also interesting. The lowest price, of €35/MWh for a solar-linked PPA, was reported in Spain last year. This is followed by Germany, with prices for electricity purchase contracts averaging €41.61/MWh. The PPA contracts concluded in France and Italy were around €1 per megawatt-hour higher, according to Pexapark. The PPAs themselves varied greatly and were largely dependent on the different country circumstances, technologies, and consumers of renewable electricity.

Furthermore, Pexapark indicated several trends that will influence the development of the European PPA market this year. For example, Spain will remain the largest market in Europe in terms of volume, but Germany is pointed out as a potential challenger. The latter, on the other hand, is financially strong and has a large number of professional buyers for electricity from PPA systems – both from a credit perspective and from an industrial perspective. “Provided that the price level for photovoltaic PPAs allows this, this is a market that is ready to take off,” said Pexapark analyst, adding that price volatility will likely persist and with it, the high price pressure on European markets.

In addition, Pexapark expects that there will be a concentration in the PPA market through mergers and acquisitions with energy providers seeking to expand their presence in various regions. Examples are the takeover of Solarcentury by Statkraft, as well as a number of project developers that were bought up by financial investors. Similar activity can also be expected for 2021.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.