From pv magazine India

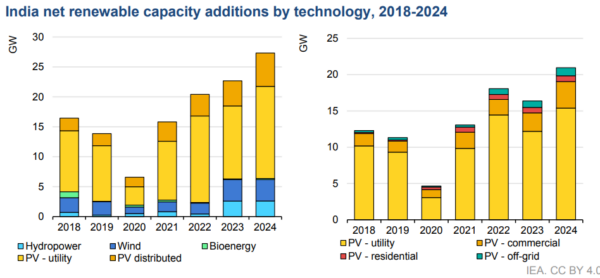

India's annual utility-scale solar installations are expected to fall by nearly 20% in 2023 due to supply chain challenges, lower auction volumes, and trade policies, according to a new IEA report. It said that India achieved a record-breaking 14 GW of capacity additions in 2022, mainly through auctions. However, auction volumes in 2022 decreased by about one-third, it noted.

Tariffs discovered in 2022 auctions rose by 15% compared to 2021, deterring financially struggling distribution companies (DISCOMs) from entering contracts. Some states that met their Renewable Purchase Obligations avoided additional auctions, while hybrid tenders gained government agency attention.

The IEA anticipates that the reduced awarded capacity in 2022 will result in a slowdown in PV capacity addition in 2023. In addition, short-term supply-demand imbalances and higher prices, caused by import tariffs, will impact PV expansion in 2023 and 2024, according to the IEA.

Developers prioritize high-output top-tier modules for cost efficiency and easier access to low-cost financing, according to the IEA. However, the demand for these modules exceeds supply in the short term, as large producers offering modules with over 500 W of power declared less than 5 GW of their total manufacturing capacity.

Import tariffs imposed on PV modules and cells in April 2022 resulted in a 30-40% price increase in the second half of the year, impacting project bankability. Consequently, developers had to postpone or cancel projects until PV prices decreased. The government responded by postponing ALMM requirements and extending commissioning deadlines for projects commissioned by April 2024.

Popular content

While government actions have addressed some challenges, the temporary supply-demand mismatch for top-tier PV modules will hinder rapid utility-scale PV expansion in 2023 and 2024. However, the IEA foresees a booming PV deployment in India beyond 2025, driven by higher auction volumes and lower prices.

The report anticipates India to achieve full self-sufficiency in solar PV supply within the next four to five years as manufacturing capacity awarded in the production-linked subsidy scheme becomes operational.

In conclusion, the IEA expects India's renewable capacity additions to rebound in 2023 and 2024, driven by faster onshore wind, hydropower, and distributed solar PV deployment.

Source: IEA

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.