A recent report by the National Energy Administration shows that total PV installations reached 24.4 GW in the first half in China, which includes 3 GW of installations from previous years and a certain amount of capacity connected to the grid before the end of June 2017, with shipments delayed in July and August.

Explosive Demand Growth, High Module Shipments

The explosive demand of the first half can be seen from module shipments. Statistics show that JinkoSolar, which recently published its latest financial report, ranked first with 2.19 GW shipped to the Chinese market, within everyone’s expectations. Meanwhile, Longi Green Energy Technology — which is neck and neck with Jinko Solar — shipped 2.15 GW in the first half, including PV cells.

GCL System Integration Technology (GCL-SI) and Trina Solar tied for third place with shipments ranging between 1.8 GW and 1.9 GW. Overall, the top 10 Chinese manufacturers contributed over 1 GW of module shipments to China. The total module shipments of these companies represents 70% of the Chinese market, which indicates high industrial concentration.

Mono-Si Products Accounting for More Global Shipments

Despite limitations on market share due to shortages of mono-Si wafers in the first half, the share of mono-Si modules on the market rose to 36%, which is a significant increase from 27% in the first half of 2016. The mono-Si module market share is calculated from 10 GW of mono-Si wafer production in China, minus exports of mono-Si wafers, cells, and modules.

For the module segment, the market share of mono-Si modules in China is expected to rise gradually. But while Longi — among the world’s leading mono-Si module manufacturers — shipped more than 2GW modules in the first half in China, other manufacturers also increased their share of the mono-Si market. JA Solar, Trina Solar, Yingli Solar, Solargiga Energy, Linyang Energy and EGing, for example, all increased their shipments of mono-Si modules.

Popular content

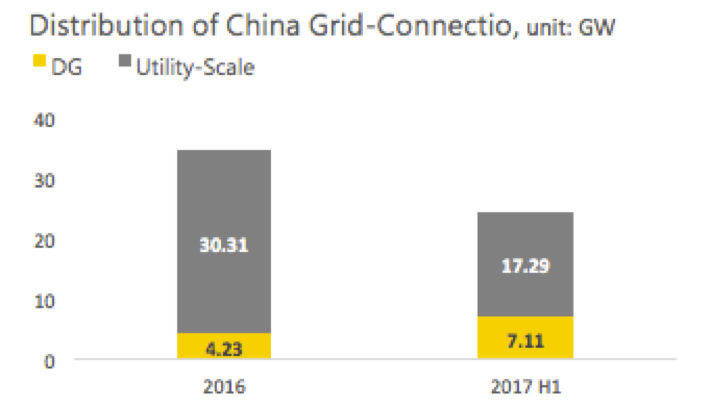

Distributed Generation Market Affecting Domestic Demand

Developers rushed to connected projects to the grid before June 30, driving the grid-connected installation total to 10.5 GW in July, on top of demand to connect distributed-generation projects. Heading into September, the biggest uncertainty for follow-up Chinese demand was speculation over when the feed-in tariff (FIT) would be adjusted. If the government decides to lower the FIT from January 1, 2018, market demand will likely rebound instantly. That in turn will heat up the distributed-generation solar market. In addition, 60-70% of 5.5 GW of capacity under the Chinese government’s Top Runner Program will be installed in the second half, which will drive up domestic installations in the fourth quarter.

Distributed-generation PV projects, as well as Top Runner installations, are required to meet strict requirements for high-efficiency modules, which is why manufacturers will focus on producing such solar panels in the second half. Currently, the two leading mono-Si wafer companies — Longi and Zhonghuan Semiconductor — have expanded their production capacities to meet market demand in the second half.

Mono-Si wafer production capacity is no longer a bottleneck for high-efficiency product expansion. As passivated emitter rear contact (PERC) technology has become increasingly mature, mono-Si products are likely to take a greater shares of the solar market. Moreover, the production of high-efficiency products is also expected to rise gradually. Moving forward, the sustainable development of mono-Si PERC modules — as well as high-efficiency products such as black silicon, half-cut modules and multi-busbar products — will support shipment increases. We look forward to seeing the application of diversified technologies on high-efficiency products in the near future.

By Corrine Lin

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.