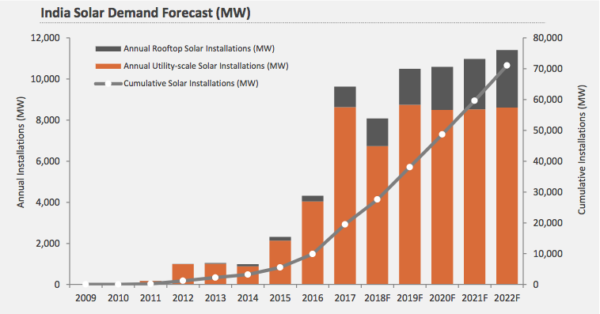

Cumulative solar PV installations have reached 22.8 GW in India, reports Mercom in its Q1 2018 India Solar Market Update. Rooftop installations comprise just over 2 GW of this. Overall, solar is now said to represent around 6.6% of total installed capacity in the country.

Up 34% on Q4 2017, new PV installations reached 3.3 GW, compared to the 2.4 GW installed in Q4, and just under 3 GW in the same quarter last year. This is the first time over 3 GW have been installed in a single quarter. Of this, utility-scale accounted for 2.9 GW, or 88%.

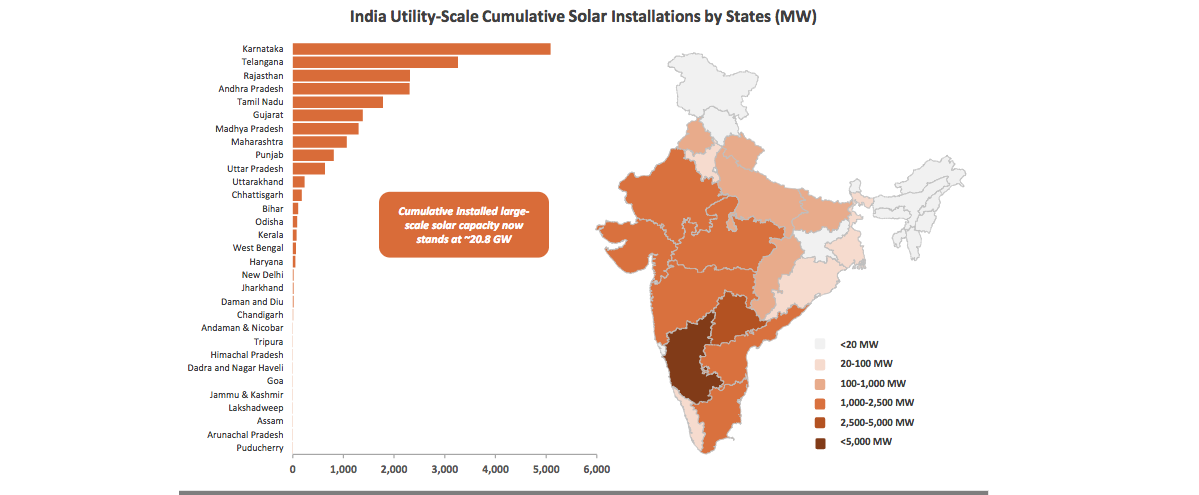

Karnataka led the way, hosting over 5 GW, with Telangana, Rajasthan and Andhra Pradesh following in second, third and fourth places, respectively.

While still paltry in comparison, the rooftop sector recorded a 50% quarterly increase, with 390 MW installed.

“The surge in installations in Q1 2018 was primarily due to the completion of projects which were scheduled for commissioning the previous quarter, but had experienced delays due to grid connection issues,” said the analysts.

Positive forecasts

Overall, Mercom expects to see between 8 and 9 GW of new installations this year. This is higher than Bridge to India’s anticipated 6 GW, but still lower than IHS Markit’s expectations of 11 GW.

Mercom says that the utility-scale pipeline of projects under construction is currently sitting at 9.7 GW. Meanwhile, over 13 GW were tendered in Q1 – of which utility comprises 10.2 GW – and 1.8 GW auctioned. The lowest bid was said to have come in at around US$0.043)/kWh, which was quoted by ReNew Power for a 300 MW project in the Pavagada Solar Park auction.

With a nod to the recent decision by China to curtail its PV industry, Mercom believes the potential oversupply situation, and resulting module price crash, could prove a boon to Indian solar project developers, who would be able to offer lower bids in tenders. This could, “in turn could open the auction floodgates as states jump in to lock in low tariffs.”

Popular content

Talking of module prices, Mercom says that average selling prices began to decline in the first quarter, after two consecutive quarters of increasing prices. It didn’t release any details, however.

Roadblocks

Despite the overall positive news, Mercom warns that the safeguard duties issue must be cleared up before “strong growth” can take place, chief of which is the safeguard duties.

“It now comes down to how the safeguard duty will be handled. Will the government apply a low tariff which could be easily absorbed by the industry as Chinese module prices decline or will trade cases drag on continuing to create uncertainty in the near future? There is a clear opening for the government right now to use this opportunity to lay the path for growth,” said Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

Residential is another area, which requires improvement. As Mercom remarks, the sector is still very dependent on government tenders and projects.

“Open access projects were really sought after, but slowly states are making them less attractive by levying wheeling and banking charges. Residential solar is still untapped as financing and upfront costs continue to be big challenges. Government subsidies are not getting paid on time, affecting small installers,” writes Mercom.

Speaking recently to pv magazine, Dharmendra Kumar an analysts with IHS Markit said, “Some of the prominent issues behind the slow growth of rooftop segment are lack of uniform regulation, multiple tenders by different government agencies, but getting delayed, Discoms not ready to buy power from residentials, lack of net metering in few states, involvement of multiple stake holders, lack of viable rooftops to sustain installations.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.