German market research and consulting company, macrom released a report, which places the European market in poll position in terms of global residential storage system sales. Within the last two years, the number of systems sold in Europe has reportedly tripled, it finds.

The consulting firm further highlights that within Europe, Germany is the most important market for battery storage systems, particularly in terms of domestic manufacturers.

However, while German suppliers dominate the European market, the growth of Asian manufacturers is remarkable. Indeed, in addition to popular German brands E3/DC GmbH, Kostal, Solarwatt GmbH, SMA Solar Technology AG, sonnen GmbH, there are other leading suppliers, including Israel-based SolarEdge Technologies Inc., Tesla, Inc. from the United States, China's Goodwe Power Supply Technology Co., Ltd and BYD Co. Ltd and Korean company, LG Chem Ltd, which are gaining in popularity in Europe.

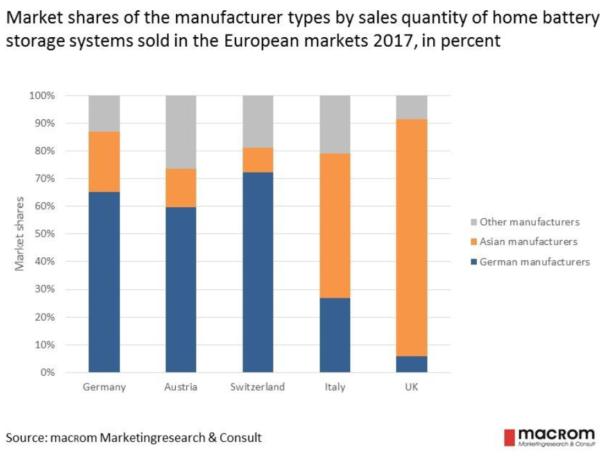

Notably, in Great Britain, Asian suppliers have found a lucrative market, as British customers tend to be more price sensitive and, thus, unwilling to purchase the generally more expensive German systems. Indeed, while in Germany and Switzerland, says macrom, over 65% of the systems came from German manufacturers, Asian suppliers took an over 80% market share in Britain.

Popular content

Overall, the German market remains the most active worldwide, continues macrom, with the central European market recently inaugurating its 100,000th residential storage system, at a press event on the outskirts of Berlin.

The analysts say the storage market is characterized by substantial price volatility and severe fluctuations of consumer interest in storage systems, however. This is mainly due to policy changes, which make it somewhat difficult to determine the cost efficiencies of such systems. Varying degrees of subsidies and feed-in tariff schemes, or grid charges for stored electricity for self-consumption, make the market vulnerable, say the analysts.

In the future, Spain will grow to become a significant market within Europe, according to the report. Here as well, a recent change in government – which favors renewable energy much more than the previous one – is driving this increased interest. Italy is also demonstrating impressive growth. From 2016 to 2017, the market grew by 70%, and the trend is continuing.

In addition to policy, the report highlights the importance of national regulations, to which systems must adhere to. For example, the Italian market is dominated by 6 kWh systems. In Britain, in comparison, potential buyers do not show much interest in turnkey solutions, i.e. combining batteries and inverters into one system.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.