From pv magazine USA

Following the passage of the Inflation Reduction Act, an energized solar industry is aiming high and envisioning a future in which the United States has a robust domestic energy supply chain. SEIA's new roadmap charts a path to achieving this goal, with a target of 50 GW of annual solar manufacturing capacity by 2030.

The United States has been plagued by numerous pressures threatening the supply of solar modules imported from overseas. With decarbonization and climate goals under threat due to this shortage, the country is now turning to boosting domestic manufacturing to power the energy transition.

“Greatly expanding US PV manufacturing could mitigate global supply chain challenges and lead to tremendous benefits for the climate as well as for US workers, employers and the economy,” said the Department of Energy (DoE). It concluded in a study that US production could reach 10 GW in two years, 15 GW in three years, and 25 GW in five years on its path to 50 GW of annual production.

The “Catalyzing American Solar Manufacturing” report explores how the United States can move from its current state of limited production to a full-fledged, economy-powering domestic energy supply chain.

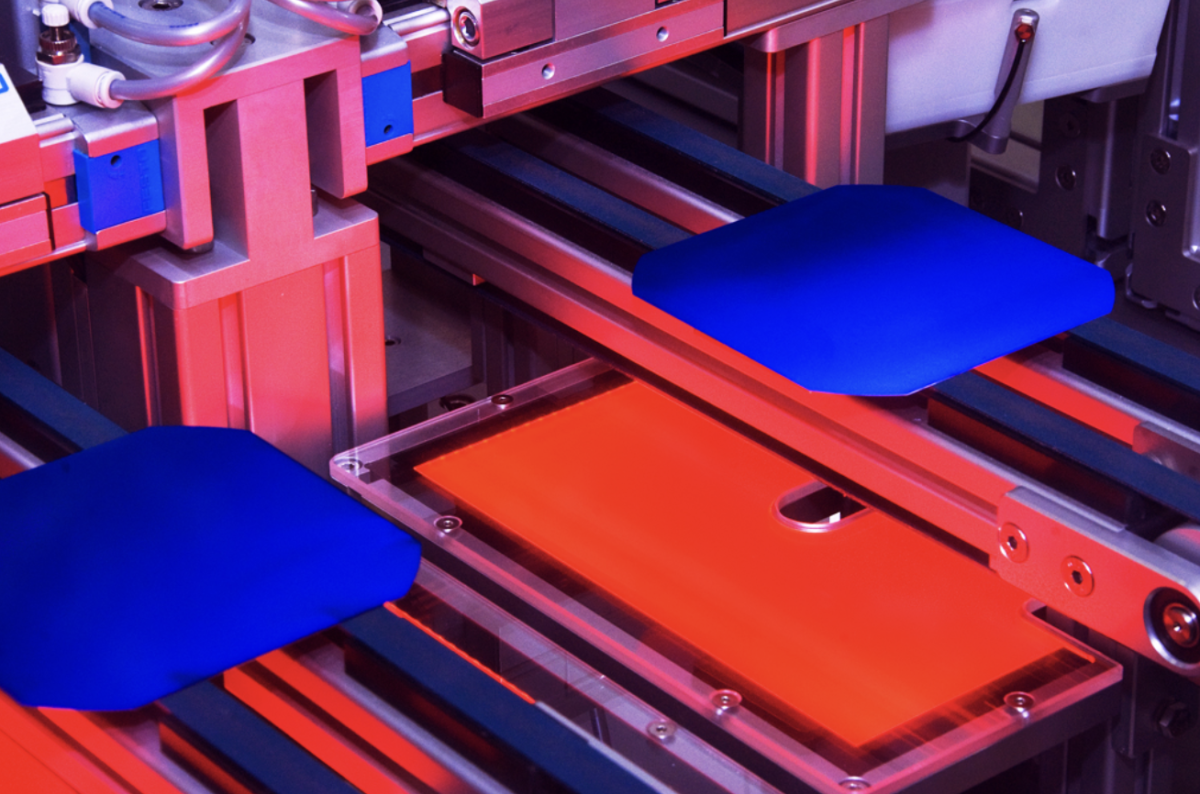

Currently, the nation has the capacity to produce materials like metallurgical-grade silicon, polysilicon, steel, aluminum, resins, racking, and mountings. However, there are significant gaps in the supply chain. The United States does not currently have domestic solar ingot, wafer or cell manufacturing capacity and only modest capacity to produce solar modules, inverters and trackers, said SEIA. As a result, these segments must be targeted on the path to 50 GW.

The SEIA report said that with the right application of new Inflation Reduction Act incentives, the United States should be on track to meet, or even exceed, the 50 GW goal across all segments of the solar supply chain.

Popular content

Domestic manufacturers should focus on building downstream production first and backfilling components with imports while upstream domestic production is built out, said SEIA. While scaling domestic module capacity will take two to three years, it will be three to five years before there is significant domestic manufacturing capacity for ingots, wafers and cells.

SEIA said investments in manufacturing should be timed intelligently and with awareness of demand. As an example, scaling solar ingot and wafer operations before new domestic cell capacity comes online could potentially strand new investments. The importance of domestic raw material supplies, and funding for related environmental impact assessments also cannot be overlooked. For example, building new domestic solar glass capacity will significantly improve the cost competitiveness of US module assembly.

US manufacturers must create in-demand products, by selling at a competitive price and delivering quality goods. This cost competitiveness will likely only be achieved at large scale, which requires significant upfront investment, said the report.

Following the Inflation Reduction Act, groundbreakings for large-scale manufacturing facilities will likely commence in 2023. The first new factories supported by these policies will begin production in 2025, or as early as 2024 for trackers, racking and aggressive inverter and module manufacturing investments.

A successful buildout will require a robust US workforce. The report said this will depends upon collaboration between companies, government agencies and higher education institutions, to advance solar-specific technical training and college-to-career programs. Diversity, equity, inclusion and justice should be central to the workforce strategy of the energy transition.

The full report can be read here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.