A group of German and US researchers claim that green hydrogen and derived electrofuels will likely supply less than 1% of final energy by 2030 in the European Union and by 2035 throughout the world, if electrolysis grows as quickly as wind and solar power did in the past.

“By 2040, a breakthrough to higher shares is more likely, but large uncertainties prevail with an interquartile range of 3.2% to 11.2% (EU) and 0.7% to 3.3% (globally),” said the researchers. They suggested that short-term scarcity and long-term uncertainty will slow investments in hydrogen end uses and infrastructure, reducing green hydrogen’s potential and jeopardizing climate targets.

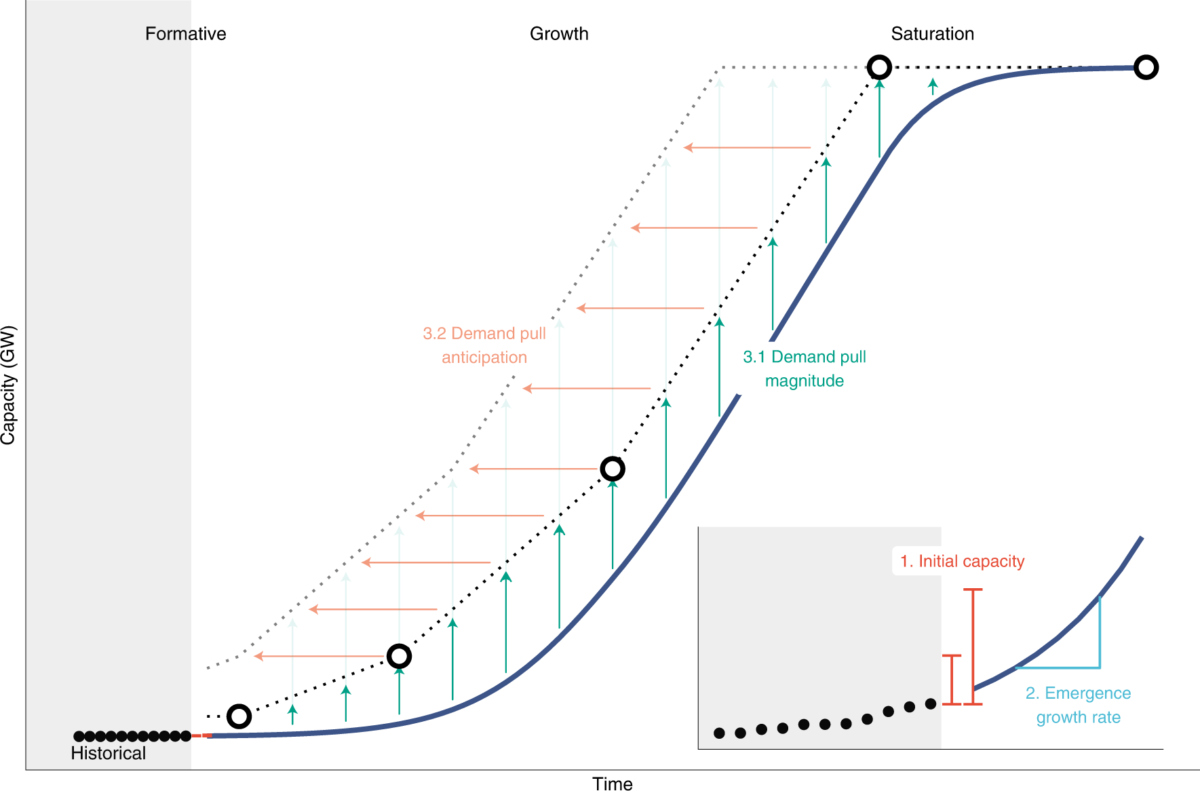

“However, historic analogues suggest that emergency-like policy measures could foster substantially higher growth rates, expediting the breakthrough and increasing the likelihood of future hydrogen availability,” the researchers said in “Probabilistic feasibility space of scaling up green hydrogen supply,” which was recently published in Nature Energy.

The researchers acknowledged the importance of demand, infrastructure, and renewable capacity, but used electrolyzers as a proxy for hydrogen developments. They based their conclusions on 2021 data, but confirmed the validity of their modeling to pv magazine.

“Spurred by concrete policies supporting green hydrogen scale-up, the past year has seen substantial momentum in electrolysis project announcements and associated final investment decisions,” said researcher Adrian Odenweller. “However, due to long lead times and time required for construction, recent final investment decisions are unlikely to translate into operating projects already next year. We, therefore, take 2023 as the ‘initial year' in our model.”

The researchers welcomed recent support schemes announced in Europe and North America, like the US tax credit for green hydrogen or the creation of a European bank meant to support hydrogen developments.

“The European Hydrogen Bank underpins the highly ambitious green hydrogen targets with concrete policy measures,” said Odenweller. “It is a much-needed step in the right direction. The exact design and allocation of the funds remain to be seen.”

The Potsdam Institute for Climate Impact Research academic said that reaching the REPowerEU target for domestic renewable hydrogen production – 10 million metric tons by 2030 – requires unprecedented growth rates for energy technologies.

“The current energy crisis might offer a window of opportunity to catalyze the energy transition by spurring investment into renewable energy technologies. Yet, it is important to note that this should include all crucial zero-carbon technologies, not just green hydrogen,” commented Odenweller. “So if policymakers decide for war-time efforts, they should still balance these measures across technologies.”

Popular content

The researchers said the uncertainties are due to a lack of a dominant electrolysis technology, and contradictory shreds of evidence about the costs of different hydrogen supply chains.

“It is likely that the first large-scale imports of hydrogen products can be realised around 2030. Imports via pipelines have a large potential to reduce costs, but cost estimates remain uncertain,” said Odenweller.

Another uncertainty is related to the speed the green hydrogen supply can expand.

“The empirical record shows that small-scale modular technologies are adopted more quickly than large-scale technologies. Electrolyzers are also modular and thus could grow at fast rates,” Odenweller told pv magazine. “However, hydrogen infrastructure is chunky, material-intensive, and labor-intensive, making it less amenable to rapid learning and adoption.”

The researchers suggest that policymakers should include subsidies such as co-financing capital expenditures for electrolyzers on the supply side, while subsidizing operating expenditures of industrial processes on the demand side. Odenweller mentioned carbon contracts for differences (CCfDs) as an example. He warned that investments should prioritize hydrogen in those end-use applications where direct electrification is infeasible.

In terms of additional policies, the researchers consider the Carbon Border Adjustment Mechanism as a potentially helpful instrument.

“The CBAM should be adjusted such that hydrogen, and derived fuels such as ammonia, are included with all upstream emissions,” they said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“The Potsdam Institute for Climate Impact Research academic said that reaching the REPowerEU target for domestic renewable hydrogen production – 10 metric tons by 2030 – requires unprecedented growth rates for energy technologies.”

I think you mean 10 million metric tonnes.

Thanks for your comment. The article was amended.