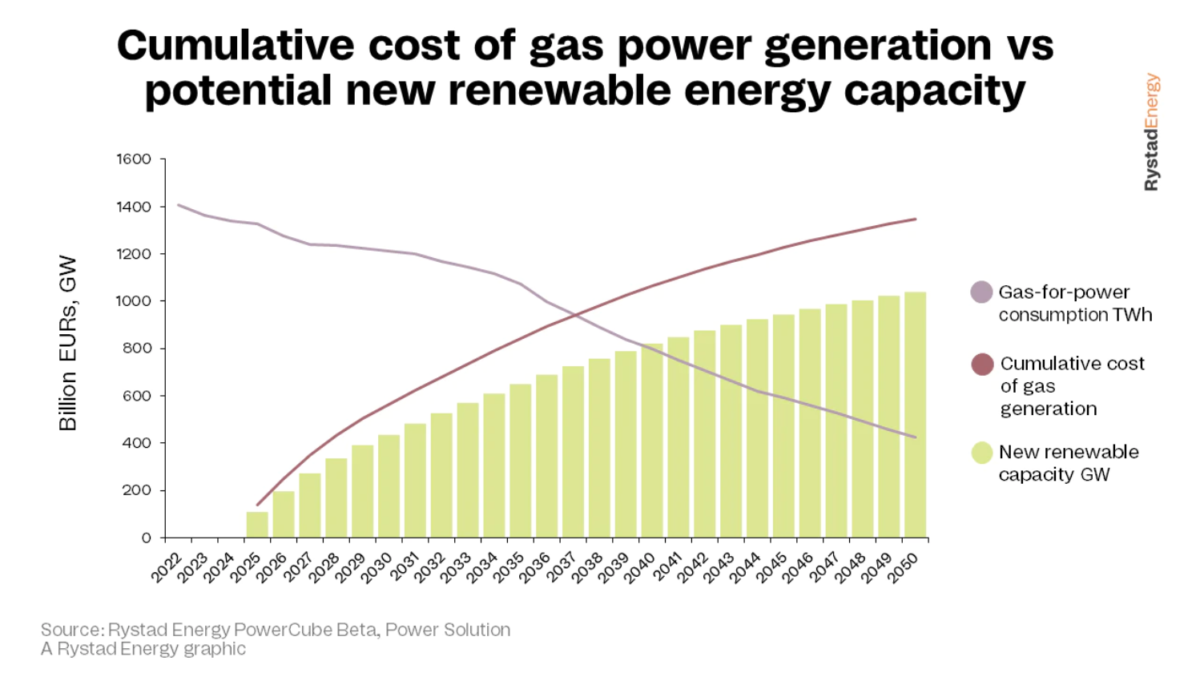

Building new solar capacity in Europe could be 10 times cheaper than continuing to operate gas-fired power plants in the long-term, according to a new study by Norway-based research company Rystad Energy.

Europe has seen skyrocketing gas prices since the drop in Russian gas exports, with spot prices on the Netherlands-based Title Transfer Facility (TTF) rising to an average €134 ($135.15)/MWh so far this year. Rystad forecasts prices will stabilize at around €31 per MWh by 2030, which puts the LCOE of existing gas-fired plants closer to €150 per MWh.

“This is still three times more than the LCOE of new solar PV facilities. For gas-fired plants to continue being competitive, gas prices would need to fall closer to €17 per MWh and carbon prices would need to fall to €10 per tonne, which is currently unthinkable,” the company said in a statement.

Popular content

“Gas will continue to play an important role in the European energy mix for some time to come, but unless something fundamental shifts, then simple economics, as well as climate concerns, will tip the balance in favor of renewables,” said Carlos Torres Diaz, head of power at Rystad Energy.

If gas funds were invested in renewables instead, Europe could replace gas with solar and onshore wind power generation by 2028, when total capacity would reach 333 GW, Rystad forecasts. This estimate assumes a weighted average capital cost for the technologies of €1.3 per watt, as well as a two-year pre-development phase.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Inflation will be a thing of the past

Based on computer models then when they get into real world problems of snow rain clouds they find out that they produce 20-30% less as Spain Germany England California did.

Hi Ian – real world met data is always factored into computer simulations. It is usually based on a nominal year, calculated from a 10 year average of measured data.

My experience is that we often find that our real-world solar installations out-perform the computer models used to support the initial business case.

“If gas funds were invested in renewables instead, Europe could replace gas with solar and onshore wind power generation by 2028″….. And when the sun doesn’t shine and the wind doesn’t blow we just have a Holliday or freez. This approach only works if there is the political will to build a substantial base load nuclear system, if not gas is here to stay.

If only there were some way to store some of that energy and use it to power the grid when generation isn’t enough…

Not true. If you read more here at PV Magazine you will learn about grid-scale energy storage systems. Intermittency is the trump card of the fossil fuel industry and it conveniently ignores all the amazing developments in sustainable battery technology.

The debacle with Russian gas illustrates that fossil fuels provide low levels of energy security compared to sustainable energy supplies. I think in this regard, gas and oil has bigger problems with intermittency.

Think of it as going to war. If Germany was going to war it would borrow $trillion. It can burrow $trillons to go fully renewable.

Carbon tax at $10, what is the actual cost difference at zero carbon tax? And zero subsidies for solar…and using gas prices prior to 2021.