Equis Development has committed to invest $1.27 billion to develop the Melbourne Renewable Energy Hub (MREH) north of Melbourne in the state of Victoria after acquiring the battery energy storage project from Australian renewables developer Syncline Energy.

The project, previously known as the Melton Renewable Energy Hub, was first unveiled in August 2021 by Melbourne-based Syncline. The original design featured a 600 MW/2,400 MWh battery energy storage system (BESS) backed by a 12.5 MWp solar farm to supply the battery’s ancillary cooling loads and ensure low-cost, “net-zero” operations. But Equis, which assumed full control of the project earlier this year, has since rebranded and resized the big battery.

The MREH, to be built on a 90-hectare site just 25 kilometers northwest of Melbourne, has been boosted to include a 1,200 MWh battery system, while the storage capacity will remain at 2.4 GWh. The massive facility will connect to the National Electricity Market (NEM) via the state’s main 500 kV transmission link and will collect excess energy, store it, and then release it back into the grid to satisfy demand.

Equis said it is expected the battery will be capable of stabilising about 1.6 GW of solar power or 1.2 GW of wind generation.

“Fully developed, MREH will be … the largest such system in Australia and Asia,” the company said. “MREH is Australia’s only BESS above 200 MW in capacity that connects to the NEM’s high-voltage 500 kV transmission system, allowing a volume of electricity to be rapidly dispatched unmatched by other battery storage systems.”

The MREH, which has received all necessary planning approvals after being fast-tracked by the Victorian government as a “project of state significance,” will be rolled out in two 600 MW stages, with construction of the first phase scheduled to begin in early 2023 with operations anticipated to commence in 2024.

The battery project will utilize lithium iron phosphate (LFP) chemistry batteries provided by Finnish technology group Wartsila.

Popular content

Equis said the MREH had been “uniquely developed” with six separate 200 MW points of connection to the NEM, allowing the battery to satisfy different uses and grid responses simultaneously. The company said the project has been designed with innovative inverter technology to support the transmission grid's voltage and frequency and replace “system inertia” that is lost when coal and gas-fired power stations retire over the next decade.

“The scale and uniqueness of MREH’s approvals and development mean it will be capable of providing both short and long-hour storage and response services catering to the changing demands of the National Electricity Market,” Equis Managing Director David Russell said.

Equis anticipates the project will also facilitate the development of a large-scale battery recycling hub and hydrogen production facility.

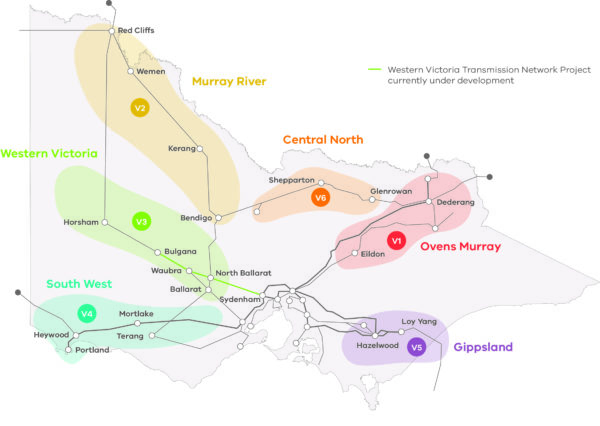

Syncline, which is to remain involved with the project until major construction starts, said the battery is ideally sited because of its proximity to the main 500 kV line. It expects the positioning to allow it to support Victoria’s Murray River, Western Victoria and South Victoria renewable energy zones.

“Four years ago, Syncline combed Victoria for the ideal location to build a large-scale grid storage battery which would partially replace the state’s ageing fleet of coal generation plants,” Syncline Managing Director Phil Galloway said. “We needed enough space to operate safely and to minimise the impact on the community. It also had to be at the metropolitan load centre, to ensure that we could improve the reliability and resilience of the grid and materially support regional wind and solar energy.

“Finally, we had to connect at 500 kV to deliver the volume of energy that is required when Australia’s large thermal generators retire over the next 10 years. MREH was the ideal location.”

The MREH project is just one of 39 renewable energy, battery storage, and waste infrastructure projects worth more than $4.4 billion that Equis, which is backed by the Abu Dhabi Investment Authority and the Ontario Teachers’ Pension Plan Board, is currently developing in Australia. While the MREH is the biggest of its battery projects, Equis has also announced plans to develop a 300MW/1,200MWh battery near Tamworth in New South Wales, a 200 MW/800 MWh energy storage system near Brinkworth in South Australia, and two battery projects totaling 250 MW in Queensland.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

To get an example of a meaningful cost comparison:

The “Nant-de-Drance” pumped-storage plant in Switzerland (-> Youtube), which has just been commissioned, cost around $2 billion for 900 MW of output and 20 GWh of energy capacity.

This means that 1 GWh of energy capacity costs around USD 100 million.

This battery is said to cost $1.27 billion (AUD I assume) and will provide 2.4 GWh of energy capacity (at a power output of 1,200 MW).

So here, 1 GWh of energy capacity costs around USD 330 million.

Of course, you need the appropriate topography for a pumped storage plant, which is not the case everywhere (in this case 230 million m3 of water with a head of 425m). The battery will react a little faster than a pumped storage plant, but this can be solved with a small battery. The construction time for a pumped storage plant is certainly longer, in this case it was around 13 years.