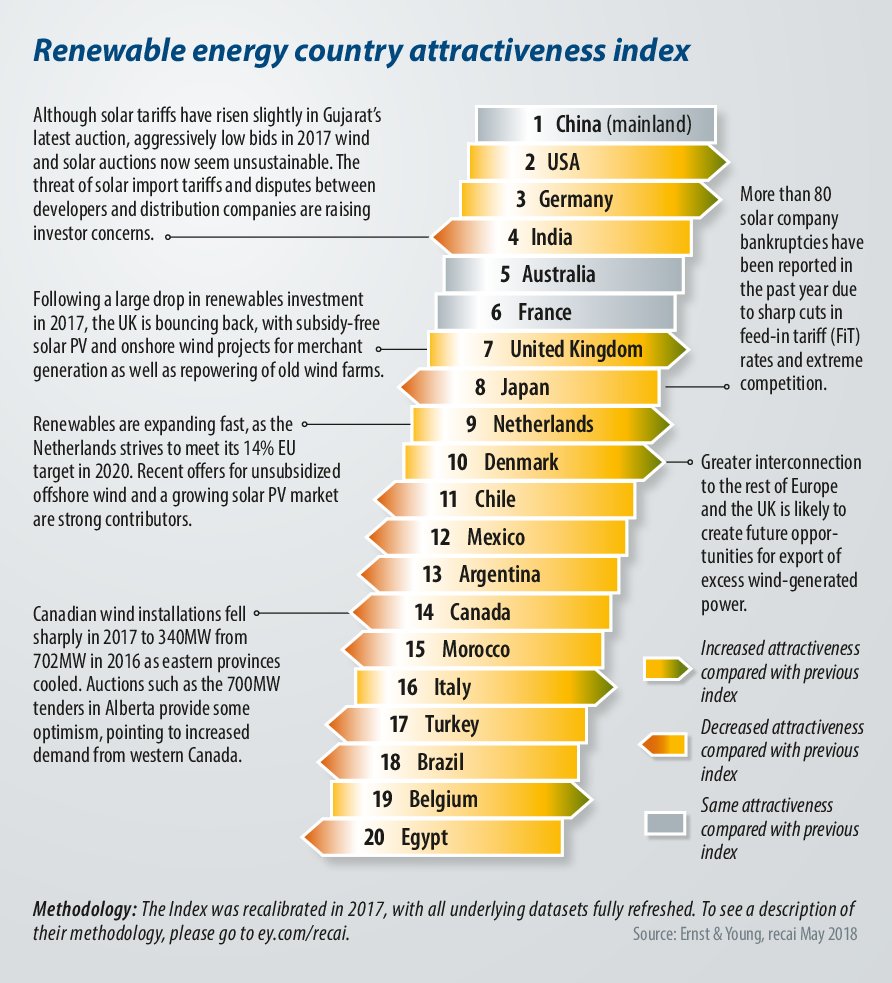

Ernst and Young (EY), a global business consultancy, published in May its annual Renewable Energy Country Attractiveness Index (RECAI) report, which tracks investment appetite for clean energy across the globe. This year EY’s index ranked the U.K. seventh, up from the 10th and 13th places in 2017’s and 2016’s indexes respectively.

Explaining the U.K.’s upward trend, EY says that “following a large drop in renewables investment in 2017, the U.K. is bouncing back, with subsidy-free solar PV and onshore wind projects for merchant generation as well as repowering of old wind farms.”

While England has a restrictive planning regime, which hitherto has hampered wind generation development, Scotland experienced quite a wind power boom in the 1990s, with many installations pending a revamp, now.

First movers

On the solar PV front, British renewable energy developer Anesco inaugurated the U.K.’s first subsidy-free PV farm in September last year. The 10 MW project in Bedfordshire, co-located with a 6 MW battery storage facility has generated quite some adulation among politicians and representatives of the industry.

Through the sale of ancillary services to National Grid, The U.K.’s owner and operator of transmission grids, from the adjacent energy storage system, Anesco’s solar PV plant can tap extra revenues.

Providing insight into the financials of subsidy-free solar PV plants, Matthew Clayton, Managing Director of Thrive Renewables, a British renewable energy investment company, spoke to pv magazine last September. He then argued that PV projects under a power purchase agreement (PPA) are more likely to go subsidy-free, than those that sell generated electricity directly to the grid.

Following EY’s RECAI 2018, in May, Clayton explained that “commercial rooftop systems and very large schemes are most likely to move first in the subsidy-free [era].” For commercial rooftop projects specifically, Clayton argued that such projects “benefiting from host PPAs can secure the premium required above wholesale to make this to cover the capital expenditure (capex),” while for large schemes “dilution of the grid connection costs and civil costs have an advantage,” plus they “attract more aggressive equipment pricing.”

Kareen Boutonnat, Chief Operating Officer at Lightsource BP, a global solar PV developer active in all segments of the PV market, says that the costs to build utilityscale, subsidy-free PV plants in the U.K. today are still tight and depend on capital expenditure and the system rating of the plants to be developed.

Therefore, she argues that, while grid parity projects are emerging, probably the sector will be populated by a small number of players, and not the myriad developers that had been active in U.K. solar in the last seven years.

Boutonnat also offers a glimpse into the process of building large-scale projects without any public subsidy support. Since the U.K.’s planning regime for projects exceeding 50 MW is more time consuming than for smaller projects, Boutonnat says it is possible to see developers opting for multiple projects of about 50 MW each, rather than say one 100 or

200 MW project. Obviously, Boutonnat adds, the general rule in the subsidyfree era is the bigger the better, but “if you are able to build them [multiple projects] in parallel, then you still get economies of scale… and the cost of capital is everything.”

When asked about the individual costs of building separate projects instead of a larger one, Boutonnat answers that since every project will need separate preparation (e.g. building access tracks), construction costs are likely to increase. She does note, however, that if developers are able to aggregate their projects and offer them to the same EPC contractor, they will achieve economies of scale in the components, which tend to be about 70% of the EPC contract.

Popular content

PPAs: corporate and private wire

Eventually, all utility-scale, subsidy-free projects are built based on PPAs, though there is a difference whether the project uses the grid to transmit electricity

Both options exist in parallel and can connect the same locations. Projects using the latter option connect directly behind the meter and are widely referred to as ‘private wire’ projects.

Lightsource BP’s Boutonnat says in the first case the developer is “competing against the wholesale power price which is most challenging.” It can, however, “build a 50 MW project and have an off-taker to purchase the electricity.” In fact, Boutonnat appears very positive that Lightsource will announce some good news in this category of subsidy-free projects soon.

In the second case, PPAs “compete against retail prices, which leaves a bit more room for maneuver, but typically [a developer] will have to scale [their] project to the consumption of the off-taker, so [they] end up with a [PV] plant much smaller – around 2 MW to 10 MW,” says Boutonnat. “Typically, in these cases, the off-takers will be able to offset about 20 to 30% of their electricity needs” – for projects that do not use battery storage.

While smaller unsubsidized private wire projects exist in theory, higher O&M expenditures as well as slightly off-facing roofs – on which systems are mounted – impede performance yields, which renders such projects uncompetitive.

Based on Lightsource’s experience, British and international corporations that are active in the U.K. and use large amounts of electricity are actively looking for contracts of the first category, aiming to fulfill their electricity needs with green power. Contracts of this kind are typically trilateral, involving the developer, the corporate client, and a utility, while the length of the PPA agreement is pivotal to make the project bankable.

Boutonnat adds that “as soon as you buy from the grid, the kind of issue that you have with private wires goes away”. It is not necessary to size the PV plant to one location and to one factory. The corporate client can buy large sums of electricity from PV plants scattered around several places in the U.K.

Finance

The challenge, Boutonnat argues, is the duration of the PPA agreement. The developer is “building a long-term asset that is going to be there for 30 years plus.” Without long-term PPAs, banks are not too keen on the merchant risk that is connected to covering such a project by traditional means of project financing.

Thrive Renewables’ Clayton points at the differences between subsidy-free projects and projects built based on a subsidy scheme: “The lack of revenue certainty changes the risk profile of investments. Therefore, this changes the parties interested in funding the assets.”

Rather interestingly though, Clayton argues that “there is plenty of capital available – it’s just different parties at a different cost compared to those which have been investing in inflation link cash flows generated by feed-in tariffs (FITs) and Renewables Obligation Certificates (ROC).” These were the U.K. subsidy schemes supporting renewable energy. “The ‘wholesale’ electricity prices are distorted by a cocktail of subsidies, products and incentives, which makes investing against merchant risk higher risk in the medium term.”

After all, 2018’s EY index came with a message from its Chief Editor: “wherever we look, we see growing evidence of the maturity of the renewable energy sector. A few years ago, cuts to subsidies, import tariffs, and rising interest rates would blow down the industry. Today, they create headwinds, but no hurricanes.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.