In its latest report on funding and mergers and acquisitions (M&A) activity for the Battery Storage, Smart Grid, and Energy Efficiency sectors, Mercom Capital Group, llc finds that battery storage continued to be an attractive proposition.

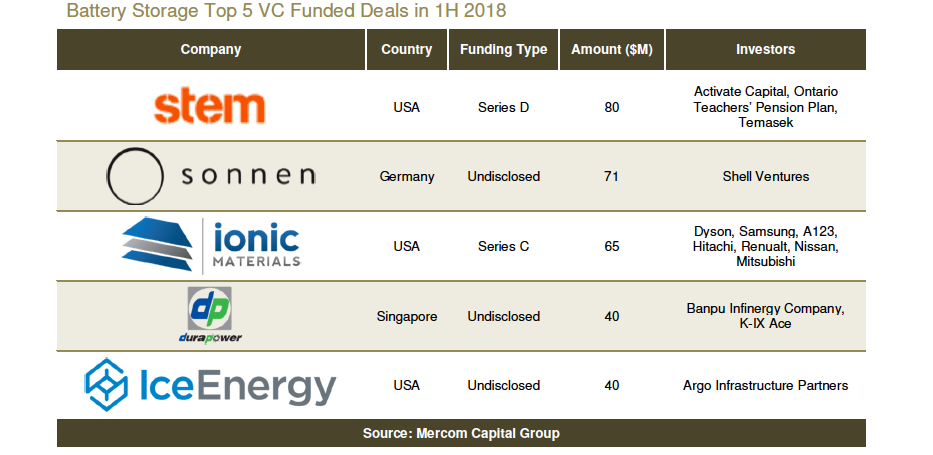

Indeed, VC funding in this category attracted US$539 million from 34 investors in H1 2018, up 12% on the same period a year earlier, where $480 million was raised. Deals here included $80 million by Stem, and $71 million raised by sonnen.

Overall, 14 categories were targeted, including, Energy Storage Systems, Lithium-based Batteries, Solid State Battery, Flow Batteries, Energy Storage Downstream, Fuel Cells, Nickel-based Batteries, Energy Storage, and Management Software.

Representing an increase of 10%, debt and public market financing activity grew to $142 million across five deals, compared to $129 million raised across nine deals in H1 2017. In terms of project funding, H1 2018 saw $34 million was raised across four deals, up significantly from the $5 million in two deals in 2017.

Finally, the first half of this year saw eight Battery Storage M&A transactions, up from two in 2017.

Performing markedly worse were the Smart Gird and Efficiency categories, which chalked up declines across the board, and accounted for the overall decrease – 14% or $2.4 billion raised compared to $2.8 billion – in total corporate funding.

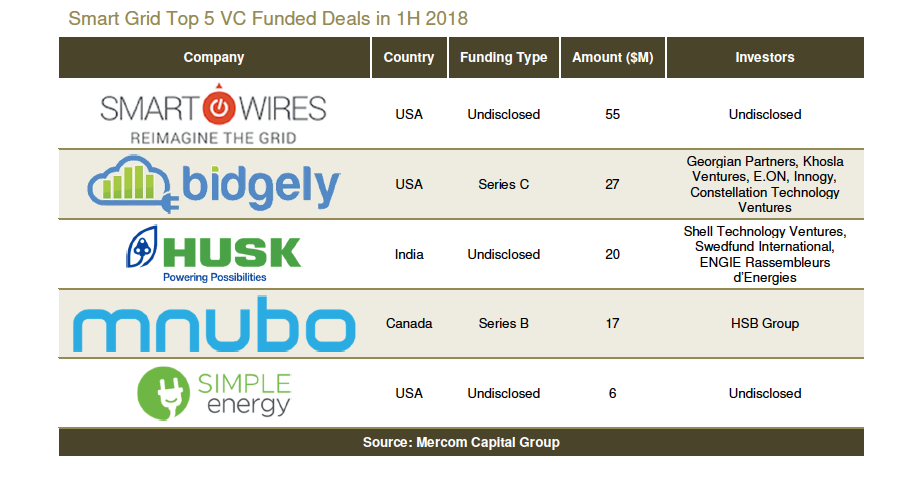

Of the two, smart grid companies saw the biggest declines, with VC funding in H1 2018 falling a massive 56%, from $304 million raised in 1H 2017, to $135 million via 19 VC investors.

Popular content

Marking the only increase – and a significant one at that – in this category, $1.3 billion was raised via debt and public market financing, across two deals, compared to $9 million.

Regarding M&A activity, just five transactions were recorded, down from 13 a year previously.

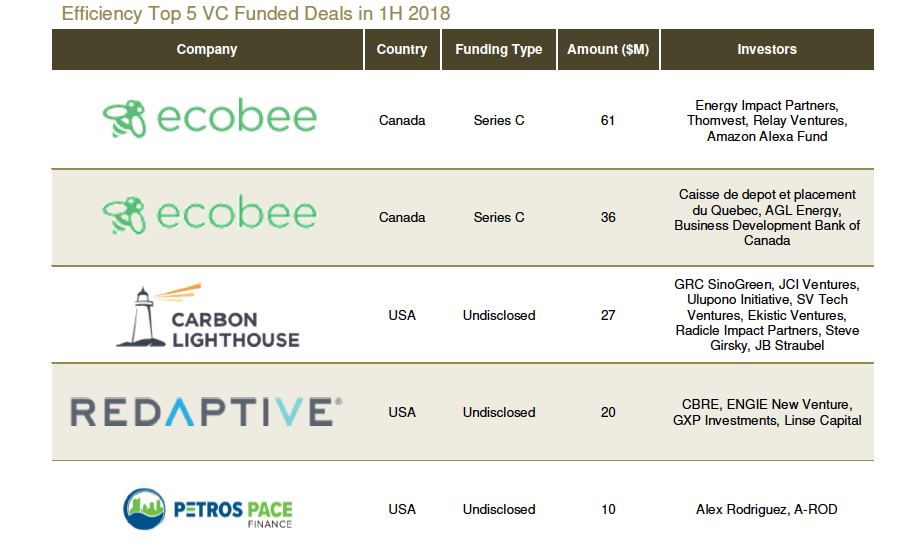

Efficiency companies also fared badly, with VC funding in the period falling 32% to $165 million via 20 investors, compared to $242 million.

Meanwhile, debt and public market financing recorded a huge 88% loss, with just $212 million secured across two deals, compared to $1.7 billion across nine deals.

In terms of M&A activity, just three efficiency transactions were recorded, down from five in H1 2017.

In comparison, Mercom recently found that, despite the uncertainty caused by U.S. solar panel import tariffs, deteriorating trade relations between the U.S. and China, and the looming consequences of China’s PV policy change, the solar industry saw a 15% YoY increase in corporate funding in the first half of 2018.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.