The Brazilian solar market resumed strong growth in the middle of the second year of the Covid-19 pandemic. According to a recent report by Brazilian consultancy Greener, the country imported 4.88 GW worth of PV modules in the first half of 2021. This compares to just 2.2 GW in the first six months of last year, and surpasses the 4.76 GW of PV module imports registered for the whole of 2020.

The total imports for the first half of 2021 should mobilize investments of R$20 billion (US$3.81 billion) in Brazil, Greener CEO Marcio Takata told pv magazine.

The massive import of PV modules and inverters, however, does not reflect the volume of installed capacity. In the first half of 2021, 1,450 MW of distributed generation PV systems and just 63 MW of large-scale PV plants were installed in the country. For comparison, in 2020, these values stood at 2,644 MW and 793 MW, respectively.

“We started to feel this recovery at the end of last year when there was an acceleration of projects for distributed generation,” Takata continued. “This was one of the factors that triggered the acceleration and pushed companies to rebuild stocks.”

PV modules

Most of the modules used in the new PV systems in Brazil continue to be imported. The participation of national manufacturers fell in the first half of 2021, representing just 1.8% of the market, compared to 3.8% in H1 2020 and 3% in H1 2019.

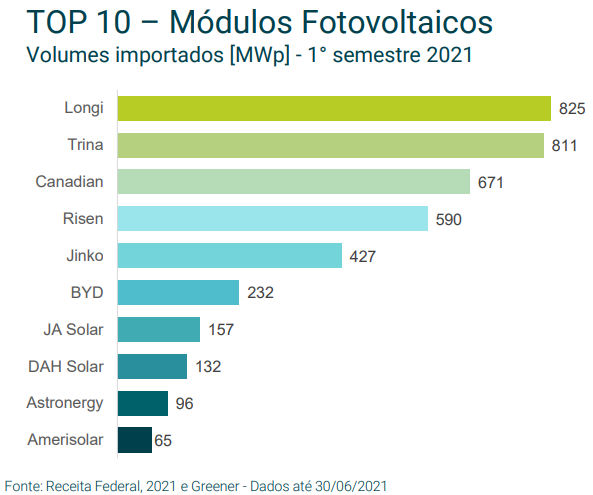

Overall, Longi was the largest importer with 825 MW in the first half of 2021. Trina, Canadian Solar, and Risen, meanwhile, all had volumes above 500 MWp. The market is still fragmented, with the top 10 brands corresponding to 82% of the market, among 52 active brands.

Popular content

PV inverters

In the first half of 2021, PV inverters of more than 50 kW accounted for over 50% of the total imported volume of string inverters. The report does not consider central inverters. In this power range, Sungrow dominates, with 853 MW exported to Brazil in the period. There are currently 33 brands of inverters operating in this market.

PV inverters with lower power (less than 10 kW) corresponded to 29% of the volume imported in the first half of the year. Among the 64 brands that operate in this niche, Growatt was the leading provider with 247 MW.

Inverters with a capacity between 10 kW and 49.9 kW represented 20.5% of the total imported volume. In this power range, the leader in the first half was Brazilian specialist WEG, with 183 MW supplied among 43 brands.

6 GW of distributed generation

In June 2021, distributed generation of solar energy in Brazil, which includes all PV systems not exceeding 5 MW in size, surpassed the 6 GW mark of installed power, reaching 6,142 MW. In the first half, 1,450 MW were added, which compares to 1,296 MW in the same period of 2020.

Brazil crossed the 9 GW mark for cumulative operational PV capacity in June.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.