From pv magazine USA

Canada’s federal government has outlined a new, six-year investment tax credit that puts a 30% tax credit in place for solar, wind and energy storage projects deployed through March 2034. The Clean Technology ITC was included as part of the Canadian government’s 2023 Budget Day fiscal priorities on March 28, with Deputy Prime Minister and Finance Minister Chrystia Freeland releasing the government’s 2023 federal budget.

The Canadian government is prioritizing a clean energy economy as one of the three main pillars of its multi-year budget plan. The federal government has a goal of making its electric grid net zero by 2035 through tax incentives for clean energy projects over the next six years.

Canada’s Budget 2023 mirrors the IRA and includes two new ITCs targeting clean energy and technology manufacturing. In the government’s remarks this week, it said the new plan allows Canada to remain competitive with its southern neighbor.

In the government’s 2022 Fall Economic Statement, it proposed a 30% refundable Clean Technologies ITC, available to eligible properties that are acquired or become available for use on or after March 28, 2023. In Budget 2023, the government expanded this ITC to apply to geothermal energy projects, in addition to solar, wind and energy storage. The term of the ITC was also extended from phasing out in 2032, as was intended under the 2022 proposal, and will remain at 30% through December 2033, stepping down to 15% in 2034 before phasing out altogether after 2034.

A new incentive that the Canadian government is providing is a refundable 15% investment tax credit on the capital costs made by non-taxable entities. These include indigenous or tribal communities, municipal utilities and Crown-corporations that make investments in renewable energy, energy storage, interprovincial power transmission and other clean energy infrastructure projects.

Popular content

The ITC also applies to new hydroelectric, wave/tidal projects, nuclear (including small modular reactors), and abated natural gas-fired generation.

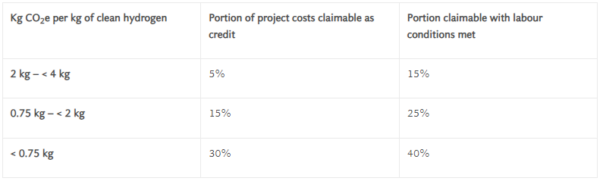

The Clean Hydrogen ITC was announced as part of the government’s 2022 proposals. New details of the basic design elements of the hydrogen ITC include a volumetric ITC credit based on carbon intensity of the project, measured by kilograms of carbon emissions produced per kilogram of hydrogen, and meeting prescribed labor conditions.

As detailed in the above chart, green hydrogen produced using the least carbon emissions and produced with claimable trained labor can see an ITC of up to 40%, while grey or blue hydrogen as its called using lesser carbon recovery can see a 5% to 25% ITC, depending on labor conditions.

To continue reading, please visit our pv magazine USA website.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

9 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.