In many ways, Egypt over the last couple of years, has purposefully tried to copy Jordan’s solar energy policy success. In October 2014, for example, Egypt announced a feed-in tariff (FIT) scheme that was specifically designed to attract international investors to develop solar farms in the country.

However, while its FIT scheme was underway, and successful FIT applicants were prequalified, Egypt also had its head turned by the lower tariffs achieved in other emerging markets, most notably across the Gulf of Aqaba in Jordan, said James Kurz, project manager at the Apricum consulting firm, which is headquartered in Berlin, Germany. The problem for Egypt was that its FIT program was already in the implementation phase, Kurz told pv magazine. To mitigate this, Egypt came up with the solution of adding a smattering of clauses to qualified solar PV projects. One such example being that arbitration would take place in the local courts and not in international courts or under international law. Another significant clause was that 85% of the financing for the successful PV projects should come from international funds. Such clauses, argues Kurz (who is Apricum’s expert for the Middle East and Northern Africa (MENA) region), discouraged international investors, most of whom pressed pause on their investments in Egypt.

Since then, Egypt has attempted to improve the investment conditions for international players, and has announced and implemented a second round of FIT projects, offering lower tariffs, but also – crucially – excluding the previous clauses.

Egypt’s FIT round 1 and 2

Ahmed Sallam, the planning and renewable energy engineer at Egypt’s electricity regulator, explained to pv magazine that the country offers two categories of FIT projects: small-scale projects with installed capacities below 500 kW, and large-scale projects with installed capacities ranging between 500 kW and 50 MW.

Under round 1 of the FIT scheme, Sallam said that “there are many power purchase agreements (PPAs) that have been signed concerning small-scale projects with a cumulative installed capacity [of] around 12 MW.” With regards to large-scale projects, Sallam revealed that there are only seven PPAs that have been signed in round 1, with a total cumulative capacity of 111 MW (this capacity comprises the following PV projects: 50 MW, 50 MW, 2 MW, 2 MW, 1 MW, 1 MW and 5MW).

Similarly, Sallam told pv magazine that there are about 30 projects that have been approved under the FIT round 2, with a total capacity of approximately 1,500 MW.

Finally, the Egyptian government set a deadline for round 1 projects to reach financial close by 27 October 2016, while round 2 projects had to reach financial close by 27 October 2017.

Building the projects

According to information supplied by Apricum, of the PV projects that signed PPAs in the first FIT round, only three received final approval from Egypt’s ministry of energy. Two of these projects (totaling 100 MW) are likely to be built, Kurz affirmed.

Sallam took a slightly different stance with regards to the building of the round 1 projects, expressing doubts only about a 50 MW project that, despite signing a PPA, “faces some difficulties in the implementation phase, so the final status is not yet clear.”

Of the total capacity approved in the second FIT round, Kurz told pv magazine that some 1,240 MW of projects have signed financing agreements with international institutions like the European Bank for Reconstruction and Development (EBRD) and the International Finance Corporation (IFC), which is a member of the World Bank. In fact, this is the source where all of the good news about financing new solar PV plants in Egypt came from in the summer. Ahead of set deadline for reaching financial close for the round 2 projects, international institutions rushed to announce a plethora of financial deals.

Kurz said there was a total of 750 MW of PV farms financed by the EBRD, and a further 490 MW financed by consortiums led by the IFC announced in the summer. All of these deals will finance projects in round 2 with the lower tariff. Yet, Kurz added: “Further declines in PV energy costs, driven by lower component costs, increasing module efficiency and improved yield as a result of technical innovations, have made the lower [tariff] rate profitable within the FIT framework, with finance from multilateral lenders.” Another element that needs to be noted, Kurz argued, is that many of the projects going ahead are projects led by developers that focus on often risky and challenging markets (like Scatec Solar) and regional independent power producers (like ACWA Power, Swicorp and others).

Going forward with tenders and net metering

Egypt’s FIT scheme expired on 27 October 2017 and the government has made it clear that it will pursue its future solar energy policy via a tender scheme for large-scale projects and a net metering program.

“There is already a PPA signed through a tendering scheme,” said Sallam. “The project concerns a wind power farm with a capacity of around 250 MW. Moreover,

the incumbent [utility] has recently raised a tender for 600 MW of PV projects. This tender is currently under processing and the deadline for submission of offers is 14 January 2018.” The electricity regulator has little to do with the tendering scheme. It will mainly issue the successful project licenses and interfere in case of disputes. Therefore, application documents to qualify for the tender must be submitted to the Egyptian Electricity Holding Company.

What remains to be seen in 2018 and the years that follow is whether tendered projects in Egypt are able to attract the interest of commercial banks and the kind of loans they receive. Egypt will need to prove that it has got the policy right this time, and demonstrate a willingness to stick to it.

Popular content

Net metering

Meanwhile, the Egyptian net metering policy, which was initially approved by the regulator in January 2013 and is only applicable to PV systems, was also significantly reformed last year in an effort to make the scheme more attractive to investors.

Specifically, in February 2017, Egypt’s electricity regulator updated the net metering framework allowing, for the first time, payments to be made for the surplus energy generated by the net metered installation. Secondly, in August 2017, the regulator also increased the upper limit of a net metering installation from 500 kW to 20 MW. Electricity customers (e.g. a factory) that are connected directly to the transmission electricity network were also allowed, for the first time, to install net metering systems.

Sallam explained in greater detail how the net metering scheme works. Whenever a PV installation generates more power than is needed on the generation site, the owner of the installation can export the electricity surplus to the grid. The settlement is made on a monthly basis and, in the case of a surplus, this is considered a credit in the customer’s account that can be used in the following months. If there is still an electricity surplus by the end of the year, “the off-taker (the transmission or the distribution network operator) will buy it at a price equivalent to the avoided cost of producing this amount of energy from the state-owned generating fleet,” said Sallam.

Image: First Solar

Private projects

A policy that has the potential to bear fruitful results for the PV industry is, according to Sallam, the scheme concerning private projects, where an investor sells the generated power directly to the consumer. “In such cases, a bilateral contract needs to be signed between the two parties, and the terms of the contract, including the purchase price, are totally negotiable,” said Sallam. “The investor has the legal right to access the transmission network to transmit the generated energy to the end consumption point. Wheeling fees shall be paid to the network operator for each 1 kWh being transmitted, and these fees are fully regulated and issued by the regulator.”

“In my opinion,” concluded Sallam, “although the scheme has not been utilized until now, it can achieve a good record in the near future. The main drivers are the regulatory framework, which is already there and includes the approved network access agreement; the gradual phasing out of the subsidy applied to Egypt’s electricity tariff, which makes the prices from other alternative approaches the breakeven economic point; and the flexibility of the applied electricity tariff (it includes a capacity component and a time of use component), which can lead to better negotiated prices between the two parties.”

Egypt’s lights stay on thanks to the power fleet of the state-owned utility, which mainly comprises conventional plants. The previous policy schemes (FITs, tenders, net metering and private projects) have the opportunity to diversify Egypt’s electricity generation mix in the coming years, especially in line with the policy of gradually removing the subsidy applied to Egypt’s electricity tariff, which is expected to lead to higher retail prices every year.

Jordan’s solar strides lengthen

Jordan will retain its position as a leading solar market in the Middle East this year, continuing to develop a healthy, booming PV sector. While most other Middle Eastern countries can point to positive developments in their own domestic PV sectors – both last year and into 2018 – few currently offer the policies that equally support all segments of the PV market (residential, commercial, utility scale projects), nor have they created a permanent local PV workforce of the like that Jordan has.

Jordan’s PV development comprises projects divided among the following categories: net metering and wheeling projects; tendered projects (rounds 1, 2 and 3) owned by private investors; tendered projects owned by the state (the tender regards the EPC); and directly negotiated projects where the state in often rather obscure and non-transparent ways awards a project to an investor that will then build and own the PV farm (e.g. the 200 MW photovoltaic park by Masdar, which is still to be built).

All established segments of the market have tangible successes, although pv magazine understands that the Masdar project has not yet begun construction and the tender round 3 process is still ongoing. Nevertheless, the biggest success of the past year in Jordan is the trend of investors embracing private projects, based on the independent power producer (IPP) business model. pv magazine is aware of at least two significant cases.

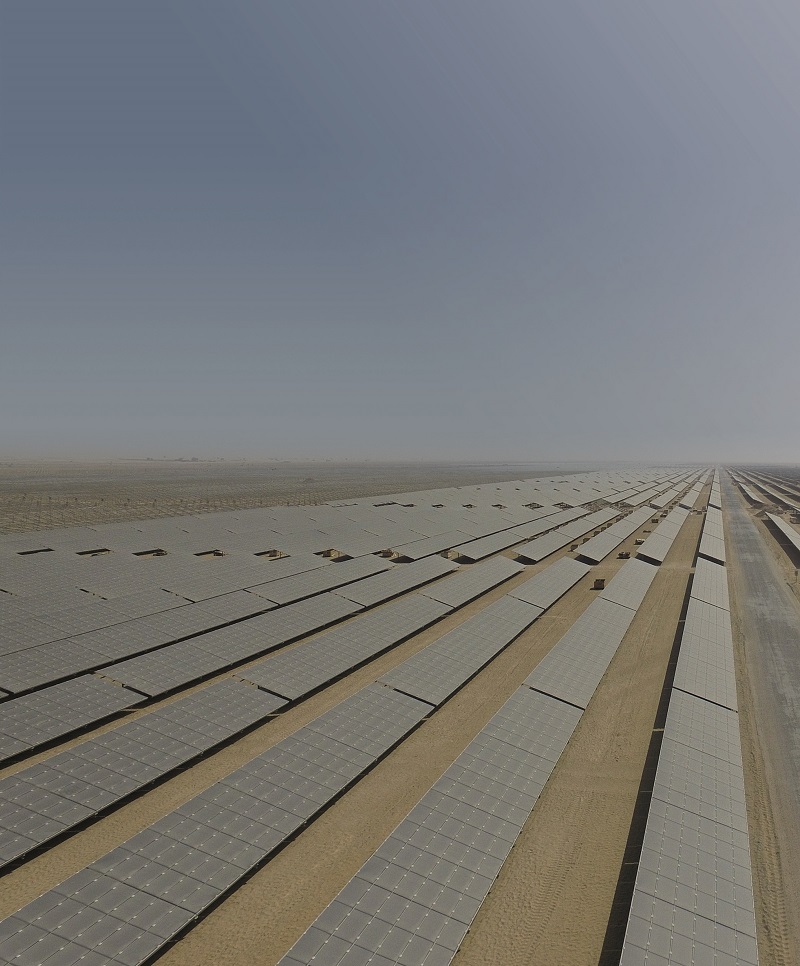

Image: DEWA

The first project is the 50 MW Risha solar PV plant to be developed by Saudi Arabia’s ACWA Power and financed by the EBRD, the German Investment Corporation DEG, and the Arab Bank. “The new plant will be located next to an existing 150 MW gas-fired power plant, owned and operated by CEGCO, the largest generator of electricity in Jordan and a subsidiary of ACWA Power. The gas-fired plant was constructed in 1984 and is nearing the end of its lifetime,” said an EBRD press release.

The second project is a 52 MW PV farm to be owned by Japan’s Mitsui and American firm AES. The IPP project is expected to come online in 2019, selling the generated electricity to Jordan’s National Electric Power Company (NEPCO) based on a 20-year PPA.

The two IPP projects are an additional category of PV development in Jordan and showcase why Jordan is the Middle East’s solar powerhouse and most mature market. Commenting on this development, Samer Zawaydeh, a Jordan-based freelance engineering consultant, told pv magazine: “Jordan’s power generation companies are including solar PV in their energy generation mix. This will allow them to reduce the risk.

“Years ago,” Zawaydeh continued, “Jordan had a problem with natural gas, so the government raised the gas price significantly; then Jordan shifted to oil, because we didn't have gas. Now we have gas, but the prices of renewable energy from solar PV are competitive, so slowly renewable energy will overtake fossil fuel.”

Meanwhile, all four projects of the tender round 2 totaling 200 MW are under construction, and Jordan is also preparing to tender an additional 30 MW of PV capacity (wheeling projects) to power its water sector (the delegation of the European Union to Jordan has allocated funds to support the implementation of the PV projects). Further, Jordan’s Renewable Energy and Energy Efficiency Fund has signed the second stage of a project to support the installation of 1,000 PV systems (2 kW each) for consumers that have 600 kWh/month electricity bill or bellow (the government fund covers 30% of a system’s cost). Other countries in the Middle East and Northern Africa can certainly learn a lot from Jordan’s approach to solar energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.