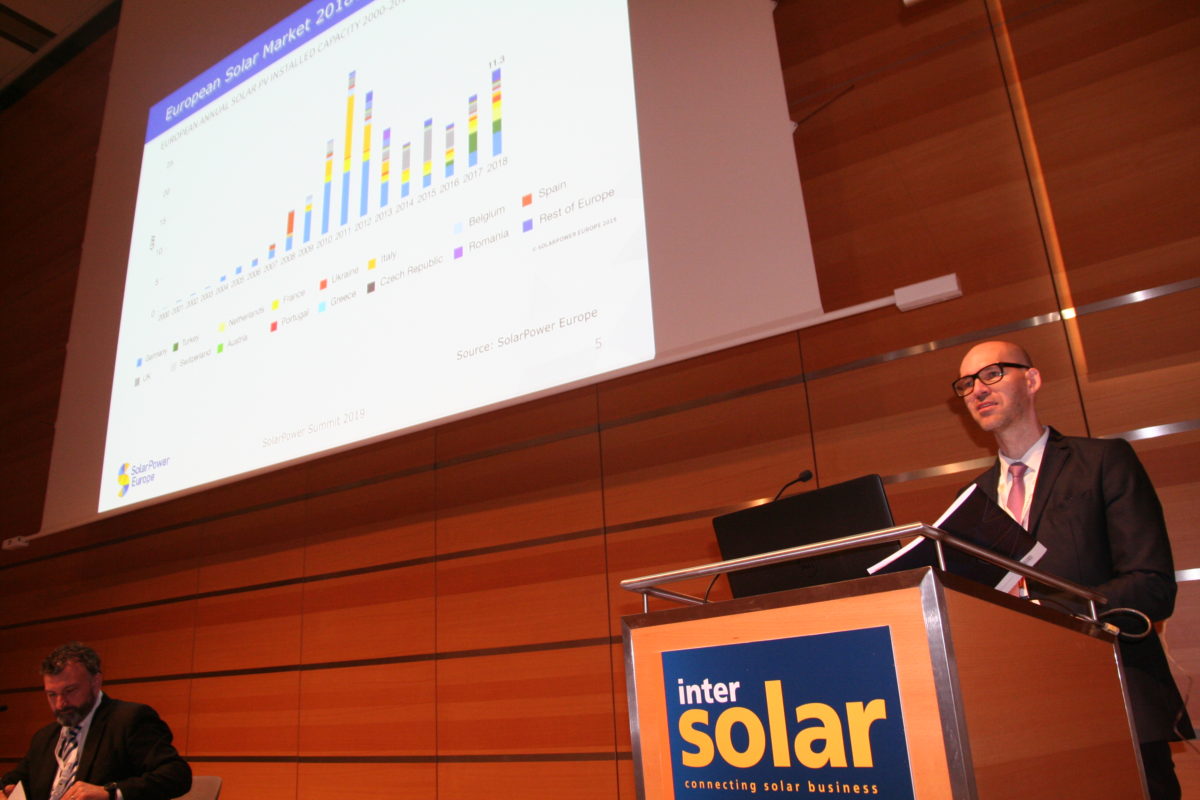

After little growth of global PV installations in 2018, optimism has returned to the solar market. “We are more upbeat than last year,” said Michael Schmela, executive advisor for PV trade association Solarpower Europe (SPE), at the Intersolar Europe conference on PV markets in Munich on Tuesday.

While the global leader China is still on the way to a new incentive regime, SPE expects Europe to celebrate a remarkable comeback this year, increasing its annual installations from 11.3 GW in 2018 by 80% to 20.4 GW.

Schmela sees several drivers for this strong growth. Seventeen of the European Union’s 28 member states have not yet reached their targets for the share of renewable energy sources in electricity generation by 2020 and are under pressure to catch up.

Moreover, the European Commission’s clean energy package has brought healthy clarifications, said Schmela. “The package provides the right framework for solar.” In a conservative scenario, the EU’s new 32% target for electricity from renewables by 2030 would translate into 320 GW of new PV installations in the EU by 2030. With continued cost reductions, however, even 600 GW would be possible, according to Schmela.

Another important factor: “Companies have woken up to the fact that they can save a lot of money with PV,” said David Wedepohl, managing director International Affairs at the German Solar Association. Commercial and industrial PV systems already have the largest share in annual German PV installations.

Concerns about grid bottlenecks

However, in 2019 Germany will probably be overtaken by Spain as the biggest European PV market. José Donoso, general director of the Spanish PV association UNEF, predicted new installations of 4 GW. Private power purchase agreements (PPAs) on another 4 GW were signed in less than one year.

Donoso forecasts that 30 GW could be installed in Spain by 2030 — just as much as France’s multi-annual energy plan targets for PV in the same time frame. But Donoso also sees a possible bottleneck in network planning and administrative procedures.

José Medeiros Pinto, secretary general of the Renewable Energy Association in neighbouring Portugal, has similar concerns. “There are network conflicts everywhere. This can cause problems,” Pinto said at the conference. Portugal wants to install 7.8 to 9.3 GW of PV by 2030.

Popular content

The most impressive example for the comeback of PV in Europe is the United Kingdom, where the last subsidies have expired now. Nonetheless, Chris Hewett, chief executive of UK’s Solar Trade Association, expects “certainly over 500 MW” of new PV installations this year; he even thinks that close to 1 GW is possible.

The first subsidy-free projects in the U.K. are using batteries to hedge against price fluctuations in the electricity market. Local authorities are starting support schemes for PV; in Scotland, for example, PV systems are required for nearly all new homes.

Saudi Arabia and UAE are pushing forward

In the wake of the European revival, PV markets in the Middle East are also taking off. “The growth in the Middle East is expected to be two to three times higher than the global average,” Nikolai Dobrott, founder of cleantech advisory firm Apricum, told the audience.

According to Apricum’s forecast, annual PV installations in the Middle East, North Africa and Turkey will increase from 5 GW in 2018 to 20 GW in 2023. Key markets in 2023 will be Saudi Arabia (5.2 GW), the United Arab Emirates (3.8 GW) and Turkey (2.7 GW). Saudi Arabia is planning to install 40 GW by 2030, while the Emirates are aiming for 16 GW in this time frame.

Turkey has at least raised its 2023 target from originally 5 GW to 10 GW. According to Halil Demirdağ, president of the Turkish Photovoltaic Industry Association (Gensed), the government announced last week that the maximum size for unlicensed PV power plants on rooftops has been lifted from 1 MW to 5 MW and net metering will be possible up to 5 MW as well. Demirdağ is happy: “We will have a new market.”

By Johannes Bernreuter

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.