The rising cost of energy prices is a significant concern for businesses across the globe. Fluctuations in energy costs can have a significant impact on a company’s bottom line, making it challenging to budget effectively and maintain a competitive edge. Fortunately, advancements in battery energy storage and solar are providing a solution to help hedge against energy price risks.

Image: GridBeyond

As pv magazine readers know, battery storage and PV systems work hand in hand to enable businesses to generate their own electricity and store excess energy for use during times of high demand or low sunlight. By leveraging these technologies, businesses can significantly reduce their reliance on grid electricity, which is often subject to volatile pricing structures.

Businesses that rely entirely on grid electricity are at the mercy of the energy market. When energy prices rise, their operating costs go up, which can have a significant impact on their profitability. By investing in battery storage and solar systems, businesses can generate their own electricity and reduce their reliance on the grid. This provides them with greater control over their energy costs and helps them avoid price spikes in the energy market. This much we know already, but how could that principle shape up in practice?

Illustration

Let’s assume that a manufacturing fab in Victoria, Australia that has annual energy consumption of 8.76 GWh has installed a 2 MW solar system and a 1 MWh battery storage facility, connected in a microgrid. The average electricity price is AUD 0.27 ($0.18)/kWh and the site could earn revenue through participation in the Australian Energy Market Operator’s Wholesale Demand Response Mechanism (WDRM). The latter program enables consumers to respond to the needs of the grid by altering their electricity load profiles and pays them to do so, with payments varying from AUD 1.50 per kilowatt of reduced peak demand, to AUD 13/kW, based on 2022 prices and depending on the month.

If the manufacturing fab’s solar system generates electricity for six hours per day and the battery is charged and discharged once per day, here’s an estimate of the potential cost savings and revenues.

The solar system generates 13 MWh daily from the six hours its 2.17 MW generation capacity operates. The fab’s industrial load demand is 24 MWh per day but it only consumes 6 MWh of the power generated by the panels, due to the mismatch between solar generation hours and unit production activity. With the battery discharging a megawatt-hour per day for industrial use, the fab uses only 17 MWh per day of grid power, rather than 24 MWh, resulting in a daily cost saving of AUD 1,890 and monthly savings of around AUD 56,700.

On top of that, if the factory has peak power demand of 3 MW for an hour per day, using its microgrid and battery to reduce that peak load to 2 MW could bring in AUD 5,000 of monthly revenue, based on a WDRM weekday peak demand reduction payment of AUD 5/kW.

Grid exports

With production accounting for only 6 MWh of the 13 MWh generated by the solar array daily, and assigning a further megawatt-hour to charge the battery, the remaining 6 MWh could generate daily revenue of AUD 600 if sold to the grid for AUD 0.10/kWh, for an AUD 18,000 monthly revenue stream.

That all adds up to monthly energy saving and incentive payments of AUD 79,700 for our notional fab in Victoria.

This is, of course, a very stylized example and ignores factors such as actual load and solar-generation profiles, which will not be flat as assumed in the simple example discussed above, as well as arbitrage revenue opportunities that exist for the battery to further increase savings by avoiding peak grid electricity prices and selling back excess energy to the network at optimal times.

Popular content

A battery can also earn revenue by participating in frequency control ancillary markets, which balance supply and demand in the event of unexpected generator failures in order to maintain frequency levels.

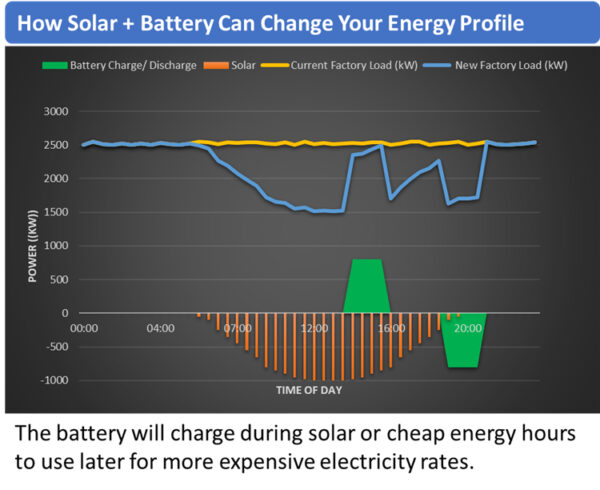

A more realistic representation of the interaction between load, solar, and battery storage is depicted in the diagram below.

Actual savings and revenues will depend on various factors such as the location, size, and type of installation; energy prices; and demand profiles in a specific region. The interaction of all these variables on any given day ensures the decision making process can become quite complex. Under such circumstances, it is useful to employ mathematical optimization programming to achieve the best outcome and derive the greatest return on investment. The critical point to note is that a battery co-located with solar changes the risk profile of the investment, ensuring that some of the uncertainties associated with weather-based power generation are, at least in part, mitigated.

Battery storage and solar systems offer businesses an innovative solution to hedge against energy price risks. By generating their own electricity, reducing their reliance on the grid, and storing excess energy, businesses can significantly reduce energy costs and improve their energy efficiency. Moreover, investing in these technologies can help businesses increase their energy independence, reduce their carbon footprint, and contribute to a more sustainable future.

With these benefits in mind, it is clear battery storage and solar are an essential investment for businesses looking to hedge against energy price risks and remain competitive in an ever-changing market.

About the author: Paul Conlon is head of modelling & forecasting at Dublin-based artificial-intelligence-backed energy services company GridBeyond and is a regular speaker at industry conferences, on energy price forecasting and risk management. Paul has more than 20 years’ experience in the energy and tech sectors and is an expert in numerous analytical techniques applied to gas and power markets. He has worked in a variety of roles within energy and consulting organizations covering market design, regulation, and trading.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.