The rising cost of solar system components – which drove prices up more than half in some cases in the second half of last year – helped dampen the recovery of the global off-grid solar appliance market in July-to-December period of a Covid-hit 2020.

That was one of the trends to emerge from the latest six-month report issued by Amsterdam-based off-grid organization GOGLA and the World Bank's Lighting Global program.

The latest edition of the biannual Global Off-grid Solar Market Report estimated 33.66 MW of solar generation capacity was deployed worldwide from July last year, in the form of off-grid systems such as lanterns, fans, TVs and fridges, as well as multiple-appliance solar home systems.

Conflict

GOGLA, formerly known as the Global Off-grid Lighting Association, noted a rise in sales of 50-100 Wp solar home systems as wealthier households moved to shore up grid power supply during the pandemic and speculated tighter family finances during lockdowns explained a shift from cash-up-front purchases to pay-as-you-go finance. The report also pointed to the effect of conflict between the Ethiopian government and the Tigray People's Liberation Front, given the importance of the off-grid market in Tigray, which is attempting to break away from Addis Ababa.

The statistics showed a recovery of sorts after the initial ravages of the pandemic in the first half of last year, with 3.6 million solar lighting product sales up 19% from the January-to-June period but down 18% on the second half of the previous year. The nascent market for non-lighting appliances held steady at around 470,000 sales with the report adding it had been expected to expand last year, before the pandemic hit.

The bigger picture

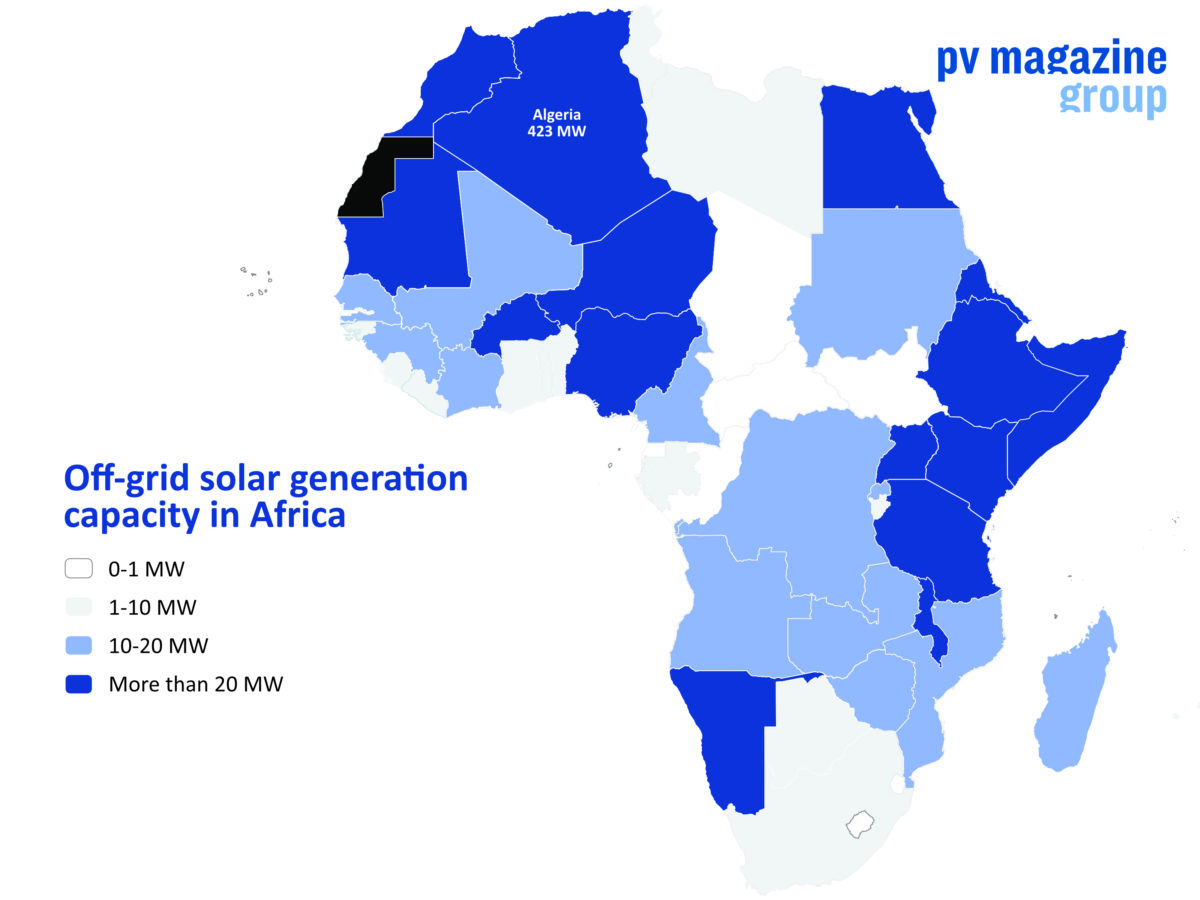

The uneven nature of the recovery was illustrated in sub-Saharan Africa, with solar lighting sales that were down 4% from the second half of 2019 overall featuring a fall of 10% in East Africa, the biggest regional market, but rising 19% in West Africa and a notable 40% in central Africa. By contrast, non-lighting appliance sales slumped 32% in the central region during the second half of last year, with the retreat only 11% in West Africa and 5% in the eastern region. The report also noted rising sales of ‘extra large' solar powered TVs across East and West Africa, reflecting advances in energy efficiency for such products over smaller screens.

Policy support for off-grid solar in Somalia and Nigeria – the latter badly hit by Covid cases and the oil price plunge – was balanced by reverses in Uganda, caused by extreme weather events; Zambia, where companies were forced to make retroactive import payments for historic shipments; and Ethiopia, where the coffers of the World Bank-funded Development Bank of Ethiopia had been almost exhausted in 2019.

Popular content

The study also highlighted the detrimental effect on off-grid appliance sales in Kenya after Covid expenses forced the government to rescind an exemption from VAT for such products. A similar, regional move saw the six-nation East African Community remove an exception from import duties for solar goods.

In South Asia, solar lighting sales tumbled 43%, from the second half of 2019, mainly because of the effects of the pandemic in India. A lack of micro finance in India worsened the picture, after the government failed to extend a three-month Covid-related repayment holiday for bank borrowers to micro finance customers. With sales tumbling, a third of South Asian retailers who provided information for the update reported figures down more than 50% during the six-month window.

Investment

The study also includes the East Asian and Pacific off-grid appliance market and the report's authors said global investment in the sector held firm during 2020, at $316 million, but that figure included a 46% fall in equity investments into provider companies.

Calling for immediate provision of more grant and concessional finance for off-grid solar, GOGLA and its partners said the advent of Covid-19 across markets last year had deprived 10-15 million people, and 300,000-450,000 enterprises, of improved energy access.

The market report was produced by GOGLA, the World Bank, clean energy appliance NGO Efficiency for Access, U.K. government body UK Aid and Dutch consultancy Berenschot.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.