With the calls for renewables-friendly policy across Africa rising in volume, the U.K. government and a Nairobi-based management consultant have called upon the Kenyan and wider, East African authorities to reverse tax decisions made last year which penalized solar products.

A policy paper written by the Africa Clean Energy Technical Assistance Facility unit of the U.K. government's Foreign, Commonwealth and Development Office, and by Open Capital Advisers, has called for the reimposition of exemptions from VAT and import duties on household solar products such as lighting systems.

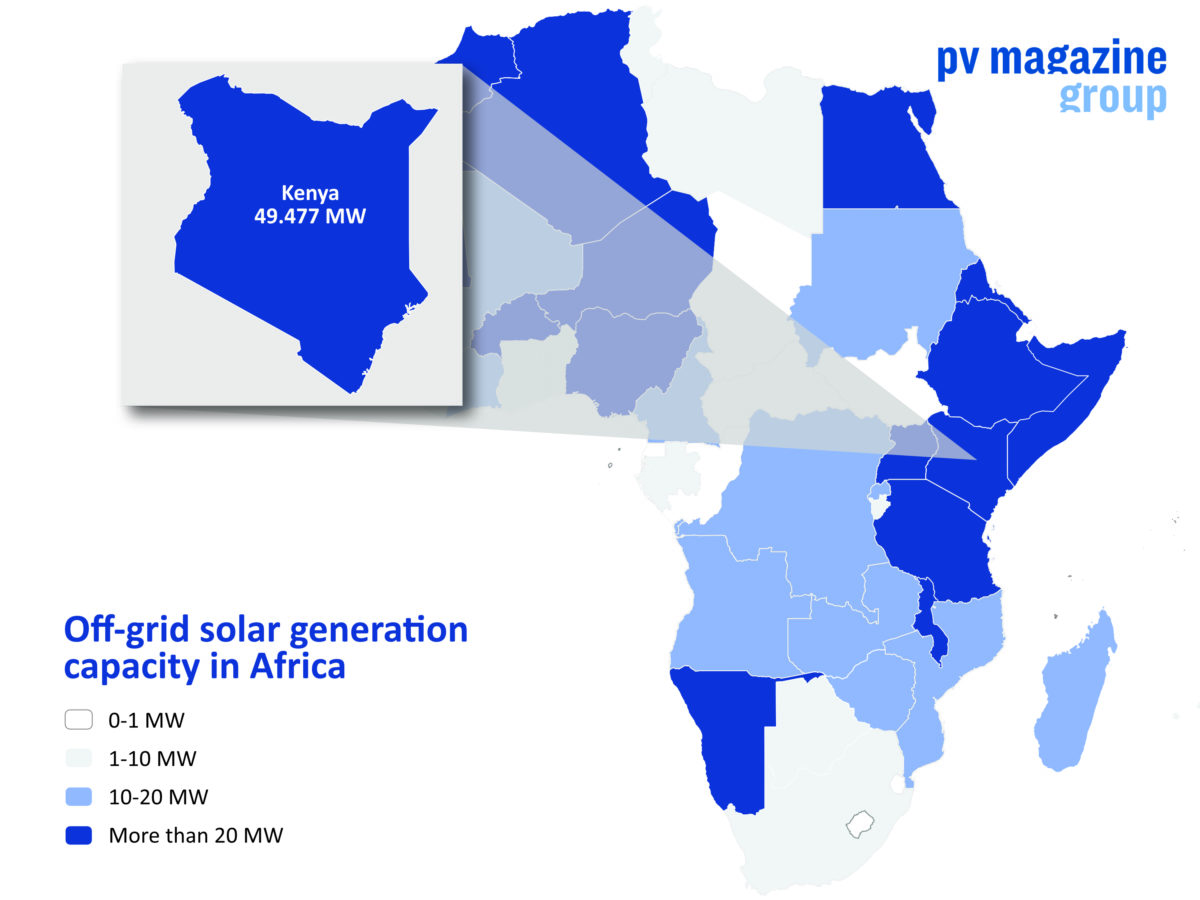

The document, presented by Netherlands-based off-grid lighting group GOGLA and trade body the Kenya Renewable Energy Association (KREA), said the nation would miss the target, set in 2018, of providing electricity to 1.9 million households by next year, with 46% of the country's rural population currently reliant on paraffin and gas lamps, torches, batteries, firewood and candles for lighting.

Legislation

Last year, the Kenyan government reimposed a 16% VAT rate on standalone solar products, and the East African Community – in which Kenya is a member, along with Burundi, Rwanda, South Sudan, Tanzania and Uganda – reinstated import duty on such products. In each case, though, solar panels and control units are still exempt from the duties, the policy paper noted.

While noting the VAT rate would generate around $9.6 million per year – and import duties $10 million – for the Kenyan government, GOGLA, which was formerly known as the Global Off-Grid Lighting Association, and the KREA said the tax benefits offered by wider access to such products would dwarf those immediate gains.

The policy paper, which claimed standalone solar system prices have risen 10-24% since the tax changes, and sales volumes fallen 25%, estimated the 250,000 households which could open new businesses, or whose residents could start new jobs with cheap access to home solar, could generate $46 million more in tax revenues for Nairobi, with a further $2.7 million per year in prospect from the creation of 2,500 more jobs in the industry.

The authorities should not only reinstate exemptions for standalone solar systems, said the paper, but should further incentivize products such as up-to-3 W and 3-11 W lighting systems, and encourage Kenyan manufacture of such devices.

Failing to take action, said the policy paper, could see 600,000 fewer households with access to solar by 2025.

The Africa Clean Energy Technical Assistance Facility is a four-year program set up by the British government to boost the private-sector standalone solar device market in Kenya.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.