In recent months, Europe has been shaping up as a hotspot of battery manufacturing activity with a flood of gigafactory announcements coming from incumbents and newcomers to the market. With a clear strategy outlined to reduce its dependence on Asian battery cell imports, Europe is set to host around 35 gigafactories by 2035, according to the latest predictions.

The newest project announcement has come from Anglo-Korean battery maker Eurocell, which yesterday said it will build its first European gigafab. The extraordinary aspect of Eurocell’s plan is that it promises to start manufacturing at scale within just 12 months, thanks to the company's “proven, production-ready technologies.”

With an initial £600 million (€716 million) investment planned in two phases, Eurocell intends to supply European energy storage, automotive, e-mobility and customer electronics industries. The first phase will begin producing battery cells at scale by early next year for existing customers, Eurocell announced. In parallel, a bespoke facility will be constructed on the same site capable of producing more than 40 million cells per year by 2025.

Eurocell says it is looking at potential sites for its European manufacturing base and will make a final choice depending on government support and investment. “We are actively seeking a European manufacturing base and are in advanced discussions with sites in the UK, Netherlands and Spain,” said the company's CEO for Europe, the Middle East and Africa, Recardo Bruins. “With the right level of central engagement and support we are keen to take advantage of the rapidly growing European market as quickly as possible.”

In return, the manufacturer said in a press release to announce the fab, the host country will benefit from “the creation of hundreds of direct and indirect jobs, transferring vital skills from Korean battery experts and boosting the economy in a strategic sector crucial to achieving Europe’s net zero ambitions.”

Eurocell has two product lines that it says can deliver better performance than conventional lithium-ion batteries. Its ultra-fast charging “UFC” battery is able to capture any input charge under any condition at a 10C rate, has a long cycle life of more than 5,000 cycles, and is 100% safe in the event of impact, penetration or shocks, so no there is no risk of thermal runaway and self-ignition, the company claims. The UFC batteries have a lithium-titanate-oxide anode which, according to Eurocell, allows for that long cycle life and a 25-year-plus lifespan, and a lithium-nickel-manganese-oxide cathode. The product's weak point is low energy density, which is why lithium-titanate batteries are usually deployed only in bulky vehicles, where space is less of an issue than it is in passenger cars.

The manufacturer's ultra-high capacity “UHC” battery excels at capacity, according to its developer, and is said to outperform conventional lithium-ion batteries by 150% by virtue of its silicone-graphite composite anode. That feature comes at a cost, however, and the UHC battery costs more than 30% more than conventional alternatives. Eurocell says its batteries have a wide operating temperature range, from -20 to 50 degrees Celsius, making them well-suited for use in extreme weather and without a grid network.

Popular content

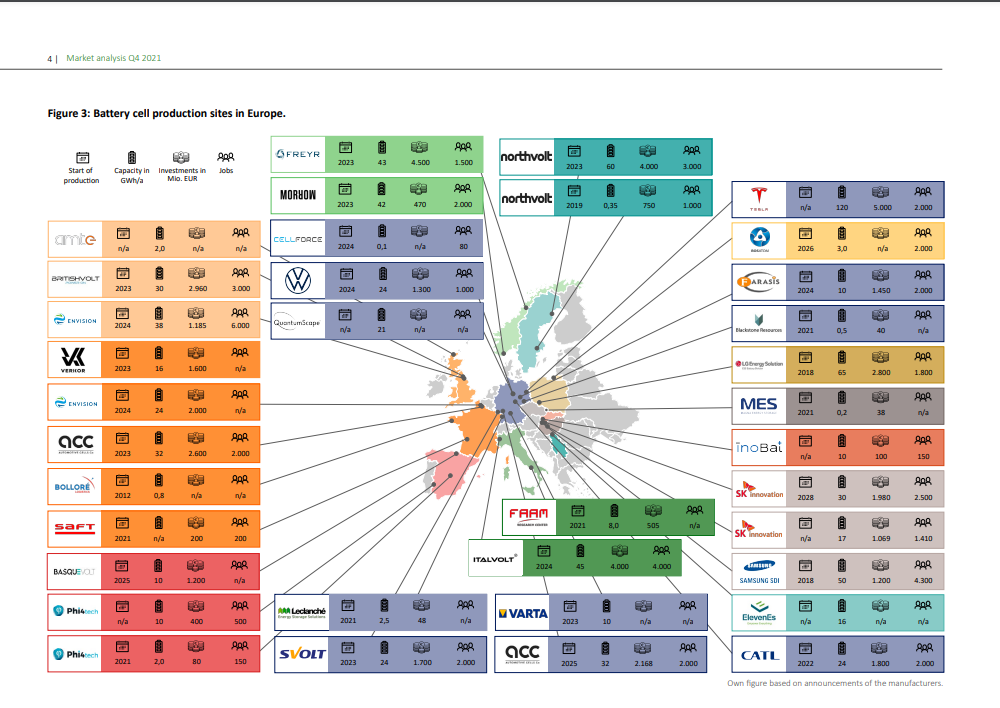

Eurocell is by no means alone in its ambition to secure a slice of the European battery market. According to data from the EU's important projects of common European interest (IPCEI) fund, which aims to promote critical projects including battery production in Europe, a massive build-up and expansion of energy storage production capacity is being planned.

E-mobility: A greener road to transportation

Urban transportation is key to modern civilization. But it has come at a cost, contributing to a dangerous carbon footprint, high levels of smog, a growing inequality gap, and the destruction of some of our most fragile environments. Thus, in the first quarter of this year, pv magazine’s UP Initiative will focus on the rise of e-mobility and how it can complement the renewable energy transition. Read our coverage here.

The annual production volume of lithium-ion cells in the EU's member states – plus Norway and EU accession state Serbia – amounted to around 35GWh in 2020, around 15% of the global total. That figure is expected to rise to 600-870GWh – 43% of the estimated world market – by the end of the decade.

First movers

The companies leading the charge in Europe are Tesla, Northvolt, and LG Chem, according to Scottish consultancy Delta-EE, which has estimated they will supply 27% of the bloc's li-ion production capacity in Europe by 2030. In terms of where the factories will be built, Germany is the top location so far, with France and Italy expected to become the second and third biggest markets by 2030 in terms of annual manufacturing capacity, overtaking Hungary, which is currently Europe's second largest battery manufacturing state.

While it is hoped enormous demand for li-ion cells in the automotive industry in the years ahead will be met through the planned expansion and development of production capacities, the supply of batteries will also hinge on sufficient availability of semiconductors and raw materials. The first noticeable deficits emerged for nickel last year and shortfalls of up to 50% in cobalt, copper, lithium and graphite are forecast for next year and 2024. As a result, US analyst BloombergNEF's recently published 2021 Battery Price Survey forecast an increase in li-ion cell prices this year after decades of declining prices.

“To counteract the threat of raw material shortages, recycling capacities are being successively built up, the utilization of alternative raw material deposits is being evaluated, and research is being conducted on novel cell chemistries that use fewer or no critical raw materials,” the European Union's IPCEI fund said in its quarterly market analysis.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Hey, Great Britain is not part of the EU as an economic area, only as a part of a geographical European continent. Probably best not to mix these differences up, as you mentioned the European Union’s IPCEI fund.